Since early August, Litecoin’s (LTC) price has been in a state of consolidation, with movements limited within a narrow range. Despite briefly breaking out of this range, LTC was quickly pulled back into consolidation, indicating weakening bullish momentum.

As a result, traders are becoming wary of a prolonged stagnation period. However, increased activity from LTC whales may signal an impending shift in momentum, with these large holders looking to change the course of Litecoin’s price action.

Litecoin Whales Could Change the Wave

Whale activity surrounding Litecoin has surged significantly over the past month, showing increased interest from large investors. Transactions worth more than $100,000 have grown by 38%, rising from $3.21 billion to $4.43 billion. This uptick in large-scale transactions is a positive sign, as it suggests that whales are actively accumulating LTC, potentially preparing for a bullish breakout.

The heightened activity from these large wallet holders often serves as a leading indicator for future price movements. Historically, whale accumulation has been linked to significant price shifts, as their influence can move the market. Should this trend continue, it could indicate growing confidence in Litecoin’s potential to break out of its consolidation phase.

Read More: How To Buy Litecoin (LTC) and Everything You Need To Know

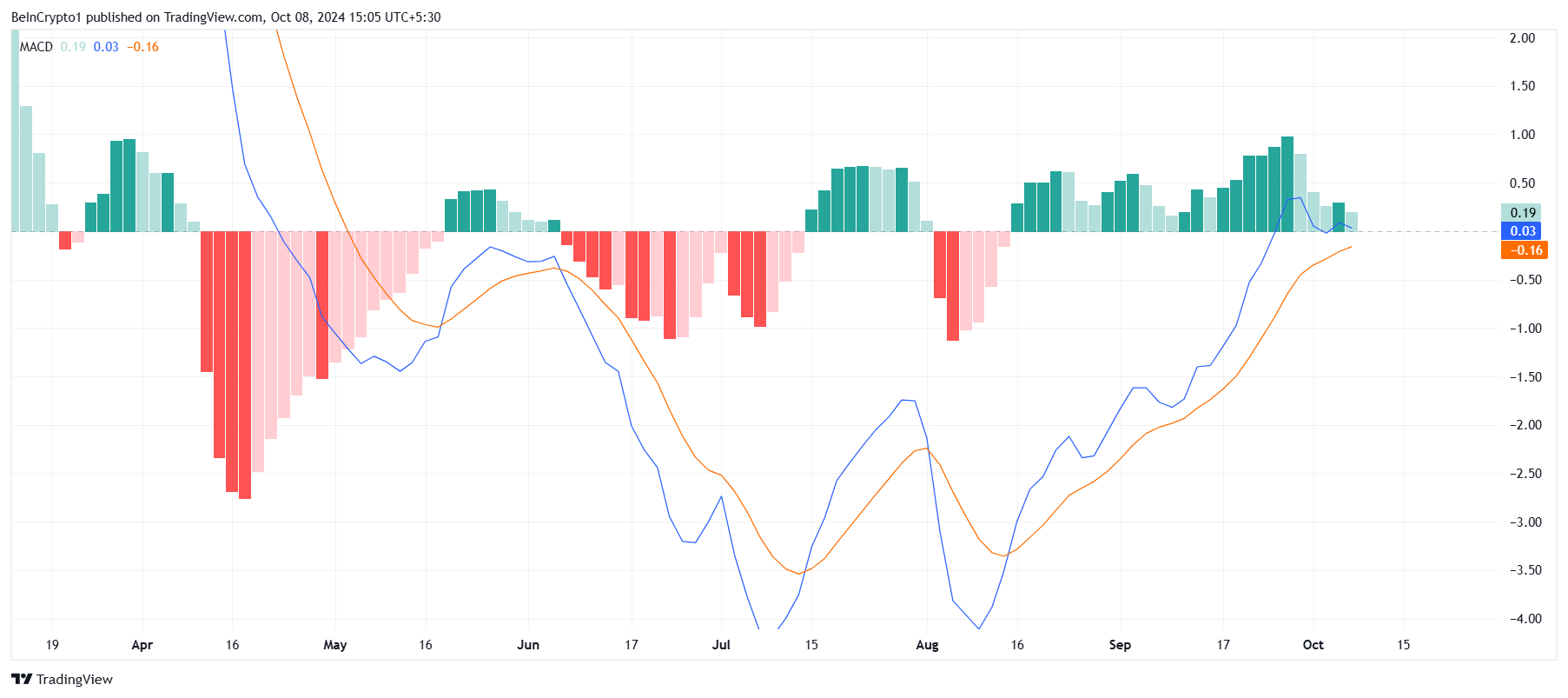

Despite the optimism surrounding whale activity, technical indicators paint a different picture. The Moving Average Convergence Divergence (MACD) indicator shows that a bearish crossover is imminent.

MACD histogram’s green bars, which represent bullish momentum, are fading, signaling that selling pressure may soon increase. If the bearish crossover is confirmed, it could negate the bullish signals from whale activity, leading to a potential price decline.

This contradiction between whale transactions and the MACD suggests that Litecoin’s price could face a turbulent period. While whales may continue to accumulate, broader market signals indicate that bearish forces are gaining strength.

LTC Price Prediction: Aim for a Rise

Litecoin’s price is currently trading at $65, consolidating within a range of $68 and $59. Should LTC breach the upper limit of this range, it could trigger an 18% rally, pushing the price toward $76. This would mark a significant recovery for the cryptocurrency, driven by whale activity and bullish sentiment.

However, this price surge is only possible if whales maintain their buying pressure and outpace the broader market’s bearish trends. A confirmed breakout would require Litecoin to flip $68 into support, signaling a new bullish phase.

Read More: Litecoin (LTC) Price Prediction 2024/2025/2030

If Litecoin fails to breach $68 and remains below this key level, the consolidation could persist, prolonging the stagnation period. A drop below $59, combined with decreased whale activity, would invalidate the bullish thesis, potentially leading to further price declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/ltc-whales-could-revive-litecoin-price-rally/

2024-10-08 12:58:24