The SUI ecosystem continues to capture investor attention this October, setting multiple notable new records.

While the recovery momentum of many altcoins has stalled, SUI has achieved a new all-time high (ATH) this month, reaching $2.16.

SUI Ecosystem Market Cap Exceeds $8 Billion

According to CoinMarketCap, the SUI ecosystem’s market cap in October reached $8.54 billion. Of that, SUI’s individual market cap is around $5.38 billion, while First Digital USD (FDUSD) accounts for almost $3 billion. The daily trading volume across the ecosystem surpassed $6 billion, with most of it still dominated by SUI and FDUSD.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

Other projects within the SUI ecosystem, such as decentralized exchanges (DEXs), meme coins, and lending protocols, hold a smaller share. According to CoinGecko, the market capitalization of meme coins on SUI currently exceeds $296 million, marking a 170% increase from $108 million at the beginning of October.

Typically, investors who buy and hold SUI tend to reinvest in other protocols and meme coins within the ecosystem. This is similar to how the Solana ecosystem surged in popularity last year.

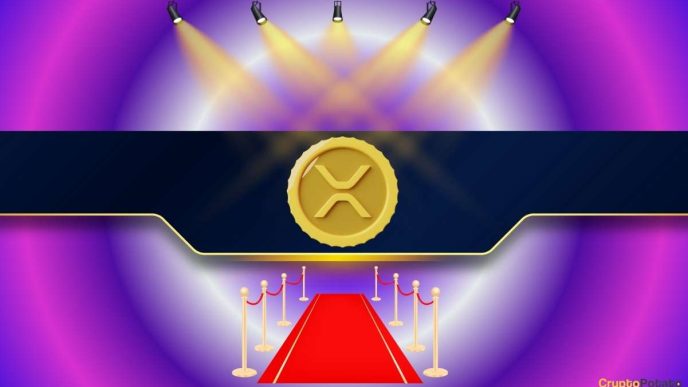

SUI Ranks Among Top 3 Altcoins by Netflow in the Past Month

More data indicates promising signals for SUI’s continued appeal to investors in the final quarter of the year. Artemis data, which tracks capital flows into and out of various ecosystems, shows that SUI ranks third in altcoin netflow over the past month, behind only Ethereum and Solana.

Looking at cross-ecosystem bridge transactions, SUI accounts for over 9% of the capital flow from Ethereum. These figures highlight the growing activity within the SUI network, reflecting the ongoing adoption and demand among users.

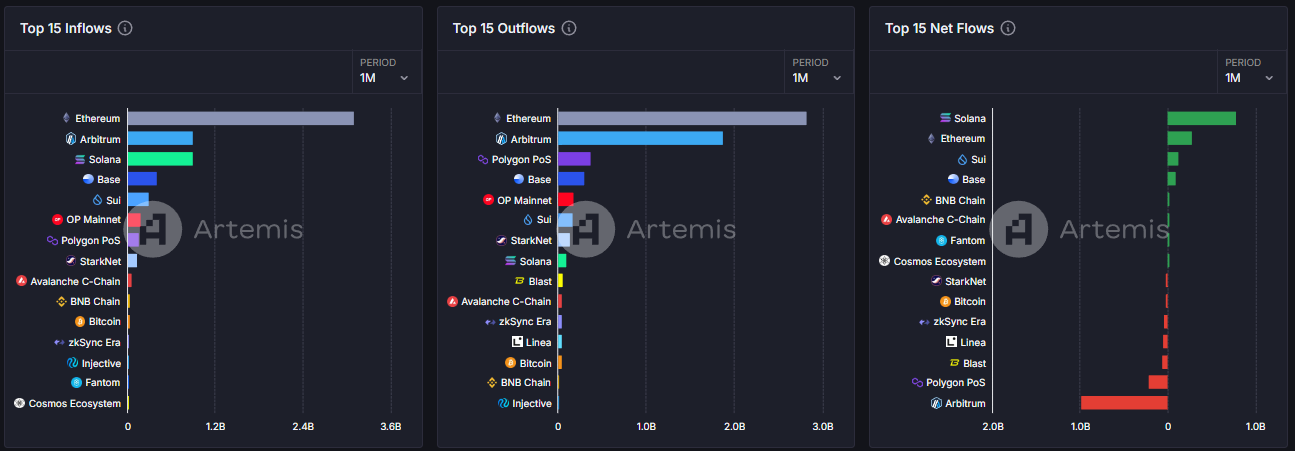

SUI Dominance Rises 270%, Reaches New High of 0.27%

SUI dominance (SUI.D), which measures SUI’s share of the total market cap, has seen a significant rise. A higher dominance indicates that SUI is becoming a preferred choice among investors.

Read more: Everything You Need to Know About the Sui Blockchain

In just the past two months, SUI.D has surged 270%, hitting a new high of 0.27%. Although it has now retraced to 0.26%. This comes at a time when most other altcoins are seeing declines in market cap share while Bitcoin dominance remains high at over 56%.

“SUI is moving exactly like SOL before the massive pump.” Investor CryptoGoos predicted

Through technical analysis, many investors are optimistic that SUI’s price could follow a similar pattern to that of SOL. However, a recent BeInCrypto analysis indicates that SUI may face significant corrections under the pressure of profit-taking from early investors.

This is because the price has increased by nearly 120% in the past 30 days. In such a scenario, investors are bound to book some profit.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/sui-dominance-new-all-time-highs/

2024-10-09 07:45:48