Solana (SOL) has been showing signs of macro bullishness, which could potentially help the altcoin break out of its current ascending triangle pattern. A breakout would open the door for a significant price surge, with institutional investors playing a key role in driving this momentum.

The largest holders of SOL have continued to back the asset, signaling growing optimism despite broader market uncertainty.

Key Solana Investors Show Support

Institutional investors have remained consistently optimistic about Solana, even as other major cryptocurrencies like Bitcoin and Ethereum have faced outflows. According to a recent report from CoinShares, for the week ending October 4, SOL saw inflows totaling $5.3 million. This figure stands out as Bitcoin and Ethereum experienced significant outflows during the same period, highlighting SOL’s strong appeal.

The fact that Solana is attracting institutional interest, even in a bearish market, suggests big players are confident in its long-term potential. As institutional inflows continue, this could provide the fuel needed to push Solana’s price higher, making it a standout asset in an otherwise uncertain market.

Read more: Solana vs. Ethereum: An Ultimate Comparison

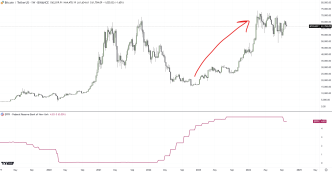

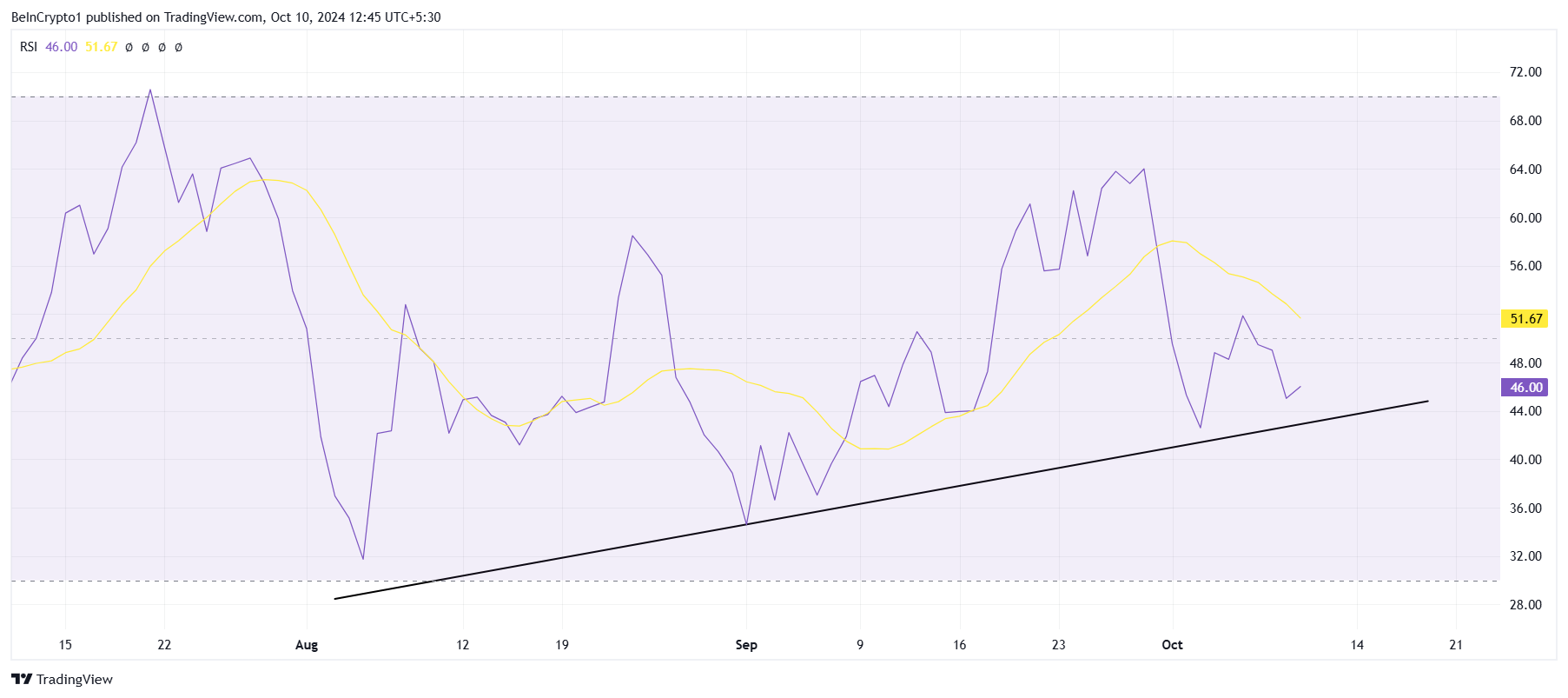

On a macro level, Solana’s momentum is supported by bullish technical indicators. The Relative Strength Index (RSI) is one such indicator that has been showing signs of macro bullish momentum.

Although the RSI is currently below the neutral line at 50.0, it has the potential to break above this level, entering the bullish zone. This shift would provide further validation for SOL’s upward movement and help it break out of its current pattern.

The combination of institutional support and improving technical indicators positions Solana for a potential breakout. If the RSI breaches the 50.0 level and turns bullish, it would reinforce the likelihood of SOL gaining upward momentum, possibly triggering a significant rally.

SOL Price Prediction: Aiming High

At the time of writing, Solana is trading at $140, holding above the key support level of $139. The cryptocurrency is currently moving within an ascending triangle pattern, which typically precedes a breakout. If Solana successfully breaks out of this formation, it could see a 33% rise, pushing the price to $216.

For this breakout to occur, Solana would first need to breach the $161 resistance level. Given the recent institutional inflows and bullish macro indicators, this is possible. A successful breakout would set the stage for further gains.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

The rally would be confirmed once Solana flips the $184 resistance level into support. However, if SOL fails to break out of the ascending triangle, the price could retrace back to $139. Losing this support would invalidate the pattern and cast doubt on the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-price-rally-by-these-investors/

2024-10-10 12:00:00