Crypto analytics platform Santiment is naming 20 digital assets that may soon rally based upon one key metric.

In a new thread on the social media platform X, the firm says 20 digital assets are standing out for the amount of negative public sentiment they are receiving on social media platforms, including decentralized oracle network Chainlink (LINK) and smart contract platform Ethereum (ETH).

The negative sentiment suggests these digital assets may soon surge, according to Santiment.

“Chainlink, Ethereum, Bitcoin, Solana and XRP are the assets the crowd has turned the most negative on during this mild crypto slump. Coins with the most bearish crowd narratives historically have the best chance of rising.”

Santiment’s “20 best candidates” for a bullish move include:

- Chainlink (LINK)

- Ethereum (ETH)

- Bitcoin (BTC)

- Solana (SOL)

- XRP

- Optimism (OP)

- Polygon (MATIC)

- Sui (SUI)

- Cronos (CRO)

- Fantom (FTM)

- Avalanche (AVAX)

- Cardano (ADA)

- Render (RENDER)

- Floki (FLOKI)

- Pepe (PEPE)

- Toncoin (TON)

- Filecoin (FIL)

- Injective (INJ)

- Shiba Inu (SHIB)

- Tron (TRX)

Santimemt explains the methodology behind the list of the 20 digital assets.

“Weighted Sentiment is an adjusted measurement we provide that combines the social volume of an asset (across X, Reddit, Telegram, 4Chan and Bitcointalk) and multiplies by the ratio of positive vs. negative comments toward that asset.”

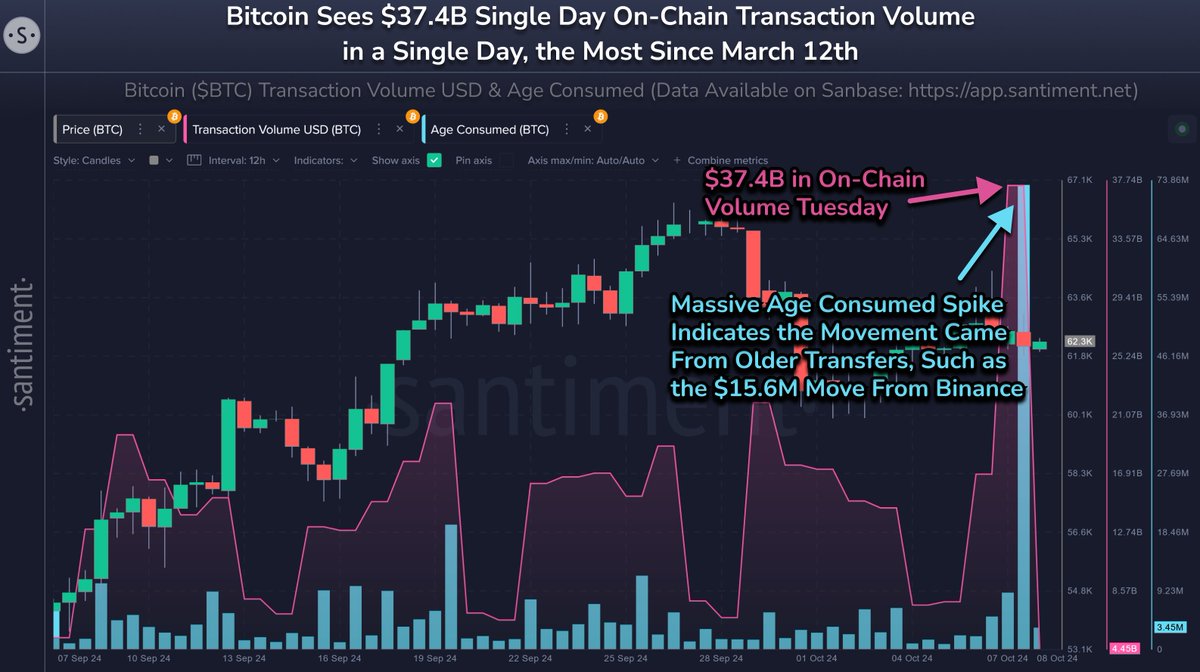

The market intelligence platform also says that recent Bitcoin activity suggests a rally for the flagship crypto is imminent.

“Our own metrics indicate a major spike in dormant activity on Bitcoin’s network to pair with $37.4 billion in on-chain volume Tuesday, the most in seven months. Historically, stagnant BTC moving back into regular circulation is a positive for future price movement.”

Bitcoin is trading for $60,734 at time of writing, down more than 2.3% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/10/10/here-are-20-crypto-assets-with-the-best-chance-of-rallying-based-on-sentiment-according-to-analytics-firm/

2024-10-10 18:05:41