The price of First Neiro on Ethereum (NEIRO) has skyrocketed by 87% over the past week, making it the market’s top gainer in the last seven days.

On Wednesday, the altcoin reached an all-time high of $0.0019. Although it has since experienced a brief pullback, its technical setup suggests that NEIRO is primed to reclaim this high and rally past it.

NEIRO Is The Talk Of the Town

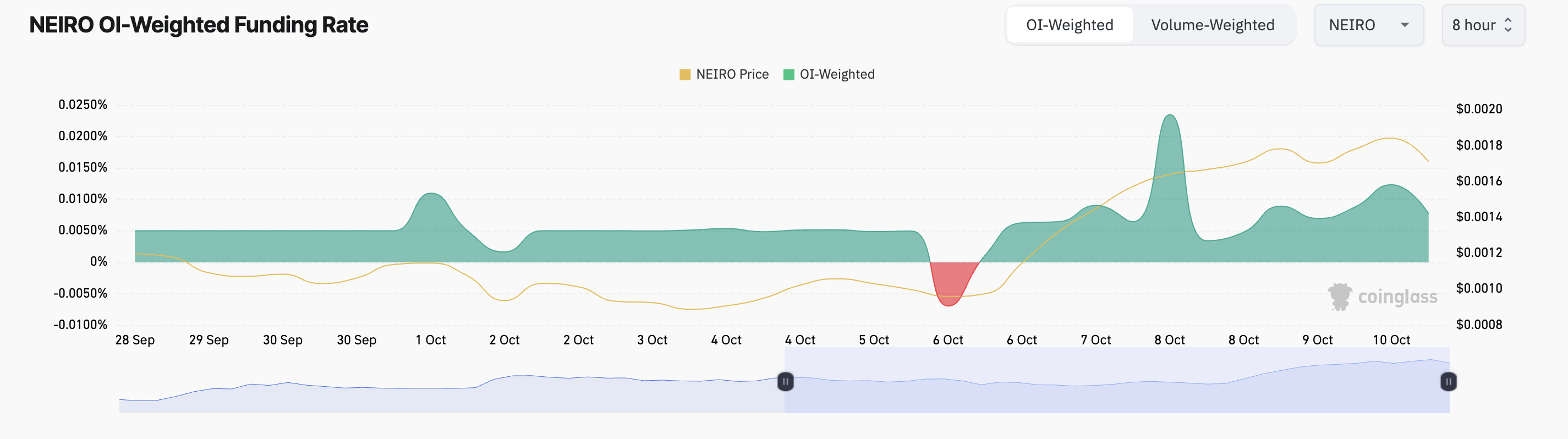

An uptick in futures open interest has accompanied NEIRO’s price rally. Coinglass data shows that the altcoin’s futures open interest currently sits at an all-time high of $196 million, climbing by 168% since the beginning of this month.

When both price and open interest rise, it typically suggests that the current trend is strong and supported by new money entering the market. This bullish signal indicates that traders are confident in the asset’s upward movement.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in October 2024

Moreover, NEIRO’s funding rate across cryptocurrency exchanges has been persistently positive, confirming the bullish bias towards it. As of this writing, this is 0.0077%.

A positive funding rate can indicate strong bullish sentiment in the market, as more traders are willing to go long. It signals that more traders expect the price to continue rising than those anticipating a decline.

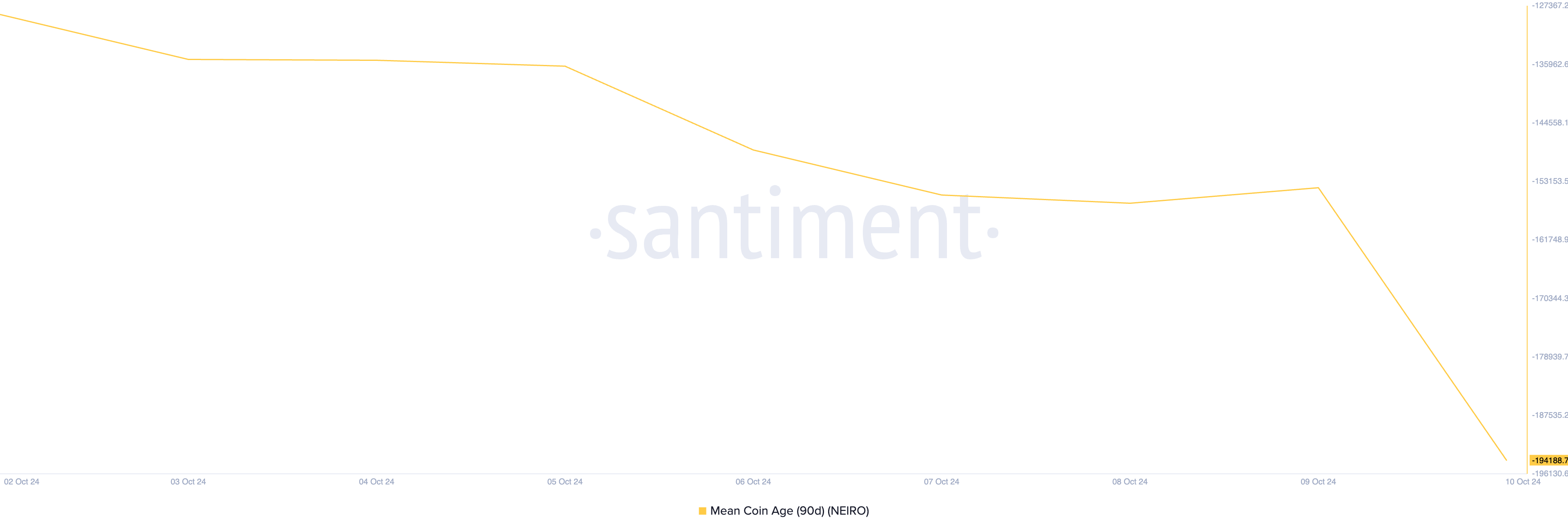

However, NEIRO’s price surge has also led to a spike in speculative trading, as evidenced by the gradual decline in its mean coin age over the past week. This metric, which tracks the average age of all coins in circulation, has registered a 51% fall in the past seven days.

When an asset’s mean coin age drops, it suggests that more speculative traders are entering the market and buying and selling coins for short-term gains rather than holding for the long term.

NEIRO Price Prediction: 41% Drop If Profit-Taking Spikes

A dip in an asset’s mean coin age typically signals profit-taking and a shift in market sentiment. If this triggers increased selling pressure, NEIRO’s price could risk losing recent gains, potentially dropping by 41% to as low as $0.00097.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

However, if profit-taking subsides and buying pressure increases, the bearish outlook would be reversed. In that case, NEIRO’s price could not only recover but also potentially surpass its all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/neiro-price-leads-market-gains/

2024-10-10 17:00:00