BNB price has faced significant challenges in recent weeks, with repeated failed attempts to breach the key resistance levels of $606 and $618. For more than two months, the altcoin has struggled to break through these barriers.

As BNB approaches these levels again, investors have begun to anticipate a bearish outcome, adjusting their positions to capitalize on a potential price decline.

BNB Is Losing Support

BNB’s overall macro momentum remains weak, as indicated by the Chaikin Money Flow (CMF). Currently, the CMF is at a three-month low, signaling low investor confidence in the asset. The last time netflows were at this low was back in June.

This steep decline shows that investors are pulling their funds out of BNB, likely due to skepticism about the token’s ability to maintain its price.

The low CMF suggests a lack of buying pressure, further reinforcing bearish sentiment. When investors begin withdrawing money from a cryptocurrency, it usually reflects growing uncertainty in the market. In BNB’s case, this trend could signal further price challenges ahead.

Read more: Best BNB Wallets to Consider in 2024

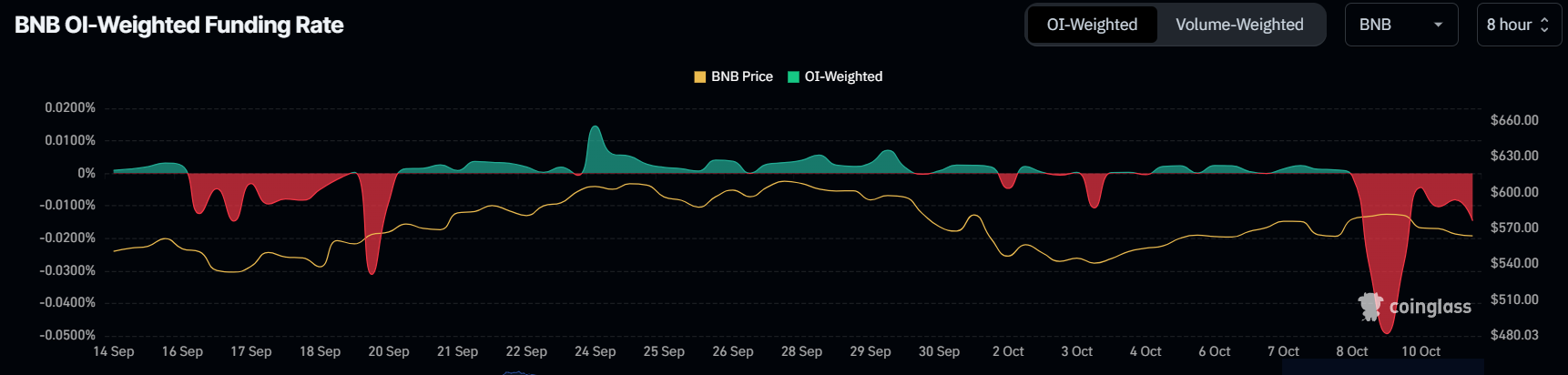

Market sentiment around BNB remains highly bearish, as evidenced by the funding rate. The negative rate shows that traders are increasingly placing short contracts, betting on a price drop. This trend reflects a market environment where traders expect the value of BNB to fall in the near future.

The bearish funding rate, combined with increased outflows, indicates that many traders are positioning themselves to benefit from a potential decline. Such widespread pessimism can sometimes become a self-fulfilling prophecy, as bearish sentiment drives further sell-offs, pushing the price lower.

BNB Price Prediction: Maintaining the Rise

Despite the bearish market sentiment, BNB has been in an uptrend since the start of September. While it failed to breach the $606 resistance last month, the altcoin has continued to test its uptrend line as support. At the moment, BNB is once again holding this support level, showing resilience in the face of broader market weakness.

If BNB loses this uptrend line as support, it could see a drawdown, with the price likely testing the $533 support level. This level has held multiple times in the past, providing a strong safety net against further decline.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

On the other hand, if BNB bounces off the uptrend line, it could rally towards $606, provided it flips $569 into support. A successful test of the $606 resistance would invalidate the current bearish outlook, even if the altcoin faces some setbacks after reaching that level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bnb-price-rally-threatened-by-outflows/

2024-10-11 06:55:55