Crypto markets will witness $1.61 billion in Bitcoin and Ethereum options contracts expire today. The massive expiration could cause a short-term price impact, particularly after Bitcoin briefly broke below $60,000.

With Bitcoin options valued at $1.10 billion and Ethereum at $510.08 million, traders are bracing for potential volatility.

Why Bitcoin and Ethereum Could See Volatility Today

There is a significant increase in Bitcoin (BTC) and Ethereum (ETH) contracts due for expiry today compared to last week. Data on Deribit shows 18,271 Bitcoin options contracts will expire with a put-to-call ratio of 0.90 and a maximum pain point of $62,000.

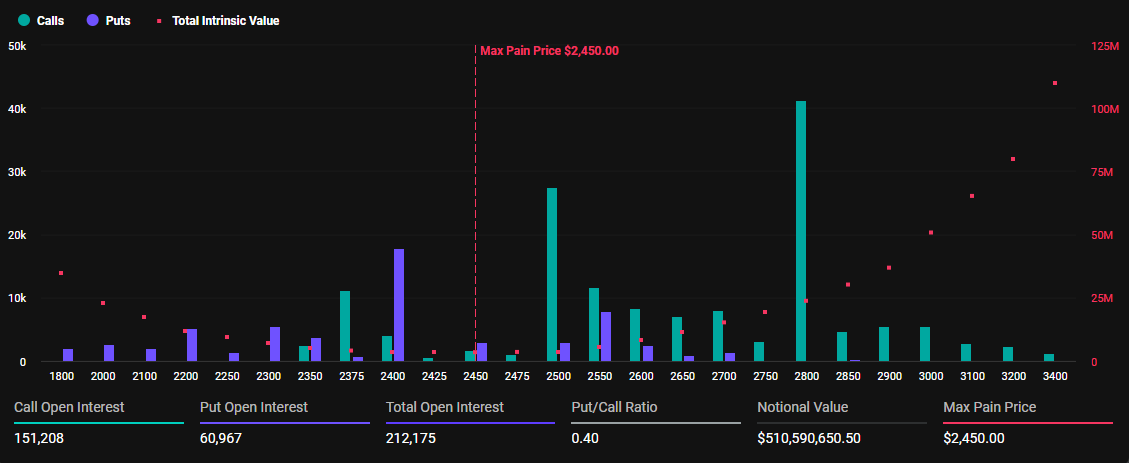

Regarding Ethereum, 212,175 contracts are due for expiry today, with a put-to-call ratio of 0.40 and a maximum pain point of $2,450.

Read more: An Introduction to Crypto Options Trading.

For Bitcoin, the expiring options suggest a generally bullish sentiment after it briefly slipped below $60,000. With a maximum pain point of $62,000, the pioneer crypto, now trading for $60,612 per share, stands well below its strike price. On the other hand, Ethereum is trading for $2,407, which is also below its maximum pain price of $2,450.

The maximum pain point is a crucial metric that often guides market behavior. It shows where the expiry will cause the greatest financial loss to all option holders that have entered into a contract at that strike rate at expiration.

“Keep an eye on the ratios and max pain levels. They might tell us where the market is leaning,” analysts at Crypto Town Hall suggested.

Bitcoin, Ethereum Trade Below Max Pain Price

As Bitcoin (BTC) and Ethereum (ETH) options near expiration both assets are expected to approach their respective strike prices. This is a result of the Max Pain theory, which predicts that options prices will converge around the strike prices where the largest number of contracts — both calls and puts — expire worthless.

Large institutions, often referred to as smart money, typically sell these options. They have an incentive to push the price toward the “max pain” level by trading in the spot or futures markets. This strategy causes option buyers, who are their counterparties, to lose the most value.

Heading into the expiry, both Bitcoin and Ethereum could gravitate toward these max pain points. The pressure on prices, however, will fade after the options expire, with Deribit expected to settle contracts at 08:00 UTC on Friday.

Currently, buyers of put options on BTC and ETH seem poised to benefit. With the current market underperforming, option sellers will likely push prices upward to reduce their losses. An in-the-money put means the current asset price is below the strike price, enabling holders to sell at a better rate than the market offers.

Read more: 9 Best Crypto Options Trading Platforms.

Analysts at Greeks.live advise traders to stay alert, as this market shift could open up new trading opportunities. Recent sector weakness could create favorable conditions for strategic moves.

The analysts also note that the recent market lull led to Bitcoin showing flat implied volatility (IV). This is ideal for building some medium — to long-term calls at a low level. Further, block call trading (large buy or sell orders that often indicate what an institution is doing to its portfolio) has been progressively more active this week.

“With crypto continuing to weaken the key $60,000 level now hotly contested, and ETH near the long-term support line of $2,300, a market change could be just around the corner. The first two weeks of the fourth quarter of this year were poor; the options market is also more depressed. The current options position has fallen to a new low since 2023. But a sluggish market also breeds new trading opportunities,” the analysts noted.

Options expirations often cause short-term price fluctuations, creating market uncertainty. However, markets usually stabilize soon after as traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing future crypto market trends.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/volatility-ahead-bitcoin-options-expiring/

2024-10-11 07:12:00