In October, the total value locked (TVL) on Solana hit a new high, surpassing $6.1 billion. This marks the highest level since January 2022.

TVL refers to the total value of assets deposited by users into a project. A rising TVL is often an indicator of increased user trust and engagement with the platform.

TVL Surpasses $6.1 Billion with 40 Million SOL Locked

Alongside the record-breaking TVL, data from DefiLlama shows that, as of October 15, over 40 million SOL tokens are locked in DeFi protocols. This figure has been steadily rising from 14 million SOL at the beginning of 2024.

Read more: Top 7 Projects on Solana With Massive Potential

Thus, the increase in TVL is not solely due to the rise in SOL’s market price. The growing amount of SOL being locked in these protocols indicates increasing user demand.

Meme Coin Hype Drives Trading Demand on DEXs

Raydium, a decentralized exchange (DEX) on Solana, has been a major contributor to its TVL exceeding $6.1 billion. Since the start of October, Solana’s TVL has increased by $1 billion, with Raydium alone accounting for $600 million of that growth.

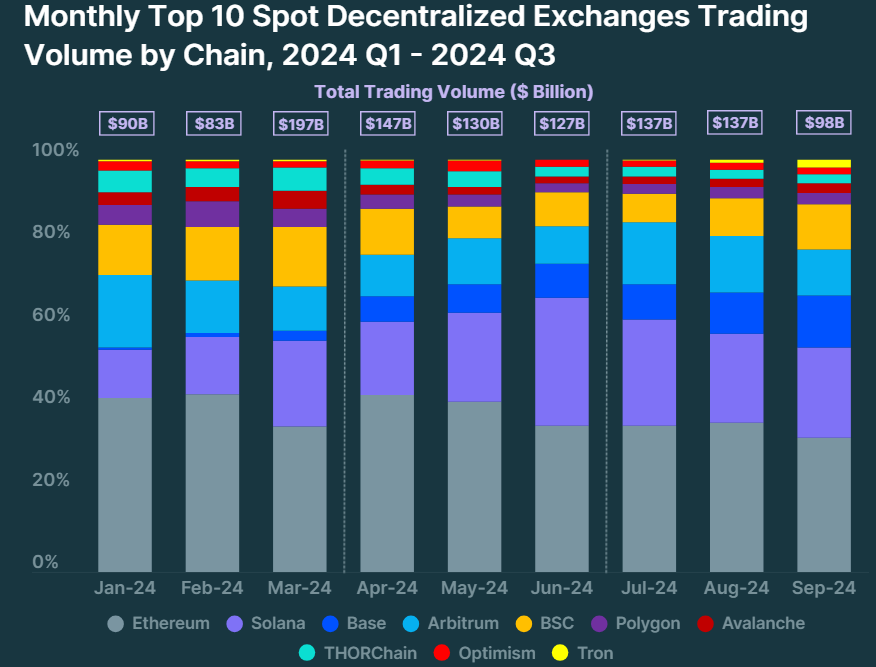

“DEX trading activity continued to flourish on Solana, buoyed by the multitude of meme coins. It ended September with a 22% market share and $21.5 billion in volume,” CoinGecko said.

Trading demand on Raydium has surged amidst the ongoing meme coin craze, which shows no signs of cooling in October. Recent data from Kaito reveals that meme coins have hit a new peak in mindshare.

Furthermore, data from CoinGecko indicates that the market capitalization of meme coins on Solana has surpassed $11.2 billion, with daily trading volume nearing $4 billion.

Read more: 13 Best Solana (SOL) Wallets to Consider in October 2024

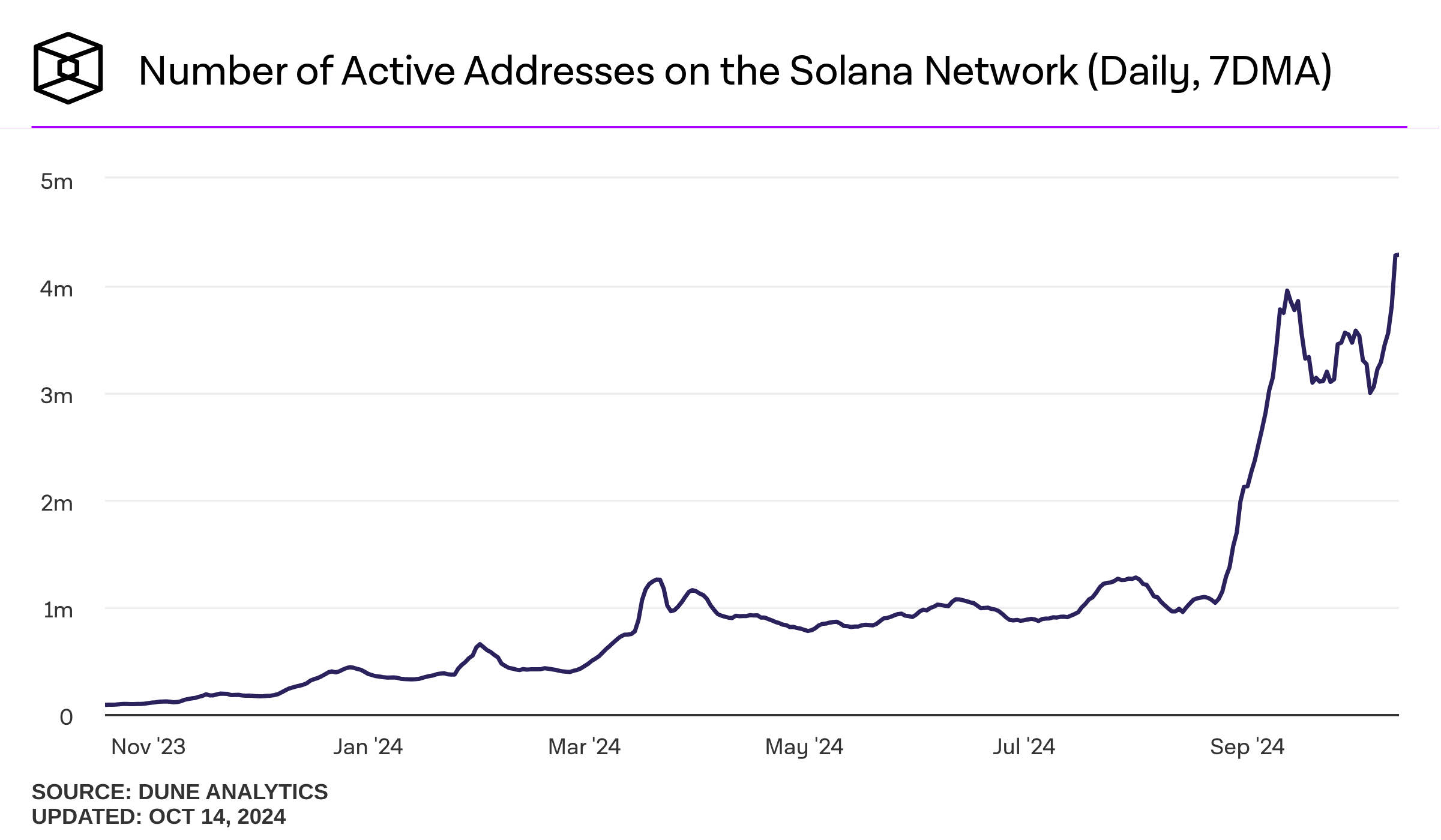

Daily Active Addresses on Solana Hit New Highs

Data from IntoTheBlock reveals that Solana’s network’s daily active addresses (DAA) reached a new record. In October, Solana’s network saw over 4 million active addresses on certain days. Since September, DAA has consistently remained above 3 million per day.

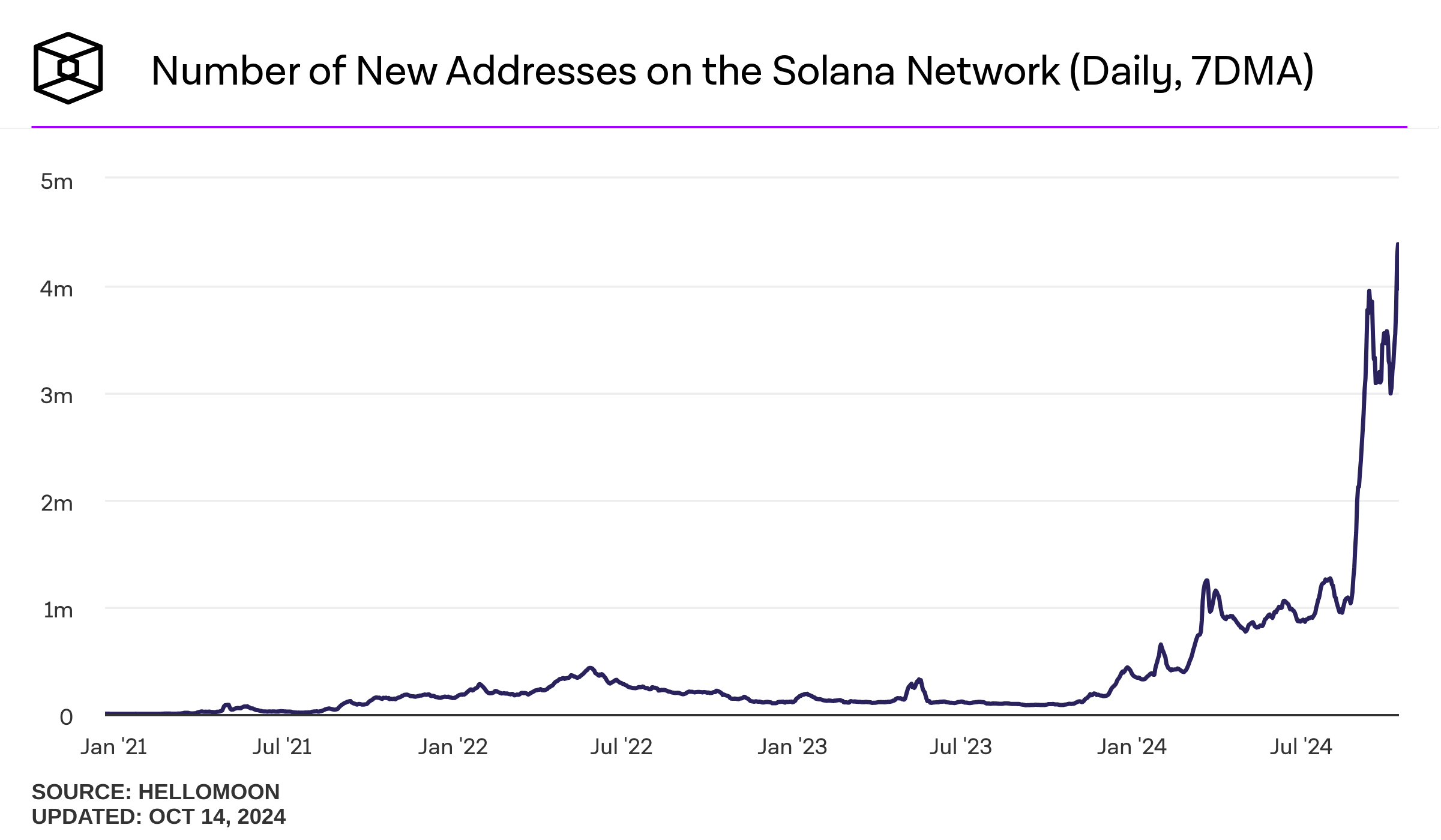

In addition, the number of new addresses on Solana (7DMA) set an all-time high in October, with over 4 million new addresses created weekly. The number of new addresses reflects demand from new users, often signaling fresh capital inflows into a project. This trend is typically a key driver of price growth for altcoins.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Currently, SOL is trading at around $156. Recent technical analysis suggests that SOL is facing significant resistance at $159, with the potential to reach $200 if it breaks past this level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/solanas-tvl-surpasses-6-1-billion/

2024-10-15 06:43:31