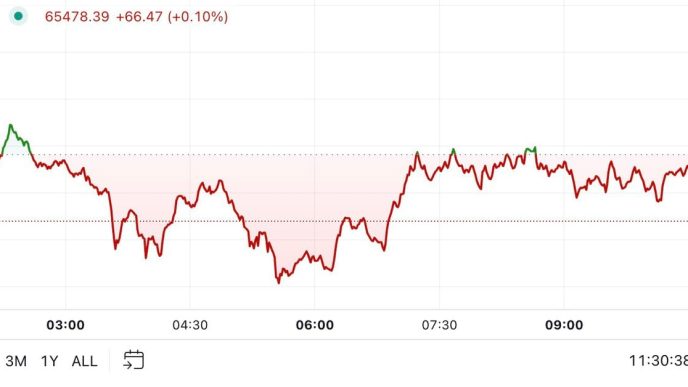

Cardano (ADA) is nearing a critical resistance level even though its price has recently increased. This is largely because several addresses holding ADA at unrealized losses may be ready to pull the plug on holding the cryptocurrency.

With sentiment currently divided, failure to break through this barrier could signal looming correction or consolidation for ADA. At the same time, an extended rally could depend on how strong the buying pressure may be against this sell wall.

Heavy Selling Pressure Awaits Cardano

According to the In/Out of Money Around Price (IOMAP), Cardano faces a significant resistance zone at $0.39. At this price level, around 161,740 addresses hold over 2 billion ADA tokens.

The IOMAP model categorizes addresses based on their market position. Those “in the money” purchased the cryptocurrency at a lower price than its current value. In comparison, “out of the money” addresses were bought at a higher price. This suggests that those holding ADA at a loss may be inclined to sell to cut losses, which increases selling pressure on the asset.

Typically, the larger the cluster of addresses or volume, the stronger the support or resistance. While Cardano’s price might rise, these addresses, which hold substantial amounts, could trigger selling pressure that could prevent further upward movement above $0.39.

Read more: How to Mine Cardano and Earn More Coins

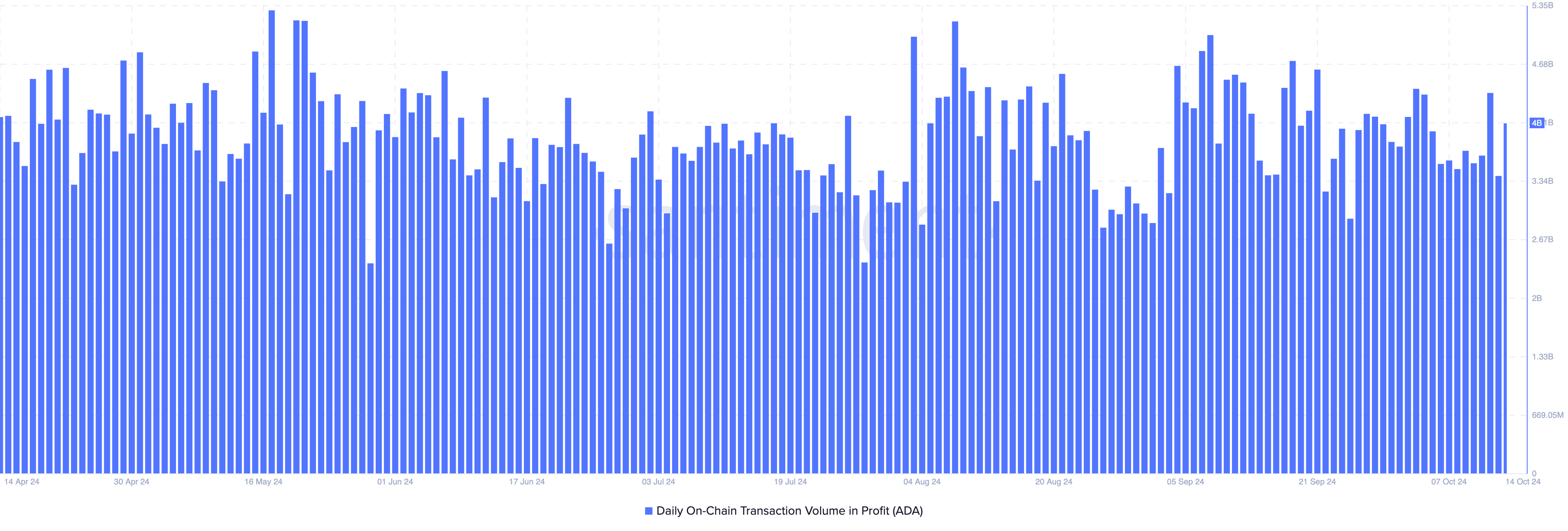

In addition to the resistance at $0.39, ADA is seeing a surge in profit-taking. Data from Santiment shows that daily on-chain transactions in profit surged to 4 billion ADA on October 14. This indicates that Cardano holders booked approximately $1.44 billion in profits in just one day.

Furthermore, this selling pressure could outweigh the upward momentum, making it harder for ADA to sustain further price gains.

Notably, the rise in profit-taking is significantly higher than what was recorded the previous day. If this trend continues, it could contribute to ADA’s price drawdown, potentially preventing it from reaching the $0.40 mark.

ADA Price Prediction: Time to Pullback

The daily chart for Cardano (ADA) shows the formation of a head and shoulders pattern, a technical signal that typically indicates the end of an uptrend. In this pattern, the price forms three peaks, with the middle peak (the head) being the highest.

The pattern of the head and shoulders is considered a bearish reversal, suggesting that ADA’s recent upswing could be nearing its end. If this pattern holds, it could prevent ADA from climbing higher, potentially leading to a price collapse to $0.31.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in October 2024

However, this bearish scenario can be invalidated if a significant surge in buying pressure occurs. For this to happen, the trading volume needs to match or exceed the levels seen at the $0.39 resistance point.

In that case, ADA could see a rally towards $0.45, reversing the bearish pattern and continuing its upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-price-to-face-sell-wall/

2024-10-15 12:00:00