Injective (INJ) briefly surged to a 16-day high of $23.09 on Thursday, following its listing on South Korea’s leading crypto exchange, Upbit. Since then, the price has corrected by 7% and is now trading at $21.28.

Despite the pullback, bullish sentiment around this Layer-1 (L1) coin remains strong. INJ is positioned to retest this recent high and potentially rally beyond it. This analysis delves into what investors can expect as momentum builds.

Injective Has Upbit To Thank

In a Thursday announcement, Upbit revealed that it will support INJ trading on its platform across both Korean Won (KRW) and USDT markets. This immediately prompted a surge in the coin’s trading activity, pushing its price to $23.09, its highest since the beginning of October.

Although the uptick was brief, and INJ now trades at $21.28, INJ’s technical setup suggests that it may reinitiate the uptrend, reclaim this high, and even surpass it. Readings from its moving average convergence/divergence (MACD) confirm this bullish outlook.

As of this writing, the coin’s MACD line (blue) is positioned above both the signal line (orange) and the zero line. The MACD indicator, which tracks price trends and momentum, helps identify potential buy or sell signals.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

This setup indicates a strong bullish trend, suggesting that momentum is positive and the asset is in an uptrend, with the short-term average notably higher than the long-term average.

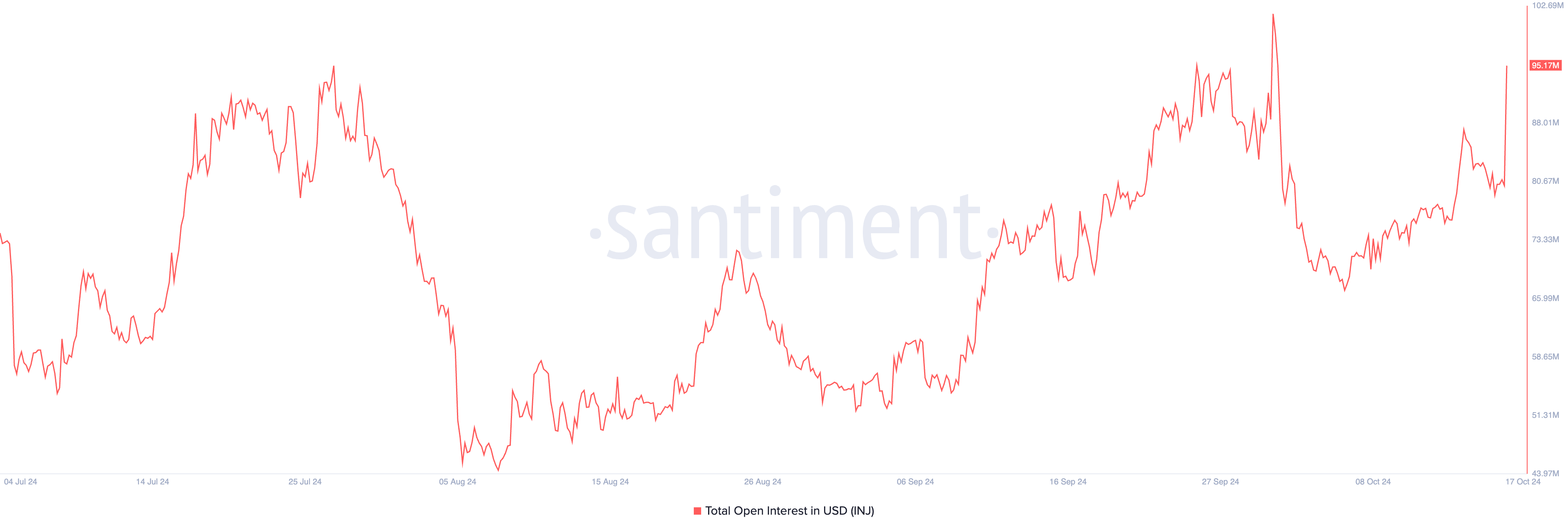

Further, INJ’s open interest has spiked by 19% over the past 24 hours, reflecting the uptick in its market activity. As of this writing, this stands at $95.17 million.

An asset’s open interest represents the total number of outstanding derivative contracts that remain unsettled or open. In INJ’s case, the rising open interest accompanying its price surge suggests that new capital is entering the market, with traders actively taking positions. This is a sign of a strengthening bullish trend.

INJ Price Prediction: Why the Bulls Are Needed

The $22.01 level serves as a key resistance for INJ, with the coin currently trading at $21.28, just below this mark. If bullish momentum persists, breaking above this resistance could trigger a 54% rally, potentially pushing the price to $33.38 — a level last seen in June.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

On the other hand, if profit-taking intensifies, INJ could fall to $15.79. Failure to hold this support may result in a further decline, with the price possibly dropping to $13.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/inj-price-eyes-54-gains/

2024-10-17 22:00:00