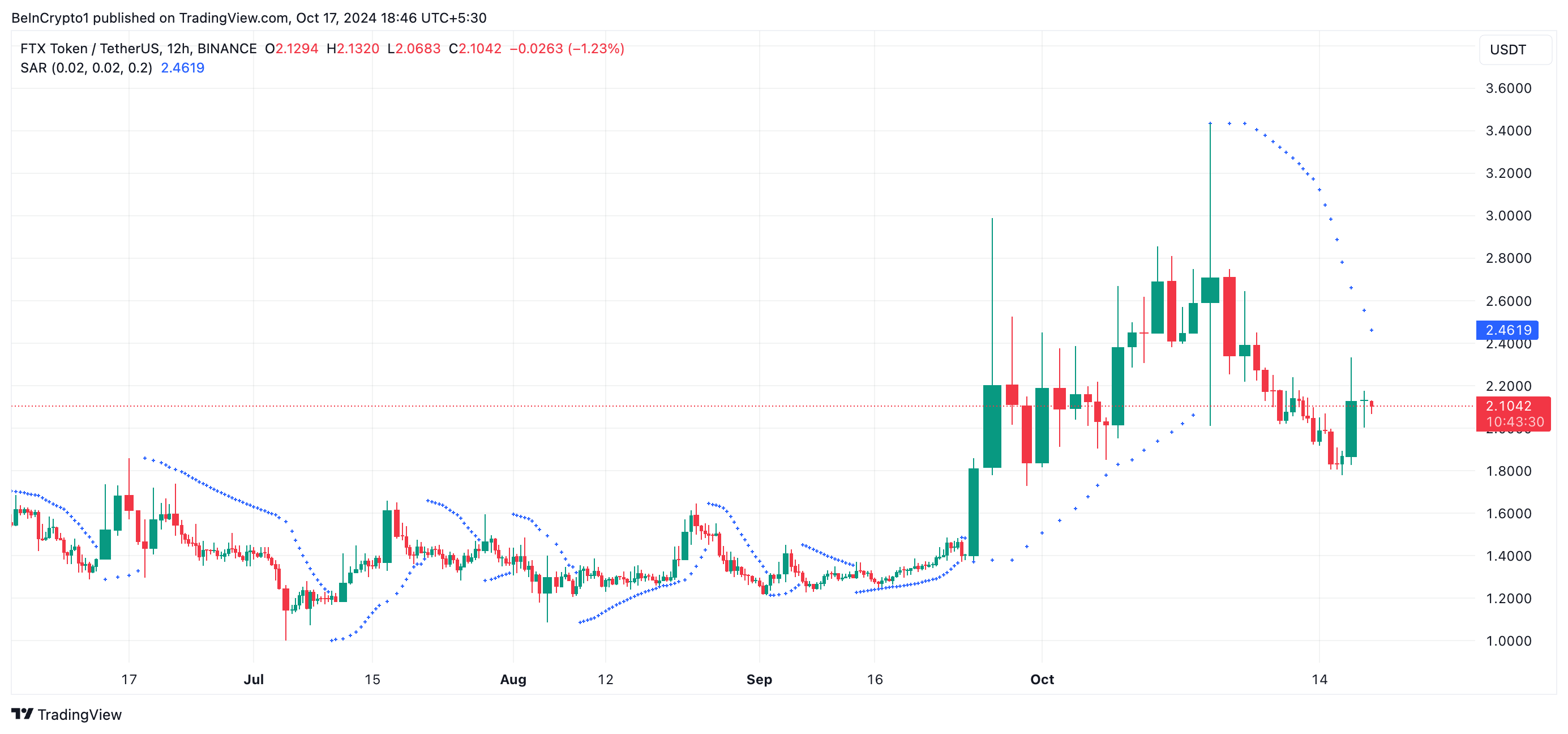

FTX Token (FTT) has seen a 14% price increase in the past 24 hours, making it the top gainer in the market. However, this surge is primarily driven by speculative trading rather than a specific increase in demand for FTT.

The altcoin’s technical setup reveals that it may shed some of these gains in the near term. Here is why.

FTX Token Climbs But Not Due To Demand

While its price has climbed by double digits over the past 24 hours, FTT’s negative Chaikin Money Flow (CMF) hints at a potential pullback. At press time, this indicator, which measures an asset’s money flow into and out of the market, is at -0.26, forming a bearish divergence with its price.

This divergence between FTT’s rising price and negative CMF signals that the uptrend is unsustainable, suggesting that the rally is driven by speculative trading, not strong market demand. This scenario often precedes an impending reversal. If the selling pressure intensifies, the price could correct downward once the upward momentum wanes.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Furthermore, the setup of FTT’s Parabolic Stop and Reverse (SAR) indicator confirms this bearish outlook. At press time, the dots of this indicator rest above FTT’s price, reflecting the overall bearish sentiment that trails the altcoin.

The Parabolic (SAR) indicator measures an asset’s trends and identifies its potential price reversal points. When its dots are located above the price, it indicates a bearish trend. This suggests that the market is experiencing downward momentum, and traders often consider this a signal to sell or take short positions.

FTT Price Prediction: A Correction Is More Than Likely

As speculative trading subsides, FTX Token’s price will likely correct, potentially shedding some of its recent gains. Its Fibonacci Retracement analysis suggests that the altcoin could drop to the support level of $1.25. If this support fails to hold, we may see a further decline toward the $1 mark.

Read more: Who Is John J. Ray III, FTX’s New CEO?

However, this bearish outlook could be overturned if FTT experiences a surge in new demand. In such a scenario, the asset could sustain its upward trajectory, breaking through resistance at $2.93 and possibly climbing to as high as $3.53.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ftx-token-price-decline/

2024-10-17 23:55:00