Shiba Inu’s (SHIB) price action over the last 30 days has drawn a notable reaction from the meme coin holders. If sustained, this action could be crucial to a significant price increase for the token, which struggled for most of the last two quarters.

Currently, SHIB’s price is $0.000019, thanks to a 30% increase within the mentioned period. However, this might not be the end of the rally, even though the upswing has slowed down recently.

16 Trillion Shiba Inu Token Leave Exchanges

Data from Glassnode showed that SHIB holders had withdrawn over 16 trillion tokens from exchanges in the last seven days. At the current price, this amounts to approximately $288 million.

When a large amount of cryptocurrency is withdrawn from an exchange, the circulating supply available for trading on that platform reduces. This can increase scarcity, particularly if the withdrawals involve a popular coin or a large portion of liquidity.

In most cases, this leads to a potential price rise due to basic supply and demand principles. Therefore, if the exchange withdrawals continue to rise, then SHIB’s price might erase its 24-hour modest decline and climb higher.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

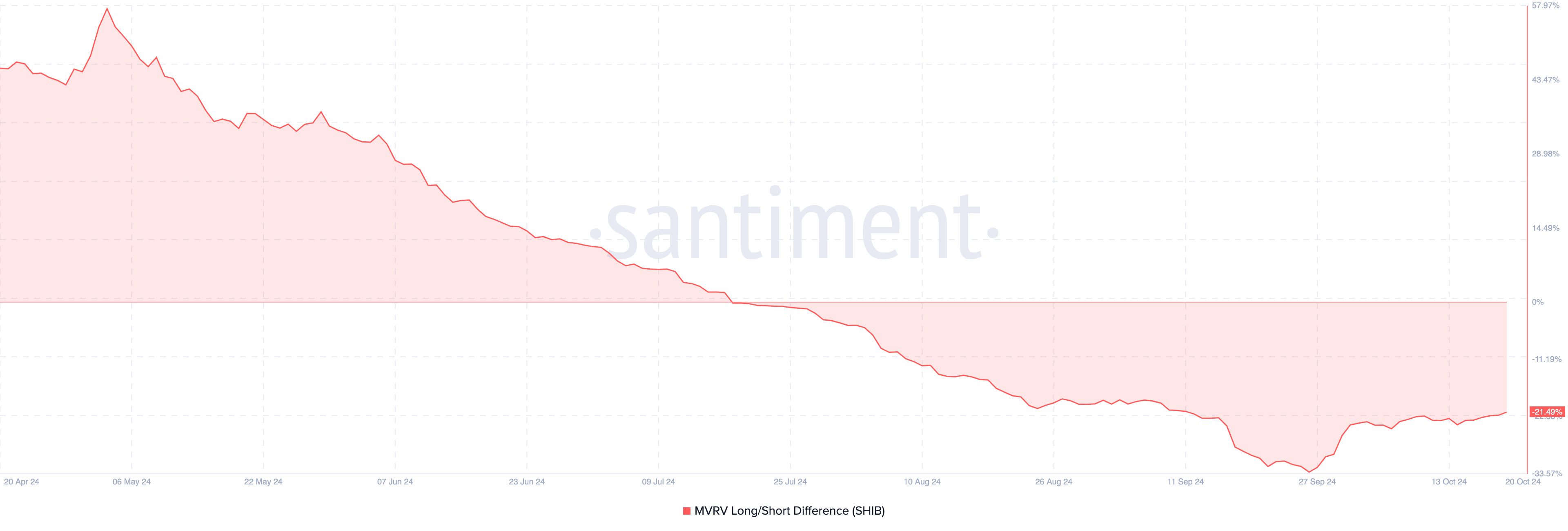

Another metric supporting such a sustained bounce is the Market Value to Realized Value (MVRV) Long/Short Difference. When the MVRV Long/Short Difference increases, it means that long-term holders have more unrealized profits than short-term holders, and this is typically a bullish sign.

On the other hand, a declining reading of the metric indicates otherwise and mostly indicates a bearish market condition. On September 26, the metric was 33.44%, coinciding with the period when SHIB’s price was $0.000014.

But as of this writing, the MVRV Long/Short Difference has risen to -21.49%, suggesting that the meme coin is slowly exiting the largely bearish phase. Should this reading continue to rise, then Shiba Inu’s price might also follow suit.

SHIB Price Prediction: Eyes on Another 25% Rally

Currently, SHIB is trading just below the psychological resistance level. However, a look at the Bull Bear Power (BBP), which measures the level of accumulation or distribution, suggests that the token might breach the obstacle.

The BBP reading measures the strength of buyers (bulls) against that of sellers (bears). When the reading is negative, sellers are in control. On the daily chart, the BBP is positive, indicating that bulls are dominant.

This was further reinforced by the Exponential Moving Average (EMA). As seen below, the 20 EMA (blue) is above the 50 EMA (yellow), which signifies a bullish trend. Should this trend continue going forward, SHIB’s price might jump to $0.000024.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

On the downside, if bears want to prevent this upswing, they need to ensure that the token does not close above $0.000020. If that happens, SHIB’s price might decline to $0.000017.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/shib-price-analysis-bullish/

2024-10-20 13:30:00