Bitcoin price has surged close to $68,260 in recent days, with bullish momentum bringing it tantalizingly close to the key psychological level of $70,000. This upward price action has sparked renewed interest in the cryptocurrency, as it breached a crucial resistance level at $68,248.

However, the next move hinges on Bitcoin (BTC) investors, who are displaying bullish signs yet are known to quickly shift sentiment. The path to $70,000 now lies in their hands, with both upside potential and downside risks ahead.

Bitcoin Investors Are Bullish

Over the weekend, the supply of Bitcoin on exchanges saw a sharp decline, reflecting a growing sense of optimism among investors. Approximately 40,000 BTC, worth over $2.73 billion, was moved out of exchanges, a bullish move.

As the price approaches $70,000, FOMO (fear of missing out) buying could further fuel the rally. While some investors are entering the market at higher prices, anticipating further gains, the fact that BTC is being pulled off exchanges is still a positive indicator. This shows that many investors are confident in Bitcoin’s upward trajectory.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

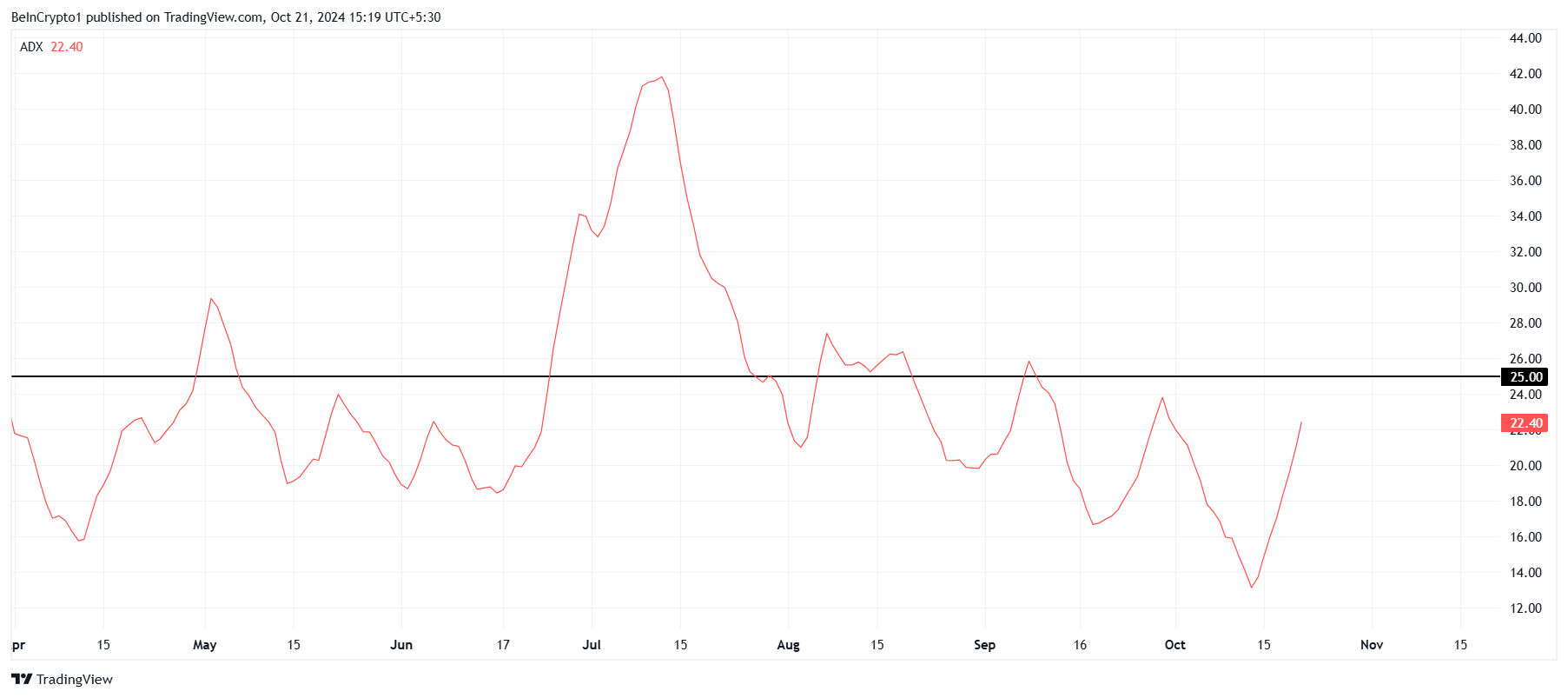

From a technical perspective, Bitcoin’s macro momentum remains strong. One key indicator supporting this bullish narrative is the Average Directional Index (ADX), which is nearing a crucial threshold of 25.0.

A breach of this level would signal that the current trend is strong, further strengthening the bullish outlook for Bitcoin. If the ADX crosses 25, it would suggest that Bitcoin is likely to continue its upward trajectory, gaining momentum as it pushes closer to new highs.

BTC Price Prediction: Eyeing All-Time Highs

At the current price of $68,260, Bitcoin has successfully flipped the previous resistance at $68,248 into a new support level. If BTC can hold above this support, the next target is the $70,000 mark, followed by $71,367, which represents the final resistance before a new all-time high. Sustaining above these levels would solidify Bitcoin’s bullish trend and open the door for further price appreciation.

If Bitcoin can break through the $71,367 resistance, the final barrier toward a new all-time high at $73,080 will be breached. This level would signify a significant milestone for BTC, indicating strong investor confidence and continued market momentum.

Read more: Bitcoin Halving History: Everything You Need To Know

However, should Bitcoin lose the $68,248 support level, it risks a correction to $65,292. This could wipe out much of BTC’s recent gains. A further decline below $65,000 would invalidate the current bullish thesis, leading to a potential bearish reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-holders-strategy-price-70000/

2024-10-21 13:30:00