In the past few weeks, Layer 1 (L1) blockchain Aptos (APT) has witnessed a significant surge in network activity. User activity on the Proof-of-Stake (PoS) network has climbed to multi-month highs, driving the value of its native token, APT, to new heights.

Readings from its technical setup suggest that APT is poised to extend its current gains. If demand is sustained, the altcoin may rally toward $19.37. This analysis delves into why that is likely in the mid-term.

Crypto Users Flock to Aptos

On-chain data has revealed a notable uptick in user activity on Aptos over the past month. Per Artemis, the daily count of unique addresses that completed at least one transaction of the blockchain in the past 30 days has skyrocketed by 115%. During the period in review, Aptos’ daily active addresses have totaled 743,466.

The recent surge in user activity on the Aptos network has led to a significant increase in its daily transactions. Over the past month, the network has processed more than 5 million transactions, marking an impressive 373% growth in transaction volume.

Read more: 5 Best Aptos (APT) Wallets in 2024

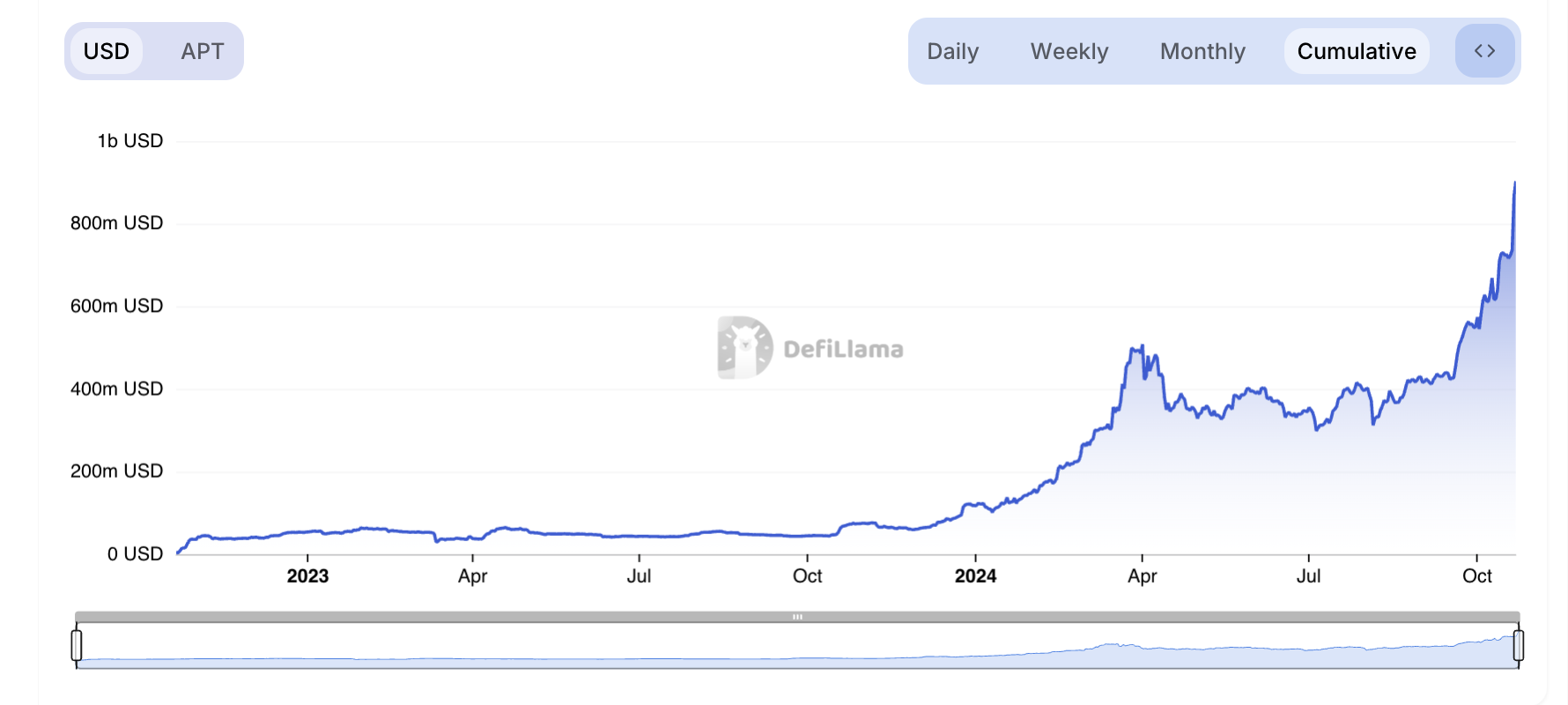

This growth is evident in Aptos’s thriving decentralized finance (DeFi) sector. Its DeFi total value locked (TVL) has spiked 67% over the past 30 days, reaching an all-time high of $909 million.

According to DefiLlama, Aptos currently ranks as the 11th largest blockchain by TVL, trailing just behind Sui, which has a TVL of $1.01 billion.

APT Price Prediction: Coin Targets Yearly High

The surge in network activity has translated into impressive price gains for APT. As of this writing, the altcoin trades at $10.88, just above the support of $10.07. It has noted an 11% price surge over the past 24 hours and currently ranks as the market’s top gainer.

BeInCrypto’s assessment of the coin’s key momentum indicators suggests the possibility of an extended rally. For example, APT’s Chaikin Money Flow (CMF) has also trended upward with its price, and it currently rests above the zero line at 0.20.

The CMF measures how money flows into and out of an asset. When it rises alongside price, as in APT’s case, it suggests the upward price movement is backed by strong buying volume, making the trend more likely to continue. If the uptrend is sustained, Aptos’ price may attempt to reclaim its yearly high of $19.37 and can possibly surge towards the psychological resistance at $20.

Read more: Aptos Crypto (APT): A Guide to What it Is and How it Works

However, a surge in profit-taking activity will invalidate this bullish projection. If this happens, APT’s price may drop to its August 5 low of $4.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/aptos-price-target-yearly-highs/

2024-10-22 16:00:00