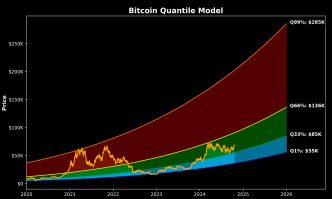

Sina—a professor, consultant, and co-founder & COO of 21stCapital.com—is projecting that the Bitcoin price could rise as high as $285,000 by the end of 2025 in a new analysis shared on X. Utilizing a quantile regression model, Sina identifies distinct phases in Bitcoin’s market cycle.

Can Bitcoin Price Skyrocket Above $200,000?

The model identifies the Cold Zone (<33%) as the price range between $55,000 and $85,000. This zone represents the lowest possible range by the end of 2025 and suggests a period ideal to “aggressively accumulate.”

The Warm Zone (33-66%), spanning from $85,000 to $136,000, marks a period where the market gains momentum, and mainstream attention intensifies. During this phase, rapid price growth is expected as the “train leaves the station.” Sina recommends a standard accumulation strategy here, such as dollar-cost averaging (DCA), to steadily increase holdings.

Related Reading

The most critical phase, the Hot Zone (>66%), ranges from $136,000 to $285,000. This zone is characterized by heightened volatility and significant price swings as mass adoption peaks and leveraged positions become prevalent.

While there is substantial room for upside, the risk of reversals escalates rapidly. Sina advises investors to either hold and enjoy potential gains or consider gradually exiting positions based on risk assessments, particularly since historical tops occur in the 90th to 99th quantile range. Notably, the 90th quantile starts at $211,000.

What astonishes Sina is how these 33% quantile ranges align seamlessly with Bitcoin’s historical phase transitions. He notes that Bitcoin tends to spend exactly one-third of its time in each zone before transitioning to the next, almost like clockwork. This pattern means that most of the bear market occurs below the 33% quantile, while bull market euphoria begins above the 66% quantile.

Renowned crypto analyst PlanC (@TheRealPlanC) acknowledged Sina’s model, commenting that it is a “perfect explanation—super clear.” Sina, in turn, credited PlanC for the foundational work that influenced his own model.

Related Reading

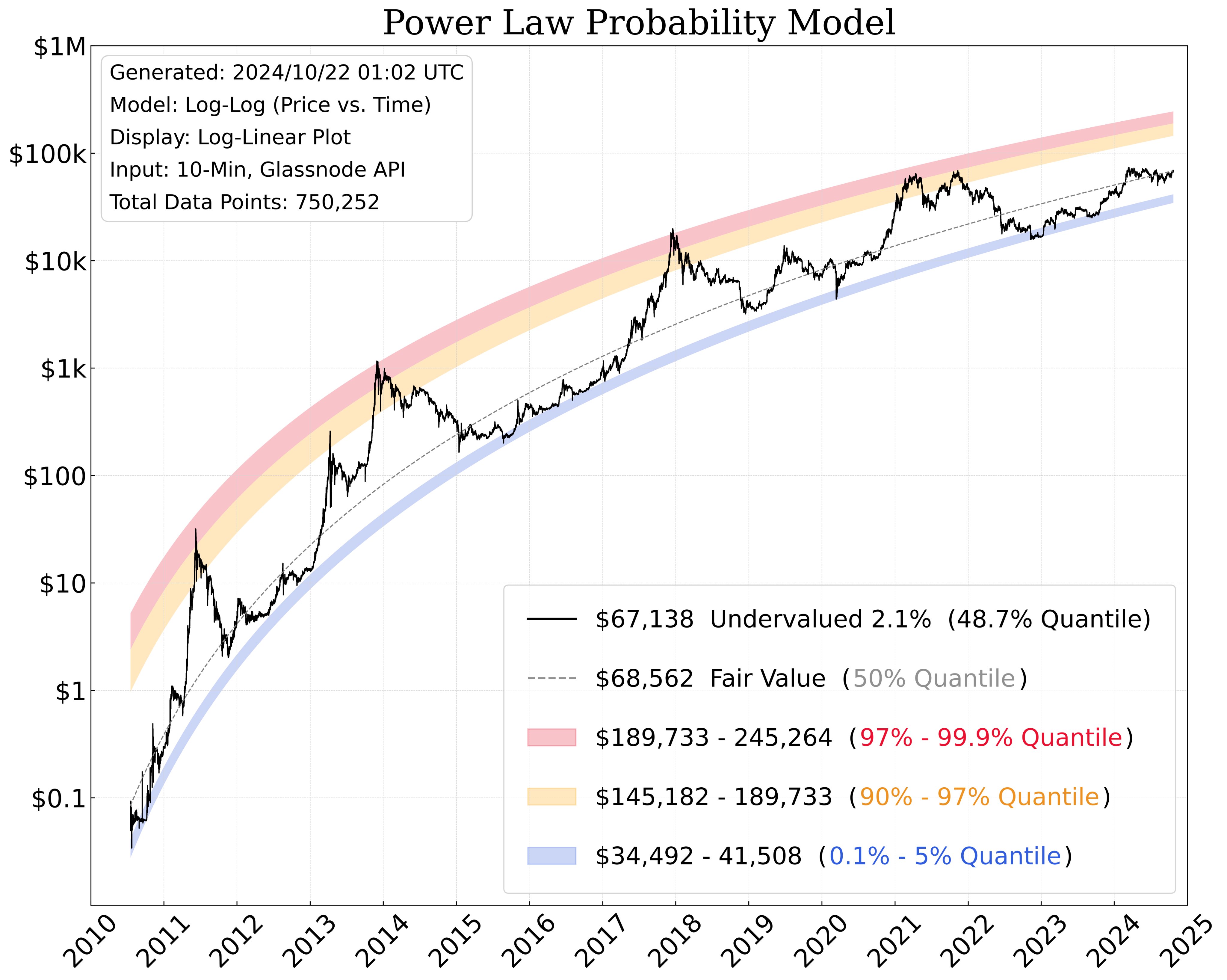

PlanC has also recently updated his “Power Law Probability Model,” which forecasts Bitcoin prices ranging from $189,733 to $245,264 for the 97% to 99.9% quantile and $145,182 to $189,733 for the 90% to 97% quantile. He emphasizes that despite appearances, the underlying data follows a power-law relationship, independent of how it’s plotted—be it linear, log-linear, or log-log scales.

“The data follows a log-log relationship with quantile regressions, whereas the rainbow chart uses logarithmic regression with a log-linear relationship. […] I am not ‘drawing’ these lines. These are quantile regressions of the log of price vs. time, based on all the data we have to date,” he explains.

To contextualize the model’s predictive capabilities, PlanC elaborates on the significance of various quantiles. The 99.9% quantile means the price has been above this line only 0.1% of the time, equating to just one day out of every 1,000 days—a very rare event. The 99% quantile indicates the price has exceeded this line 1% of the time, or one day out of every 100 days, also considered rare. Conversely, the 0.1% quantile reflects that the price has fallen below this line only 0.1% of the time.

At press time, BTC traded at $67,121.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/bitcoin/bitcoin-price-target-quantile-model/

2024-10-22 18:00:03