For some days, the price of Chainlink (LINK) has been swinging between $10 and $11. This is a surprising move, considering the project’s recent notable developments.

But with Chainlink bears at the forefront of control, here is why the altcoin might find it challenging to react positively in the short term.

Chainlink Bears Take Bulls Out

According to IntoTheBlock, the Chainlink Bulls and Bears indicator favors bears. In this context, bears are addresses selling at least 1% of the total trading volume. Bulls, on the other hand, are those selling the same supply.

When bulls have more volume than bears, the price of the asset can increase. But as of this writing, Chainlink bears have sold over 500,000 more tokens than bulls purchased.

Given this position, it seems highly unlikely that LINK’s price will increase, despite some analysts believing that the token should be trading for at least $15.

Read more: How to Buy Chainlink (LINK) With a Credit Card: A Step-By-Step Guide

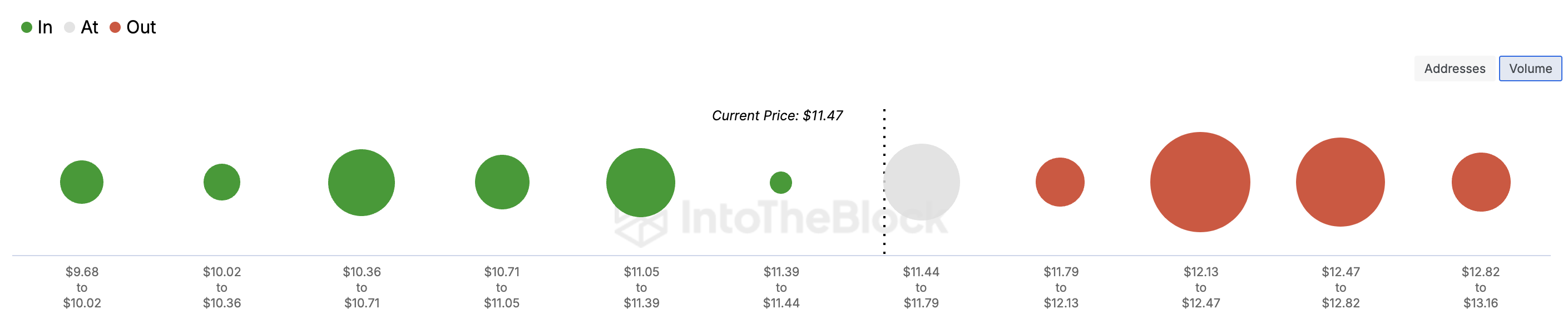

Besides this, the In/Out of Money Around Price (IOMAP) shows that LINK might continue to face resistance despite several attempts to surpass $12. The IOMAP shows the number of addresses and volume holding a token in unrealized profits or losses.

If the volume of losses surpasses that of profits, the next cluster will likely serve as a major resistance point. Conversely, a higher volume of profits will create a significant support region.

As shown above, the major resistance lies between $12.47 and $12.82. At this point, almost 18,000 addresses purchased more than 100 million LINK tokens. Therefore, if the price moves toward this region, some addresses might break even, possibly pushing the value lower.

LINK Price Prediction: Lower Lows

On the daily chart, Chainlink faces a notable resistance to $12.70. Besides that, the Exponential Moving Average (EMA) suggests that the altcoin might drop lower than the current value.

As seen below, the 20 EMA (blue) and 50 EMA (yellow) are in the same region. This trend suggests indecision among traders. But it appears that Chainlink bears have the upper hand.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Given the current situation, LINK’s price may drop below $10. However, bulls can prevent this decline. To achieve this, Chainlink bears must take a back seat. If they do, the token could rebound and reach $15.25.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/chainlink-bears-gain-ground/

2024-10-24 21:30:00