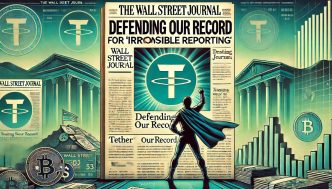

As we told to WSJ there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop.

— Paolo Ardoino 🤖🍐 (@paoloardoino) October 25, 2024

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Mathew Di Salvo

https://decrypt.co/288339/tether-ceo-no-us-treasury-investigation

2024-10-25 19:11:11