Solana (SOL) price has risen 12% over the past week, and recent developments suggest there could be even more room for growth. With the Relative Strength Index (RSI) dropping to 61 from overbought territory, SOL now has space to move upward without immediate selling pressure.

Additionally, the impressive activity on Pumpfun, one of Solana’s biggest applications, is fueling user engagement and ecosystem growth. Both the cooling RSI and the surge in Pumpfun metrics could be key drivers for further price increases in the coming days.

SOL RSI Is Below the Overbought Stage

SOL’s RSI has recently dropped to 61, down from over 70 just a day ago. This shift suggests that the buying pressure has cooled down a bit, moving away from overbought conditions. An RSI above 70 often indicates that an asset is overbought and a pullback is likely.

Now that the RSI is below that critical threshold, it signals that there could be room for the price to continue its upward movement without facing immediate selling pressure.

Read more: 13 Best Solana (SOL) Wallets To Consider in October 2024

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating an overbought condition and values below 30 suggesting an oversold state.

Despite SOL price being up by 12% over the past seven days, the recent drop in RSI below 70 could be a positive sign. It implies that the recent surge wasn’t excessively overextended, leaving space for further gains. With RSI now below the overbought level, there may be more potential for price growth in the coming days.

Can Pump.fun Metrics Drive Solana Growth?

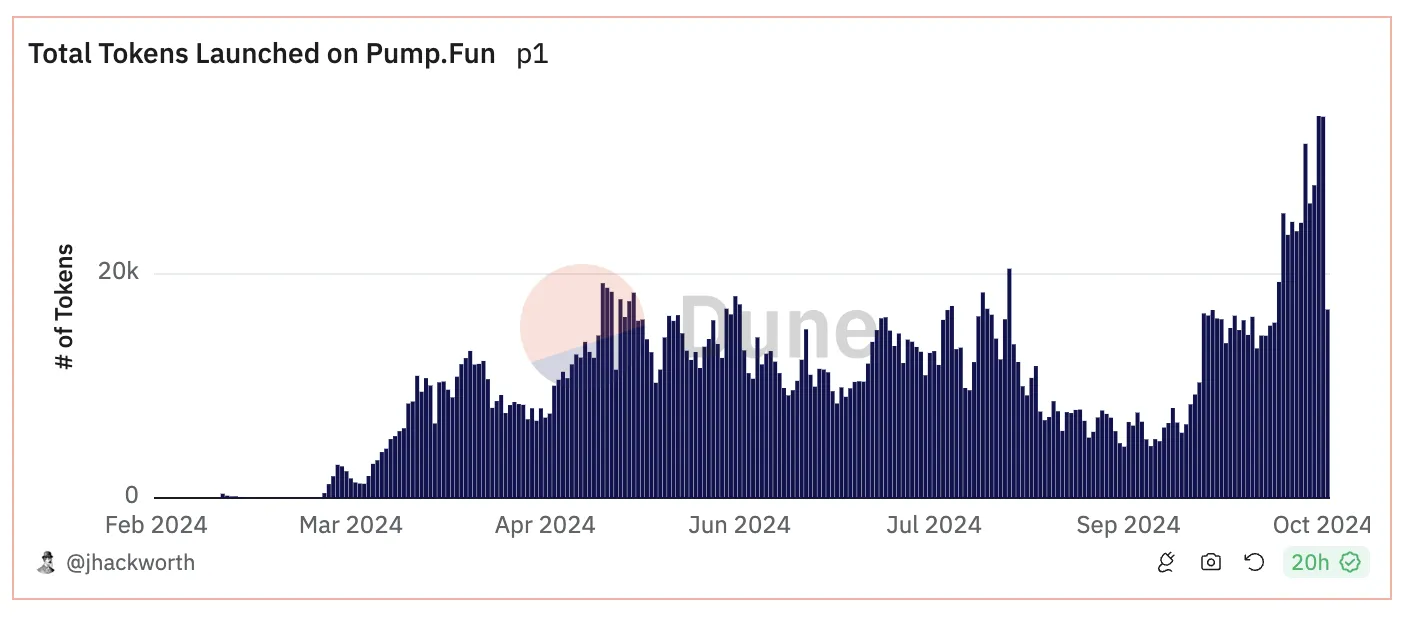

Pump.fun, one of the largest applications in the Solana ecosystem, has been setting record after record recently. Since October 14, the platform has seen more than 20,000 coins launched per day, peaking at an all-time high of 34,094 coins on October 22.

This spike in coin launches is significant because Pumpfun now accounts for almost 50% of daily DEX transactions and volume in the Solana ecosystem. Such high levels of engagement could lead to a new price surge for Solana, much like what occurred between March and April.

Back then, the exponential growth in coins launched on Pumpfun coincided with SOL’s price rising from $107 to $209 in just three weeks. The increased activity signals greater user engagement, which could naturally drive SOL’s price higher once again.

SOL Price Prediction: Back To $194 Soon?

SOL is currently trading above all the EMA lines, reflecting strong bullish momentum. The short-term EMA is acting as immediate support, indicating that buyers are actively stepping in during minor pullbacks.

The alignment of the EMA lines, with shorter-term EMAs above the longer ones, further supports this positive trend, showing healthy continuation potential.

Read more: Solana vs. Ethereum: An Ultimate Comparison

If SOL manages to break above $182.46, it could test $194.04 soon, its biggest price since July. Support areas are marked at $165.37 and $147.55 — both are crucial for maintaining the current uptrend.

The EMA configuration, alongside these support and resistance levels, suggests that the bullish trend is still intact, with room for growth if buying momentum continues.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/solana-price-further-upside/

2024-10-25 21:30:00