Bitcoin’s consolidation below $68,000 extended throughout this week, with bulls holding steady above the $66,000 support level. Although the cryptocurrency hasn’t seen a significant push to the upside, its ability to avoid a deeper correction means that Bitcoin remains on track to end October on a bullish note.

Related Reading

In support of this outlook, a crypto analyst has highlighted an emerging trend in Bitcoin’s UTXO metric, which suggests a looming breakout in the crypto’s price.

UTXO In Loss Reaches Highest Point Ever

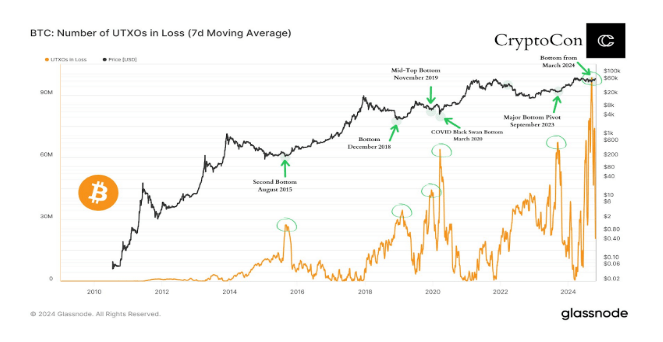

The number of Bitcoin UTXO in losses recently reached a new peak on September 11, 2024, surpassing levels last seen during the COVID-19 crash in 2020 and the September 2023 market bottom.

This metric, known as Unspent Transaction Output (UTXO), refers to the amount of Bitcoin that remains unspent in a Bitcoin wallet after a transaction. When UTXO is measured in loss, it reflects the number of Bitcoin holdings that would currently sell at a loss compared to the last transaction price from the Bitcoin wallet.

According to Glassnode data, the number of UTXO in losses spiked massively in September to surpass previous numbers, indicating that a significant portion of active Bitcoin addresses are underwater. However, while this may appear to signal bearish sentiment at first glance, history has shown this isn’t the case.

As pointed out by crypto analyst CryptoCon, major spikes in UTXO loss don’t come right before terrible price action, but they mostly come at the end of it. Keeping this trend in mind, the new peak in September most likely was an inflection point for Bitcoin’s price action for the rest of the year.

What Does This Mean For Bitcoin Price?

Past data reveals a consistent pattern: when UTXO in loss reaches extreme highs, Bitcoin’s price is often near a reversal. For instance, during the COVID-19 crash in March 2020, UTXO in loss spiked significantly, followed by a strong rally that led Bitcoin to new all-time highs in the following months.

The last time the UTXO in loss spiked massively was in September 2023, serving as the forerunner for the latest bull market cycle which kicked off in October 2023. This run culminated in a new all-time high for Bitcoin in March 2024, effectively showcasing spikes in the UTXO in loss as a signal of positive market momentum.

If history were to repeat itself, the September spike in the UTXO loss numbers could also signal a market bottom, which in turn opens up the stage for a rally in the rest of the year.

Related Reading

Interestingly, Bitcoin’s price action has been notably positive since this new peak in UTXO in loss. At the time, Bitcoin was trading around $57,000. Since then, it has experienced a considerable rally, inching closer to the $70,000 price level.

At the time of writing, Bitcoin is trading at $66,720.

Featured image from Pexels, chart from TradingView

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-utxo-surpasses-covid-2020-levels-to-new-ath-is-this-good-or-bad-for-price/

2024-10-27 05:30:27