Analysts predicted that Ethereum price could exponentially increase as whales become more interested in the crypto asset, with whale activity hitting a six-week high.

Despite the projected growth, an Ethereum insider suggested that the cryptocurrency should address several key issues to ensure that it can continue to flourish.

Related Reading

Ethereum: Projected Price Upsurge

Analyst Bаsictrаdingtv stated that prices of Ethereum could skyrocket as there is a growing interest among investors to buy the digital asset, saying that a 60% price hike is highly likely to happen.

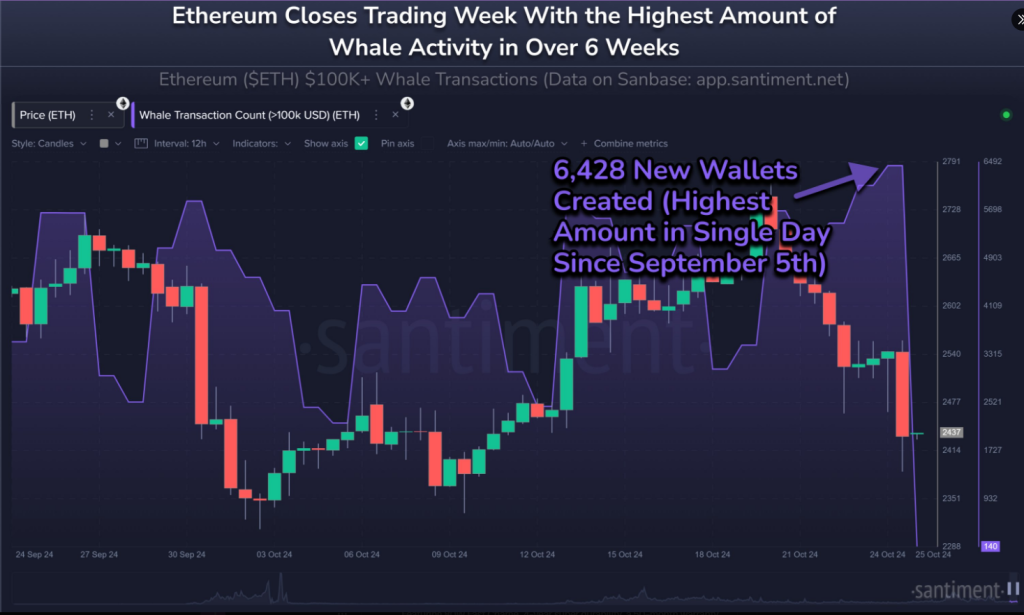

Blockchain data analysis firm Santiment identified a spike in whale activity on the Ethereum network and recommended a potential purchasing spree.

According to their recent update, whale activity reached a six-week high, with average holders accumulating Ethereum after the con’s recent price decline.

🐳 Ethereum’s whale activity spiked to a 6-week high as its price declined as low as $2.38K Friday. Historically, this is a sign of accumulation from high capital key stakeholders. Though not a guarantee this will have an immediate effect on prices bouncing, it is encouraging! pic.twitter.com/zcofdvszLF

— Santiment (@santimentfeed) October 26, 2024

Projections shown by market observers suggested that Ethereum prices could soar and hit the $4,000 mark with some analysts forecasting that it might even breach the $6,000 level.

Ethereum price growth could be fueled by its growing appeal to whales as demonstrated in the six-week high whale activity wherein more than 6,400 new wallets were made by large investors.

Bаsictrаdingtv also agreed that Ethereum prices could reach the $4,000 level. However, he hinted that the possible bullish breakout would be invalidated if the ETH price dipped to $2,000, saying that this “pricе zonе” is a key indicator that should be kept an eye on.

Recalibrating Protocol For Growth

Meanwhile, Ethereum co-founder Vitalik Buterin said in a post that there are several issues that the cryptocurrency needs to address to thrive in the ever-evolving crypto space.

Buterin explained that one of these issues is to simplify its protocol and ensure its continuous growth, saying that the coin’s protocol has become more complicated and it already undermines Ethereum’s integrity and security. He said that simplification of the protocol could help address the said issue.

He explained that Ethereum has already implemented changes in the past, citing the removal of the SELFDESTRUCT opcode as an example. The SELFDESTRUCT opcode was known to complicate interactions among users and posed potential security risks.

However, Buterin cautioned that the removal of such features must be conducted in a systematic approach so developers could see the impact of such action before implementing the changes.

Related Reading

Solving The Storage Problem

Another critical issue raised by Buterin is the storage problem being experienced by the cryptocurrency.

Buterin said that Ethereum needs at least 1.1 terrabytes of storage to house its enormous historical data.

He suggested the implementation of “cryptographic proofs of the state”, adding that this solution will allow nodes to retain only a fragment of the histories.

He added that this approach is the same as the torrent system wherein nodes only keep pieces of data that intersect from one node to another.

At the time of writing, Ethereum is being traded аt $2,470, a 2.84% price dip in the last 24 hours. On the other hand, ETH’s trаding volumе went up by more than 30% to nearly $22 billion in only a single day.

Featured image from Forbes, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/whales-are-diving-into-ethereum-could-a-60-price-spike-follow/

2024-10-27 21:00:39