Bitcoin is showing strong signs of a bullish recovery, with its price approaching the key $70K resistance level.

Buyers are focused on breaking this critical threshold, aiming for a new all-time high by the end of the year.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin’s price action on the daily chart reflects a significant bounce after finding support within the 0.5 ($56K) and 0.618 ($52K) Fibonacci retracement levels. This support zone has repeatedly halted bearish attempts and has acted as a base for buyers to re-enter the market.

The surge in buying pressure has allowed Bitcoin to reclaim the 100-day and 200-day moving averages, signaling a shift toward the bullish sentiment. Bitcoin is now testing the $70K resistance region, and a successful breakout could lead to a sharp upward move, potentially driven by a short squeeze, reinforcing the bullish trend.

The 4-Hour Chart

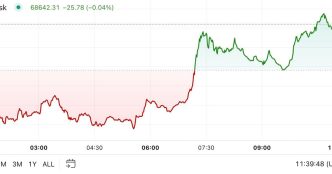

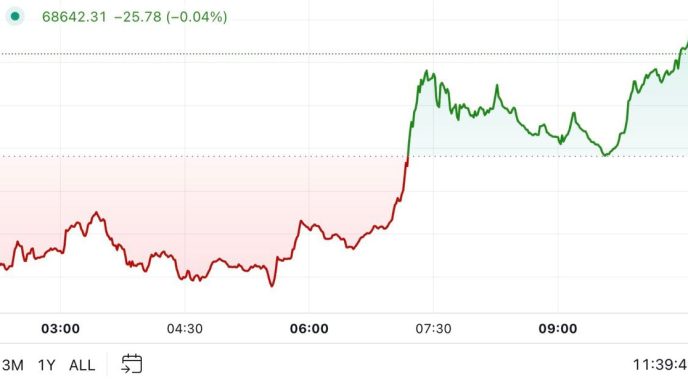

On the 4-hour chart, Bitcoin’s bullish momentum is more apparent. The asset saw a strong bounce at the ascending wedge’s lower boundary near $58K, which fueled a powerful uptrend. This move pushed Bitcoin above its previous significant swing high at $66K, marking a higher high in the 4-hour timeframe.

Now, BTC is consolidating within a narrow range between $66K and $70K. A breakout above the $70K resistance level and the wedge’s upper boundary would confirm the continuation of the bullish trend, potentially pushing Bitcoin toward a new ATH in the mid-term.

On-Chain Analysis

By Shayan

Bitcoin is experiencing increasing buying pressure, and a breakout above the critical $70K level appears imminent. The futures market provides further insight into the underlying dynamics, suggesting that this threshold could trigger a significant short liquidation event, amplifying the uptrend.

The liquidity concentration has shifted above the $70K mark, making this price range a focal point for market participants. Large liquidity pools above this level indicate that a breakout would likely attract more buyers and force short sellers to close their positions, fueling upward momentum.

This scenario points toward a potential short-squeeze, where a cascade of short liquidations could propel Bitcoin beyond $70K. Given the current technical setup and futures market positioning, Bitcoin is expected to maintain upward pressure soon. A breakout could result in a swift move above $70K, with further gains likely as the liquidation process unfolds.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Source link

CryptoVizArt

https://cryptopotato.com/bitcoin-price-analysis-btc-has-to-reclaim-this-crucial-level-to-aim-for-new-all-time-highs/

2024-10-28 11:21:10