Bitcoin’s price is nearing a pivotal moment, standing less than 2% away from the all-time high (ATH) of $73,800. This ongoing uptrend signals a breakout from the descending wedge pattern, which traditionally forecasts a strong rally.

Investors are optimistic, expecting a substantial price surge if Bitcoin breaches this ATH level. However, the threat of a market top is also hanging above BTC.

Bitcoin Profits Are Peaking

The recent uptrend in Bitcoin has been largely driven by inflows from spot ETFs, which have created a strong foundation for institutional interest. These inflows are encouraging a sustained rally as more institutions consider Bitcoin a valuable investment. This new level of interest is establishing a solid base, increasing the potential for a stronger upward push in Bitcoin’s price.

A report from 10x Research shows that over $4.1 billion worth of ETF inflows have been registered in October alone, which is the highest single-month volume since March.

“With ETF demand going parabolic, Bitcoin is set to follow suit. If this trend holds, our quant signal also projects a potential rally to $100,000 by the end of January 2025,” noted 10x.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

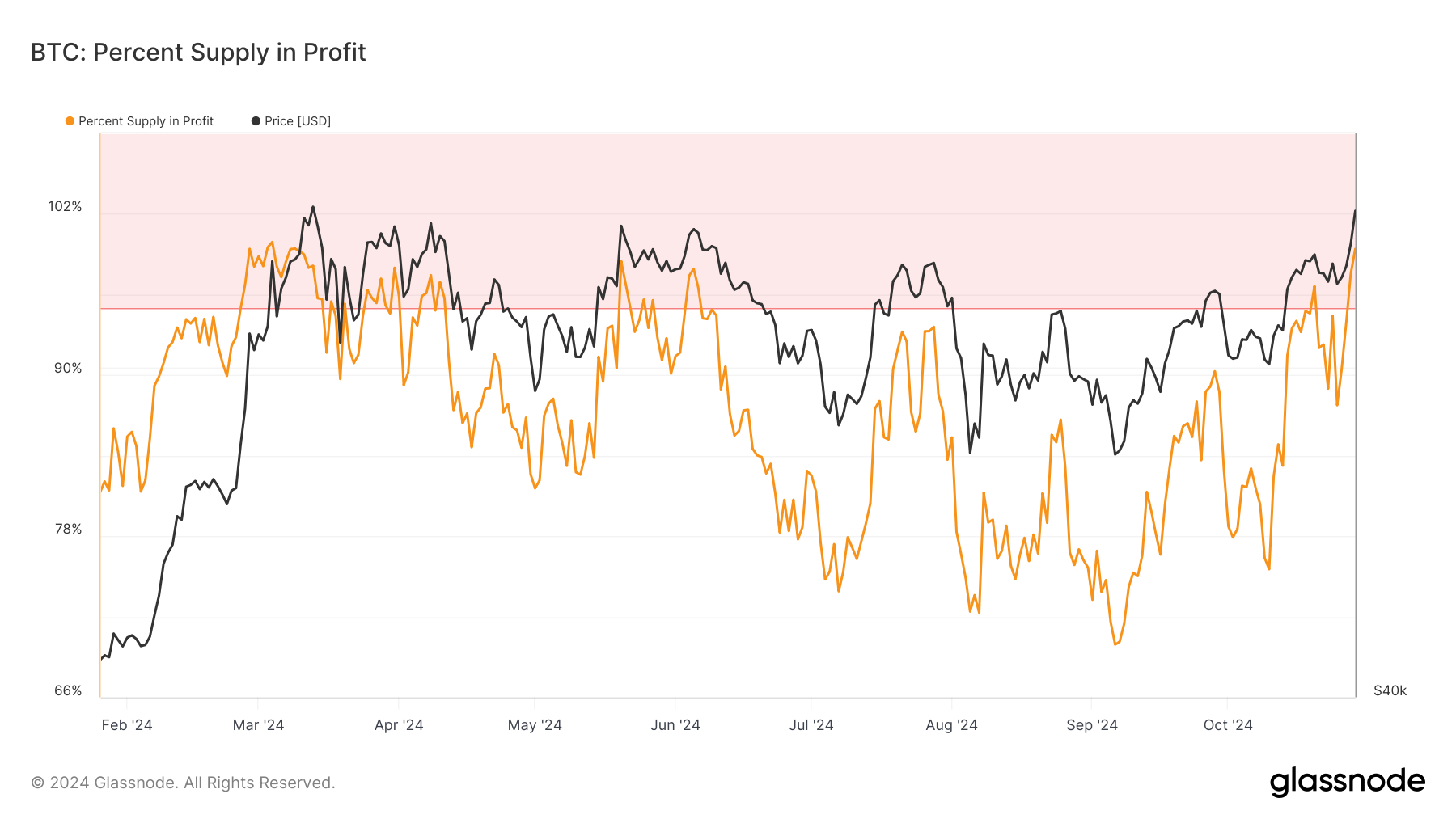

Bitcoin’s macro momentum, however, suggests caution, as the total supply in profit indicates a potential market top. Historically, a market top forms when over 95% of Bitcoin’s supply is profitable, signaling overbought conditions. Currently, approximately 99.4% of Bitcoin’s supply is in profit, reflecting the likelihood of a market top. This scenario suggests that Bitcoin’s rally may face resistance, as such high levels of profitability often lead to increased selling pressure.

The current supply in profit could result in a temporary fallback as investors secure gains, putting pressure on Bitcoin’s upward movement. This profit-taking pattern is common during extended rallies, particularly when near record highs. If selling increases, Bitcoin’s momentum may weaken, potentially hindering a sustained rally past the ATH.

BTC Price Prediction: Eyeing New Highs

Bitcoin’s breakout from the descending wedge pattern suggests a potential 27% rally, with a target of $88,185. For this rally to gain traction, Bitcoin needs to flip the ATH of $73,800 into solid support. Confirming this support would mark a strong signal for continued gains, validating the breakout.

However, the threat of a market top could delay this move, with potential selling pressure pushing Bitcoin back to $70,000 or below. Short-term profit-taking might extend the wait for a new high, especially if market sentiment shifts cautiously due to overbought conditions.

Read more: Bitcoin Halving History: Everything You Need To Know

On the other hand, if Bitcoin manages to flip $73,800 into support, a new ATH would be achieved, pushing the price toward $75,000. This successful breach would signal a new phase in Bitcoin’s rally, confirming its resilience and opening the path for further upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-nears-ath-on-etf-boost/

2024-10-30 09:30:00