SUI, the native token of the Layer-1 Move-programmed blockchain, is experiencing renewed buying interest following a recent decline. After reaching an all-time high of $2.36 on October 12, SUI dropped to a 14-day low of $1.75 on October 25.

Currently trading at $2.06, the altcoin appears positioned to extend these double-digit gains.

SUI Bulls Attempt Takeover

BeInCrypto’s assessment of the SUI/USD 1-day chart reveals that the altcoin is attempting to re-enter its rising parallel pattern, which it broke below on October 22. This channel is a bullish pattern formed when an asset’s price moves between two parallel trendlines, sloping upward.

When an asset’s price breaks below a level and then attempts to re-enter it, this often signals a potential trend reversal or recovery. SUI’s possible re-entry into the channel suggests renewed buying interest, indicating that the previous breakout may have been a bear trap.

Read more: Everything You Need to Know About the Sui Blockchain

A bear trap happens when an asset’s price briefly dips below a trendline or channel, hinting at a downtrend continuation, but then swiftly reverses and rallies, trapping sellers expecting a further decline.

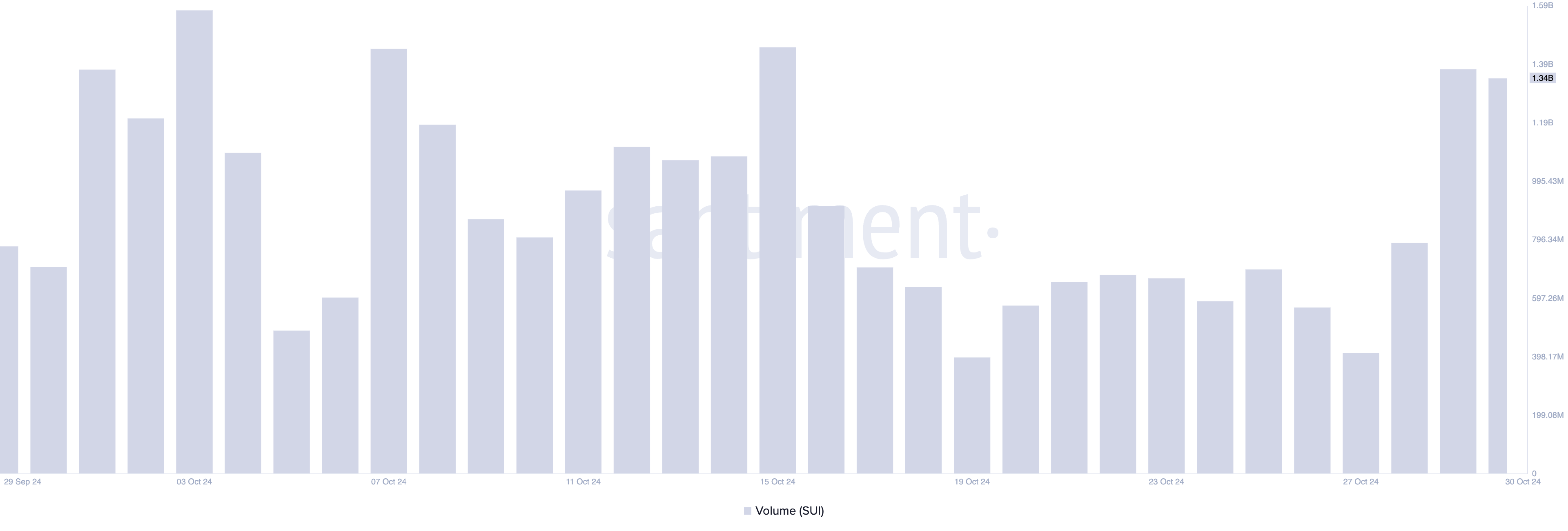

Often marked by a volume surge on the reversal, a bear trap indicates strong buying interest at lower levels. This appears to be the case with SUI, as its trading volume has surged by 39% over the past 24 hours, reaching $1.34 billion.

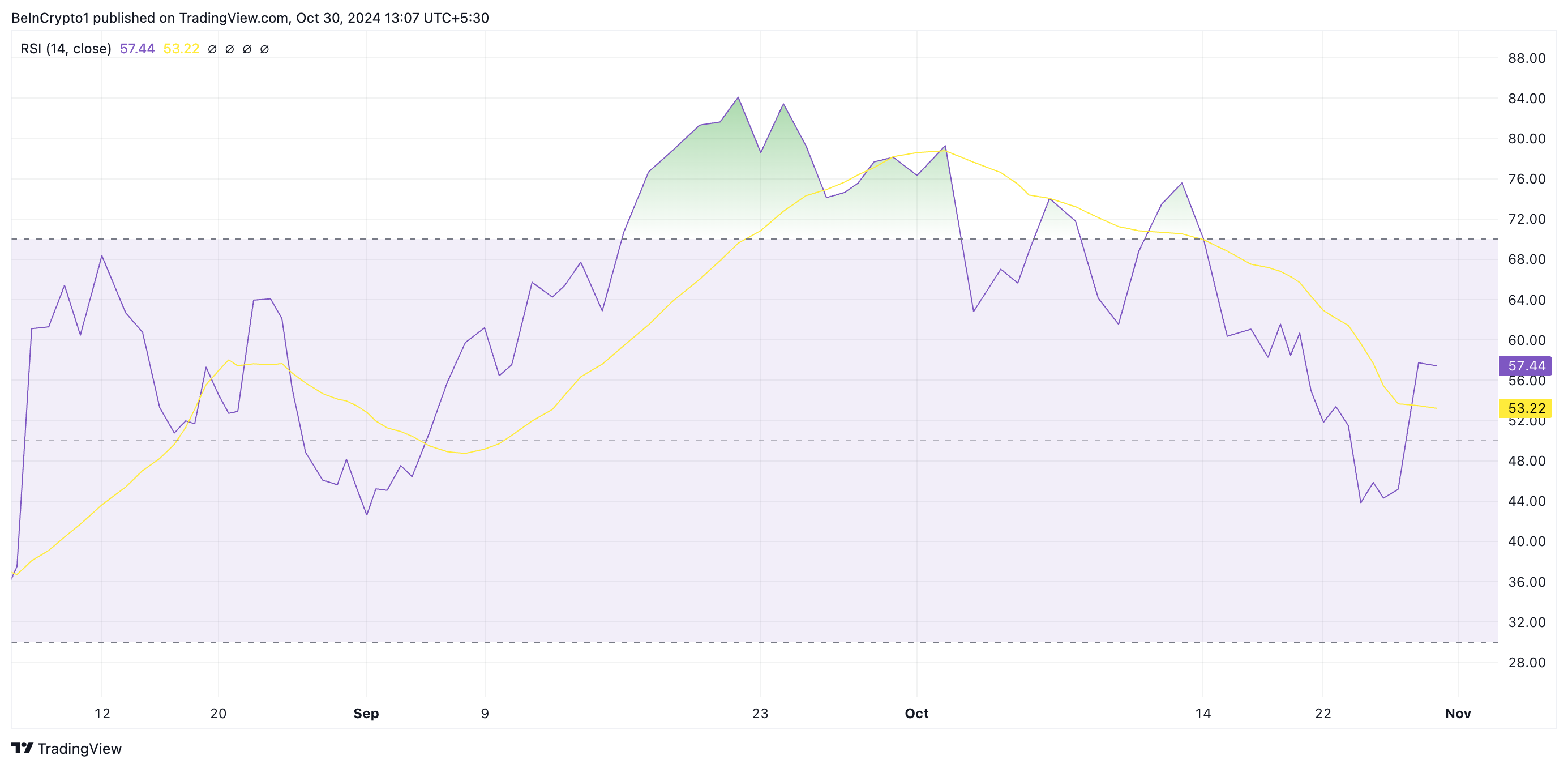

SUI’s rising Relative Strength Index (RSI) confirms the resurgence in demand. Currently trending upward at 57.44, this indicator signals that buying momentum is building and now outweighs selling activity.

SUI Price Prediction: Coin Eyes All-Time High

SUI is currently trading below the lower boundary of its parallel channel, with critical resistance at $2.30. A successful breakout above this level and re-entry into the channel would position SUI’s price to reclaim its all-time high of $2.36, last reached on October 13.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

Conversely, a failed attempt to breach the $2.30 resistance would negate this bullish outlook, potentially sending SUI’s price downward toward support at $1.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/sui-price-breaks-bear-trap/

2024-10-30 10:30:00