Bitcoin is marching higher, easing past $70,000 and $72,000 in the past two days, sparking a wave of demand. Although prices are moving within a tight range at spot rates, the uptrend remains. While there are pockets of weakness, at least seen earlier today, candlestick formation in the daily and weekly charts point to strength.

Is Bitcoin Preparing For A 6X Surge To $462,000?

In a post on X, one analyst thinks Bitcoin will not only break above its all-time high at $74,000 but can easily 6X to over $462,000 in the coming sessions. To support this outlook, the analyst said the coin is breaking out above key resistance levels, and Fibonacci extension levels mirror this shift in trend after the Q3 2024 plunge.

Based on the analyst’s assessment, historical price action shows that BTC peaks between the 1.618 and 2.272 Fibonacci extension levels. Technical analysts use this tool to project how fast prices will rally or drop based on a given range.

If history guides and the Fibonacci extension levels remain valid, applying the same pattern to the current cycle could easily see Bitcoin soar to between $174,000 and $462,000. These two levels mark the extension levels’ lower and upper limits that define past cycles’ peak zone.

As bullish as this forecast is, it should be known that the range anchoring any Fibonacci extension is subjective. For this reason, it will change depending on the analyst, meaning potential peaks will shift accordingly.

Despite everything, the consensus is that Bitcoin could break and reach new all-time highs in Q4 2024. Taking to X, another analyst said Bitcoin is already within a bullish breakout formation, easing above a descending channel or bull flag. At the same time, prices are breaking above the resistance of a “cup and handle” pattern.

Institutions Buying As BTC Recovers

If bulls take over, pushing prices higher, the evolution would confirm gains of Q1 2024. Subsequently, it would mark the resumption of bulls, an encouraging development following the 30% drop from March highs.

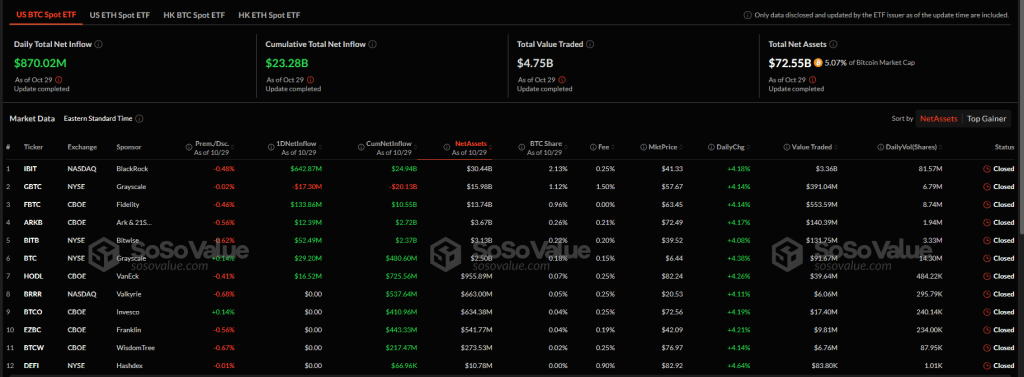

Amid this wave of optimism, institutions are also pouring in, getting exposure via spot Bitcoin ETFs. According to SosoValue, there are massive inflows as institutions buy more shares on behalf of their clients.

On October 29, spot Bitcoin ETF issuers in the United States bought $870 million worth of shares backed by BTC for their clients. BlackRock’s IBIT received $642 million, pushing their BTC under management to over $24.9 billion.

Source link

Dalmas Ngetich

https://www.newsbtc.com/bitcoin-news/bitcoin-boom-is-btc-preparing-for-another-6x-to-462000/

2024-10-31 00:00:43