Sui (SUI) Open Interest has surpassed $400 million after the altcoin’s price surged back to $2 yesterday. For many investors, the increase in OI, as the Open Interest is commonly called, suggests potential for continued uptrend.

However, recent on-chain analysis suggests that this may not be the case. So, what’s next for the token?

More Liquidity Does Not Guarantee Sui’s Upswing

For those unfamiliar, Open Interest measures the level of speculative activity around a cryptocurrency. When it increases, traders are getting more exposure to an asset and adding more liquidity to contracts related to the asset.

On the other hand, a decreasing OI implies that traders are closing existing positions and taking out their funds. According to Coinalyze, Sui’s Open Interest experienced a sharp drop on October 28.

However, today, the same metric hit $401.99 million, indicating that traders’ interest in the altcoin has improved. The rise also coincided with SUI’s rebound to $2.10. However, SUI’s price has slightly decreased from this peak in the last 24 hours.

Read more: Everything You Need to Know About the Sui Blockchain

From a price perspective, a rising OI and increasing price strengthens the uptrend. In this case, Sui’s Open Interest might not be able to support the uptrend due to the recent retracement, which has made the upswing weak.

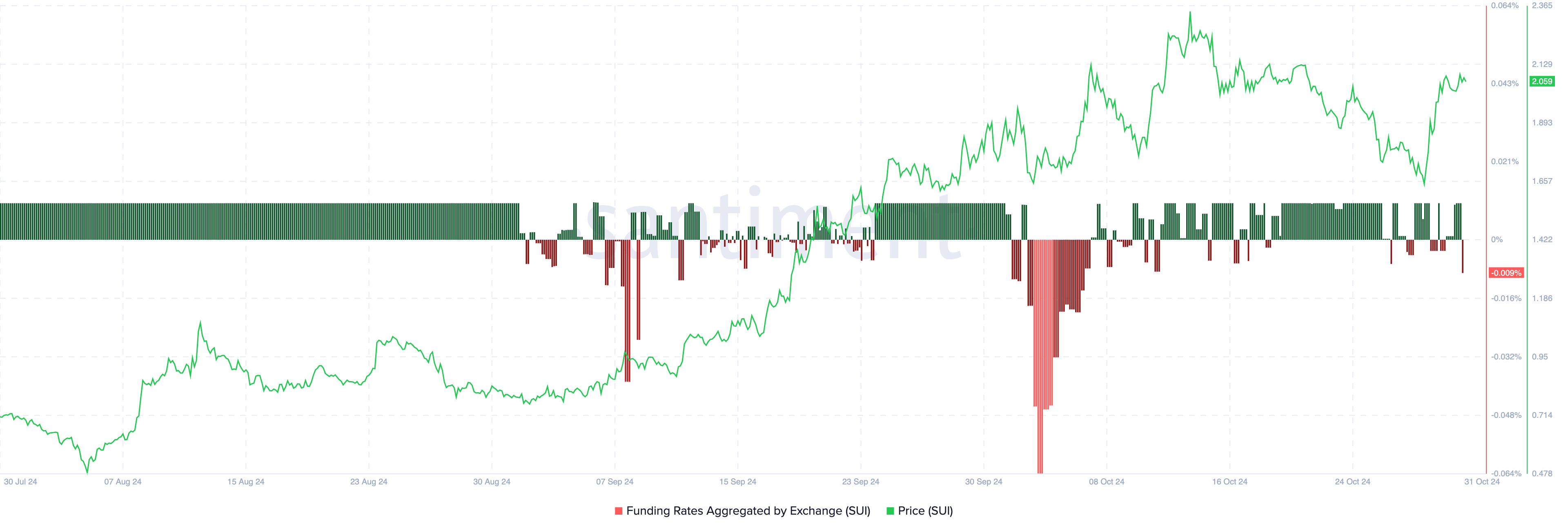

Furthermore, a look at the Funding Rate shows that it has turned negative. The Funding Rate measures the market’s overall sentiment. A high positive rate suggests a bullish outlook, where traders are willing to pay a premium to hold long positions.

A negative one, like in SUI’s case, indicates that more traders are willing to pay a premium to hold short positions. When combined with the price action, this position is potentially bearish for SUI.

SUI Price Prediction: Extended Downturn Ahead

On the daily chart, BeInCrypto observed that the Balance of Power (BoP) had turned downwards. The BoP indicator gauges buying and selling pressure by examining the strength of price movements.

Crossovers of the zero line in the BOP can serve as signals for potential buying strength. However, for SUI, the indicator dropped to -0.70, suggesting that bears are in control. If this remains the same, then SUI’s price might drop to $1.64 in the short term.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

On the other hand, if the price bounces off the $1.64 support and Sui’s Open Interest continues to increase, then the prediction might not come to pass. Should this be the case, SUI might climb to $2.37.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/sui-open-interest-rises/

2024-10-31 08:30:00