A crypto analyst has forecasted a 98% Bitcoin price crash following a substantial rally to $250,000. Interestingly, the analyst is confident that Bitcoin will eventually reach this ambitious quarter-million-dollar target. However, they caution that once profits are taken at this top, Bitcoin could decline significantly to new lows.

Bitcoin Price Projected To Crash 98%

On October 30, crypto analyst Gert van Lagen told his 106,700 followers on X (formerly Twitter) that the Bitcoin price could drop to the $24,000 range once it hits $250,000. Lagen revealed that many investors have felt overly confident that Bitcoin could never experience a 98% crash again, especially with the introduction of Spot Bitcoin Exchange Traded Funds (ETFs).

Related Reading

Countering this overconfidence, the crypto analyst asserted that ETF assets tend to lose significant value during periods of economic recession. Consequently the analyst predicts that the Bitcoin price could first experience a “blowoff” of up to $250,000, marking a historical milestone. At this point, many investors would start taking profits, triggering massive selling pressure as they liquidate ahead of potential price declines.

Following Lagen’s analysis, once the market sentiment for the Bitcoin price shifts, institutional investors, who may have been the prime drivers for the $250,000 rally, are likely to sell off their holdings. Lagen has described this massive sell-off as the “shake out of the century,” when the Bitcoin price could plummet dramatically to 98% of its high.

This suggests that after hitting $250,000, the BTC price could crash to $2,000, trading below Ethereum’s current price, which is trading at $2,635, according to CoinMarketCap.

Highlighting the reasoning behind this unexpected bearish price crash, Lagen revealed that by plotting the Bitcoin price on the “Syslog scale,” it clearly shows a High-Time Frame (HTF) rising wedge, which points at a price target between $1,000 and $10,000. He also disclosed in a much earlier post that if Bitcoin does experience his projected shakeout and price decline to $1,000, it will take four halving events before the cryptocurrency can return to its $200,000 price high.

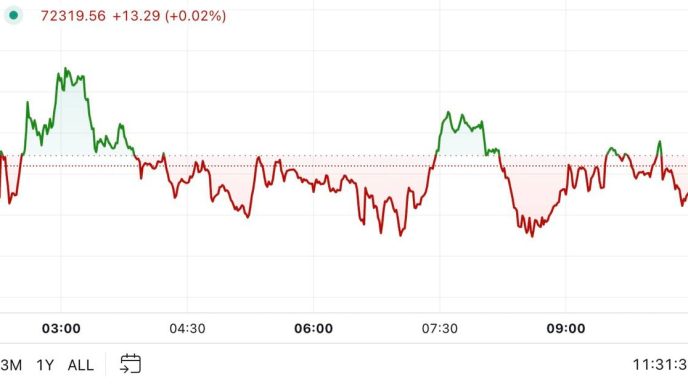

BTC To Break Above $73,000 And Rally Higher

As of writing, the Bitcoin price is trading at $72,433 after experiencing more than a 7.8% increase this week. Lagen has stated that the Bitcoin price action points to a possible “triangle bearish continuation pattern,” which typically signals a potential downward trend in a cryptocurrency.

Related Reading

The crypto analyst has set a new target of $71,200 for Bitcoin, suggesting that if the cryptocurrency follows through with the triangle bearish continuation pattern, its price could decline significantly. On the flip side, Lagen has predicted that if Bitcoin can break the $73,000 threshold, it would invalidate the triangle bearish continuation pattern. This could indicate the end of the downtrend and potentially lead to a stronger upward momentum.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-98-crash-250000/

2024-10-31 12:00:50