The Bitcoin (BTC) price has experienced a significant downturn over the past 24 hours, falling below the critical $70,000 threshold. After reaching a peak of $73,620 on Tuesday, the cryptocurrency has declined by approximately 5.7%, hitting a low of $68,830 on Friday. Analysts point to several key factors behind this decline:

#1 Risk-Off Sentiment Ahead of US Election

The timing of Bitcoin’s price drop coincides with a narrowing lead for former President Donald Trump over Democratic candidate Vice President Kamala Harris in prediction markets such as Polymarket and Kalshi, where users bet on election outcomes. Bitcoin has been considered a “Trump hedge” due to the former president’s strong advocacy for the cryptocurrency sector.

Donald Trump has proposed establishing a “strategic Bitcoin reserve” in the United States if re-elected. Speaking at the Bitcoin 2024 Conference, he outlined plans to retain all Bitcoin currently held or acquired by the US government as part of this reserve. This initiative is a core element of his campaign to strengthen the US as a leader, aiming to make the country the “crypto capital of the planet.”

Related Reading

Earlier in the week, when Trump’s lead over Harris was more substantial, Bitcoin neared its all-time high of $73,777. The shrinking of Trump’s lead appears to have prompted investors to adopt a risk-off stance, contributing to the price decline.

Crypto analyst HornHairs noted that derisking before elections has precedent. “Derisking into the election 5-6 days before it takes place happened in both 2020 and 2016. Price then went on to never retest the lows set the week before the election ever again. Be careful what you sell here,” he remarked via X.

#2 S&P 500 Loses 3-Month Trendline

The correlation between Bitcoin and traditional financial markets may have also influenced BTC’s price movement. The S&P 500 has fallen to its lowest level since October 9, potentially affecting investor sentiment in the crypto space.

Analysts from The Kobeissi Letter observed that despite major tech companies like Apple reporting strong earnings, their stock prices have declined. “Yet another tech giant to beat earnings but trade lower,” they noted, adding that technology stocks faced widespread selling even as Meta, Amazon, and Apple exceeded earnings expectations. They added, It appears that markets are de-risking ahead of the election next week. Brace for volatility.”

Related Reading

Crypto trader Marco Johanning highlighted concerns about the S&P 500 losing its three-month trendline. “Given that the S&P 500 lost the 3-months trendline yesterday, it looks more like a potential selloff before the US election on Tuesday and lower prices in the short term. The perfect bounce level is the 7-month trendline (blue). I don’t want to see prices below the POC/key level around 63k (red),” he wrote via X.

#3 Leverage Flush Out

A significant unwinding of leveraged positions in the markets has also contributed to Bitcoin’s price decline. The market correction appears to be a healthy response to an overextension driven by leverage.

Renowned crypto analyst Miles Deutscher noted: “This pullback is normal (and expected). Market was looking overextended the last few days, and largely driven by leverage. Still not buying heavy as it isn’t a full cascade yet—will wait for one of those days around the election. Not a bad DCA day for certain coins tho.”

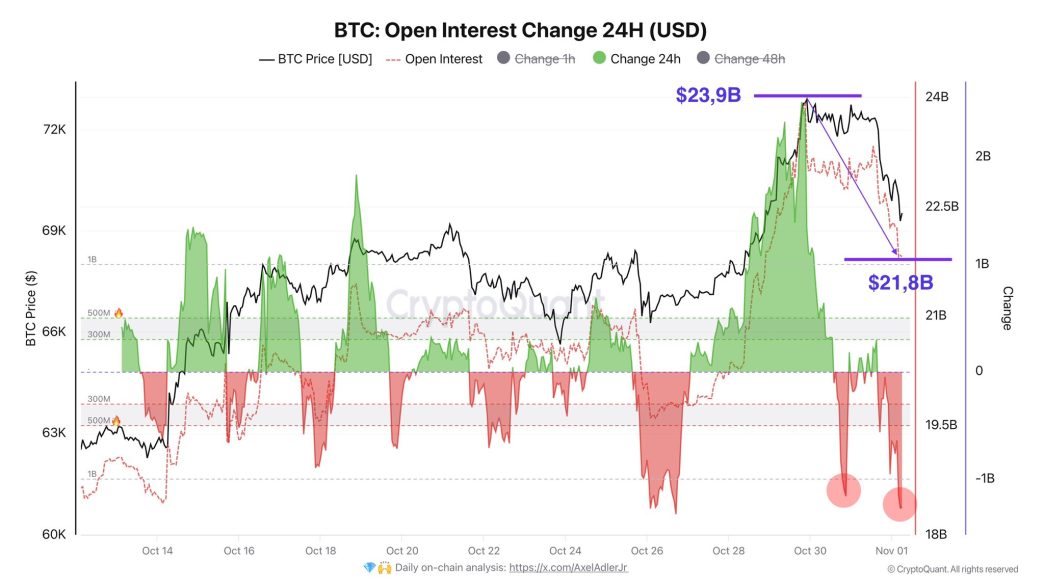

Austin Reid, Global Head of Revenue & Business at crypto prime brokerage firm FalconX, pointed out that the crypto derivatives market was “on fire” ahead of the election, with futures open interest for BTC, ETH, and SOL crossing the $50 billion mark for the first time.

On-chain analyst Axel Adler Jr reported that open interest was reduced by $2.1 billion, implying a significant leverage flush out.

According to data from Coinglass, over the past 24 hours, 93,864 traders were liquidated, with total liquidations amounting to $286.73 million. The largest single liquidation order occurred on Binance’s BTCUSDT pair, valued at $11.26 million. For Bitcoin alone, $81.38 million in long positions were liquidated—the largest amount since October 1.

At press time, BTC traded at $69,446.

Featured image created with DALL.E, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/bitcoin/bitcoin-price-slides-below-70000-key-reasons/

2024-11-01 14:00:04