On November 1, BNB Chain announced the completion of its 29th quarterly burn, effectively decreasing the cryptocurrency’s total supply. Following this event, Binance Coin (BNB) bulls are eager to capitalize on the reduced supply to drive the token’s price upward.

But will they succeed? This analysis looks at the possibility by employing some on-chain and technical indicators.

Token Burn Drives Change in Binance Coin Sentiment

In a recent blog post, BNB Chain, Binance’s blockchain for decentralized applications, announced the burn of 1.77 million BNB. This total includes two components: 1.71 million BNB for the Auto-Burn, and 62,569 BNB as an additional burn for BTokens. BNB Chain began its token burn after moving from Ethereum to its native blockchain, aiming to reduce the supply to 100 million.

This 29th quarterly burn, valued at over $1 billion, contributes to reducing BNB’s overall supply, potentially fueling bullish sentiment as holders anticipate price gains. Notably, the Balance of Power (BoP) reading on the daily chart rose post-burn, suggesting increased bullish momentum. Typically, a declining BoP indicates bearish control, often signaling price drops.

Read more: How to Buy BNB and Everything You Need To Know

However, in the current scenario, BNB bulls appear to be in control. With the cryptocurrency’s price hovering around $576, there is a potential for further upward movement.

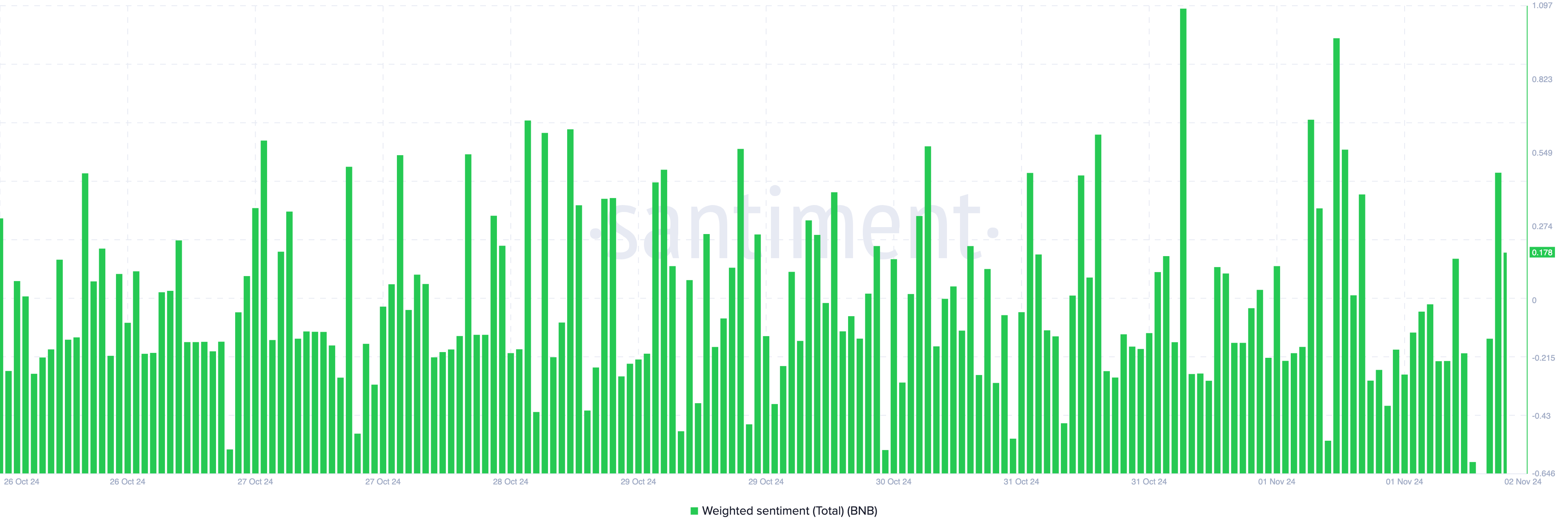

From an on-chain perspective, data from Santiment shows a notable increase in the Weighted Sentiment, a metric that gauges the broader market’s perception of a cryptocurrency.

When the reading is negative, the average remark tracked via social volume is bearish. Since it is positive in this case, it means that most investors are optimistic about BNB’s price potential, which could drive increased demand.

BNB Price Prediction: $606 Is Within Reach

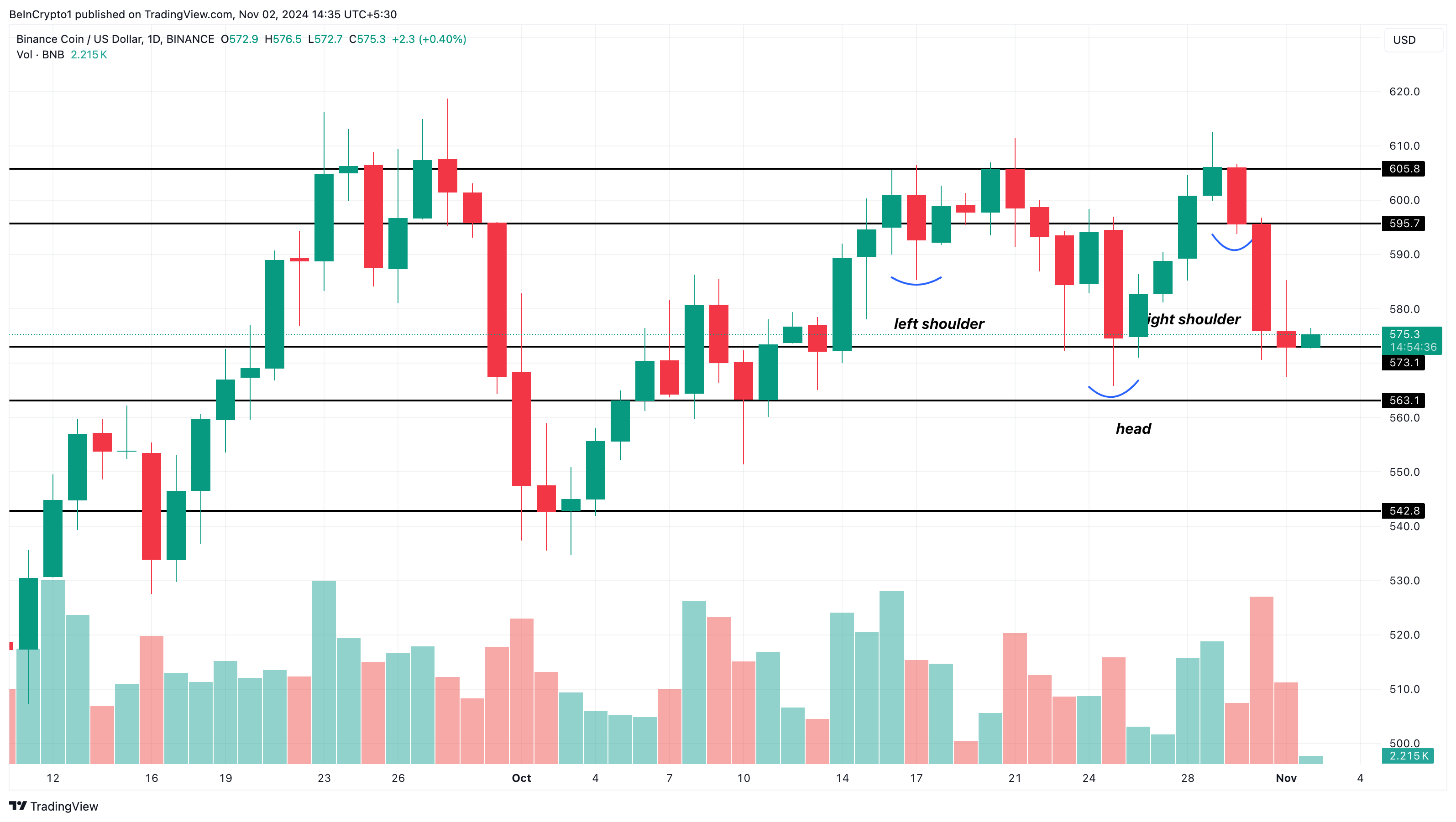

On the daily chart, BNB has slightly bounced after bulls successfully defended the support level at $573. If this support hadn’t held, the cryptocurrency could have fallen to $563, the next significant support level.

Additionally, BNB’s price has formed an inverse head and shoulders pattern, signaling a potential reversal from bearish to bullish momentum. Considering this technical structure, BNB’s price might climb above the $596 resistance and rally to $606.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, if bears are able to overpower bulls this time, the prediction could be invalidated. In that scenario, BNB might fall below the $5673 support and decline to $543.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/bnb-bulls-eye-recovery-after-quarterly-burn/

2024-11-02 12:00:00