TIA, the native token of the modular blockchain network Celestia, has extended its downtrend, losing over 15% of its value in the past week. Currently, the altcoin is trading at $4.23, hovering near its year-to-date low of $3.72.

The sustained value drop and technical indicators suggest that Celestia’s price decline may continue in the short term. This analysis highlights the price targets the token holders need to look out for and why.

Celestia Buyers Exit the Market

BeInCrypto’s assessment of the TIA/USD one-day chart shows that the coin’s double-digit decline over the past seven days has pushed its price below its Ichimoku Cloud.

This indicator tracks an asset’s market trends, momentum, and key support/resistance zones. When the price dips below it, it signals a bearish phase, indicating stronger downward momentum. In this case, the Cloud serves as a resistance zone, making it harder for the price to break back above without substantial buying pressure.

Read more: What is a Layer-1 Blockchain?

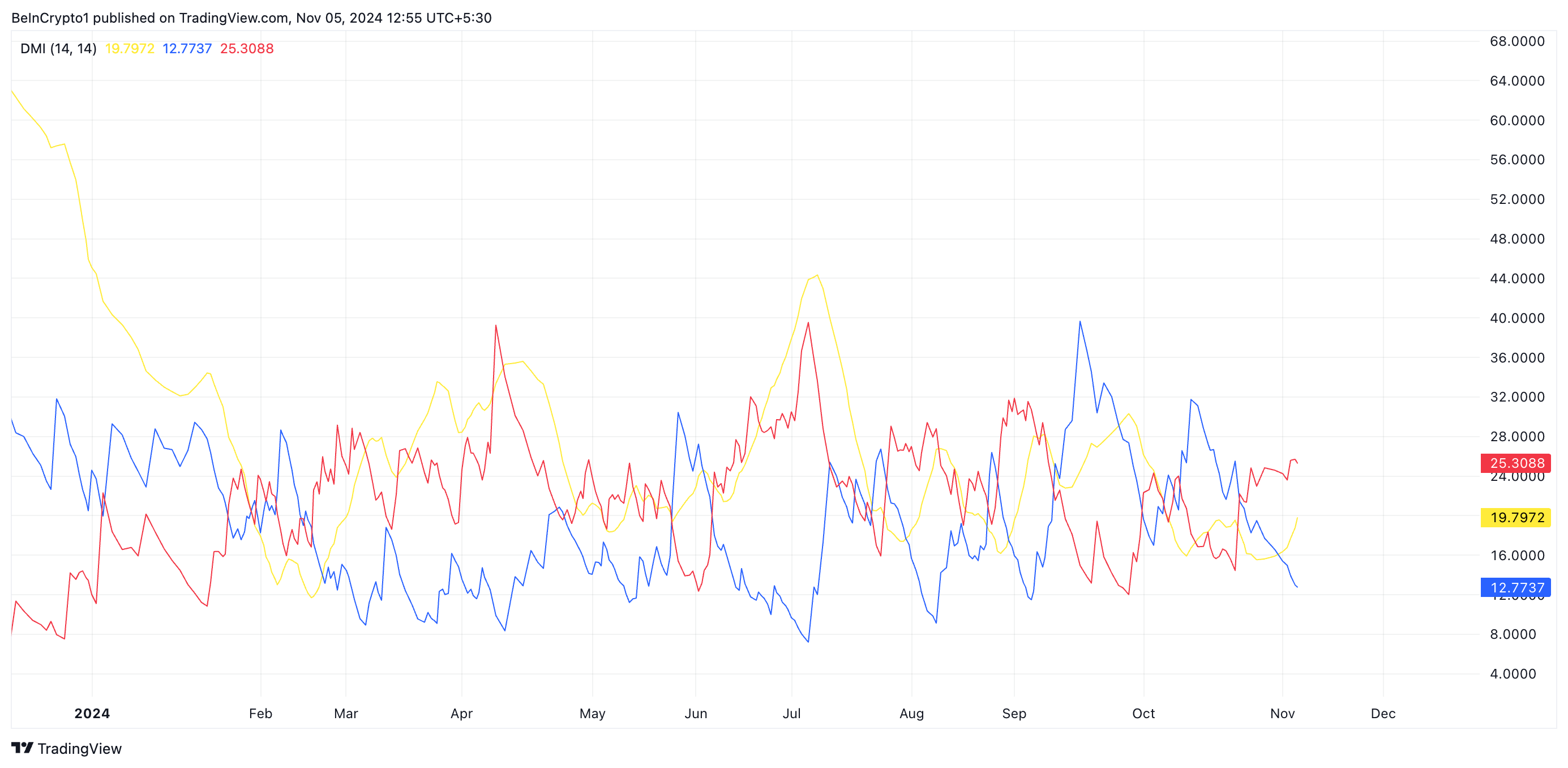

However, readings from TIA’s Directional Movement Index (DMI) suggest that such buying pressure is currently absent in the coin’s market, worsening the Celestia price decline. At press time, the altcoin’s positive directional indicator (+DI) (blue) rests below its negative directional indicator (-DI).

The DMI indicator measures an asset’s price strength and direction. When its +DI lies below its -DI, it signals that the asset’s price is experiencing more downtrend than uptrend movements. Traders view this as a bearish signal, suggesting that sellers are stronger than buyers.

TIA Price Prediction: A Pull Toward Year-To-Date Low

At press time, TIA is trading at $4.23, just 13% above its year-to-date low of $3.72, last reached on September 6. Increasing selling pressure could push TIA back down to this support level.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in November 2024

If TIA experiences renewed demand, however, the price could rebound from this floor and begin an uptrend. In this bullish scenario, TIA would target breaking above the Ichimoku Cloud resistance levels at $5.06 and $5.53. Successfully surpassing these thresholds could position TIA for a potential rally toward $7.84, a peak it last achieved in June.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/celestia-price-decline-year-to-date-low/

2024-11-05 10:00:00