XRP’s price recently slipped below the critical support level of $0.51. This decline signals short-term bearish momentum but leaves room for recovery as XRP’s market conditions improve.

The asset has shown resilience at this level, suggesting that it could soon reclaim it with stronger investor support.

XRP Long-Term Investors Are Unsure

XRP’s Mean Coin Age (MCA) ratio has experienced periodic dips since August, indicating wavering conviction among long-term holders (LTHs). LTHs often play a crucial role in maintaining an asset’s price stability. The recent dips reflect a sense of caution, hinting that these holders may be re-evaluating their stance.

A sustained decline in LTH conviction could become a concerning trend for XRP, weakening its price foundation. While LTHs remain cautious, renewed interest from other market participants could potentially bolster the asset’s recovery efforts.

Read more: XRP ETF Explained: What It Is and How It Works

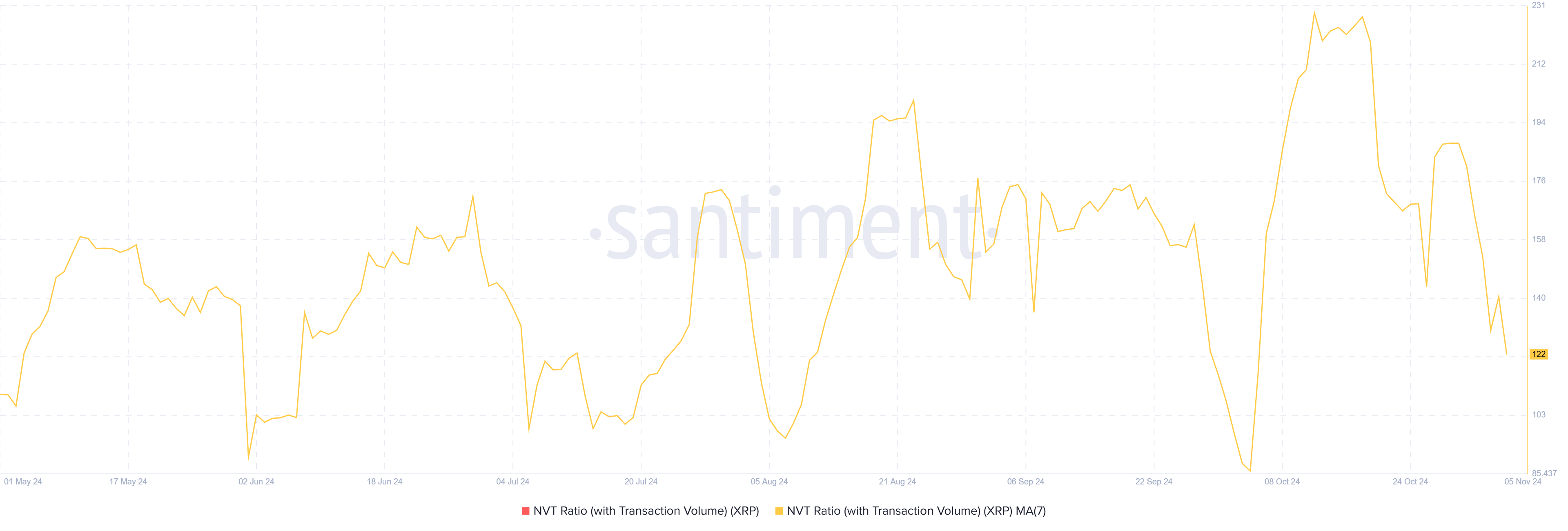

XRP’s Network Value to Transactions (NVT) ratio has also been on a decline, suggesting an improving alignment between network value and transaction activity. A lower NVT ratio generally reflects healthier network dynamics, as it indicates that XRP’s value is proportional to its transaction activity. When NVT is high, the asset risks overvaluation, often leading to corrections.

Currently, XRP’s transaction activity aligns closely with its value, which is a promising indicator for potential growth. The decline in NVT suggests that XRP is better positioned for stability and growth than during previous price spikes. With network fundamentals supporting its valuation, XRP may have a more favorable setup for a gradual recovery.

XRP Price Prediction: Flipping Resistances Into Supports

XRP is trading just under the $0.51 resistance level, which it aims to flip back into support. While LTH sentiment is somewhat cautious, support from other investors could aid in re-establishing this level. Reclaiming $0.51 as support could provide a launchpad for further gains, potentially driving XRP toward $0.56 and beyond.

Talking to BeInCrypto, Juan Pellicer, Senior Researcher at IntoTheBlock, noted that the ongoing development surrounding XRP could also impact price.

“The anticipation around XRP’s RLUSD stablecoin launch is palpable, particularly with its potential for deeper DeFi integration. Strategic moves via institutional partnerships and targeted infrastructure development may create substantial value drivers, positioning XRP uniquely within the evolving DeFi space,” stated Pellicer.

If XRP manages to flip $0.56 into support, it could signal the start of a recovery from its late September losses. A rally past this level would mark a key milestone, setting up XRP for renewed momentum in the weeks ahead.

Read more: How To Buy XRP and Everything You Need To Know

However, if XRP fails to secure $0.56 or struggles to reclaim $0.51, the altcoin could enter a consolidation phase below these levels. A sustained inability to breach $0.51 may even lead to a dip to $0.47, challenging the current bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-long-term-investors-caution/

2024-11-05 14:00:00