Block, Inc. is doubling down on its bitcoin mining hardware business as President-elect Donald Trump’s presidential win opens the crypto industry to a potentially more favorable environment for the crypto mining sector.

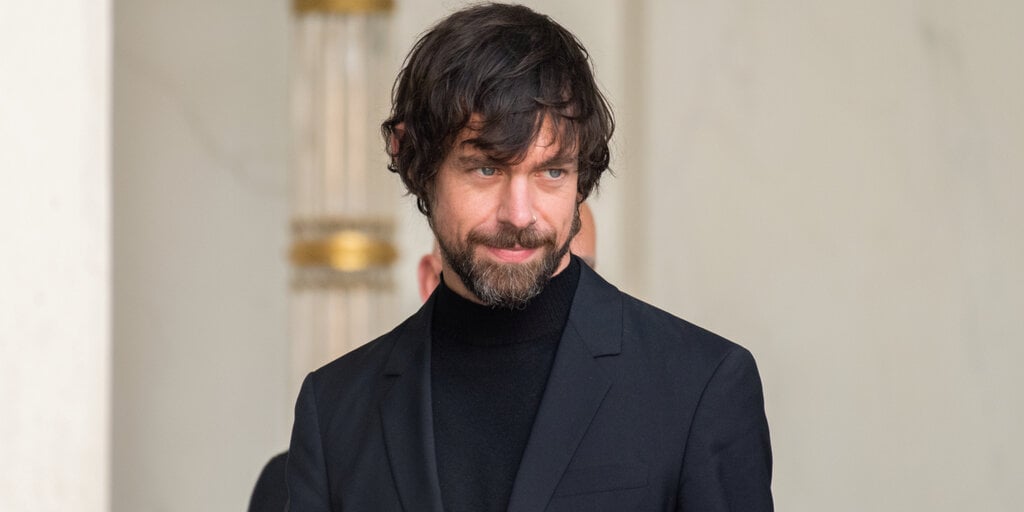

The payments and blockchain infrastructure company led by Jack Dorsey announced in a published shareholder letter Thursday that it would reallocate resources to focus on mining equipment development.

Trump’s campaign promises to support bitcoin mining in the US come at a critical time for the sector, which has faced profitability challenges following the recent halving event, which reduced mining rewards by half to 3.125 BTC.

It comes as Block prepares to scale back its investments in TIDAL, a music streaming platform it acquired in 2021 for roughly $300 million. Notably, the company is also sunsetting TBD, its “Web5” decentralized internet initiative, according to the letter.

The company says such a move would give it room to redirect its resources to Proto, its Bitcoin mining initiative, which it claims “has strong product market fit and a healthy pipeline of demand.”

It is unclear whether Block’s Proto team handles development for the mining chips or if it also works on the development of Block’s modular mining platforms and software. Decrypt has reached out to Block for clarification.

Financial rigor

Block’s strategic pivot follow a previous announcement in January that it would slash 10% of its workforce by the end of the year, citing company growth outpacing business and revenue expansion.

Block posted strong Q3 2024 results Thursday, with gross profit up 19% to $2.25 billion year-on-year, led by Cash App’s $1.31 billion and Square’s $932 million contributions.

The company also showed improved profitability, with its operating income posted at $323 million over a net income of $284 million. Core earnings grew 69% to $807 million compared to the previous year.

The company’s mining initiatives include developing proprietary hardware, highlighted by the completion of a 3-nanometer mining chip to rival Bitmain’s BM1600 chip.

For context, Bitmain is a dominant player in the Bitcoin mining industry, operating significant mining pools like Antpool, which accounts for a fifth (21.3%) of the Bitcoin network’s hash rate.

Core Scientific, a major player in U.S. Bitcoin mining, has committed to using Block’s mining equipment for its operations, which has been touted as one of the largest deals in the sector’s history.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Vince Dioquino

https://decrypt.co/290766/jack-dorseys-block-shifts-focus-to-bitcoin-mining-amid-trumps-crypto-promises

2024-11-08 01:46:51