This week in crypto, BeInCrypto unpacks everything from Donald Trump’s historic election, its impacts on Bitcoin and SEC Chair Gary Gensler, to new XRP ETF applications amidst institutional support, and a major new upgrade for Cardano.

These chaotic and interrelated developments have spurred bullish sentiment across the entire crypto community.

Cardano’s Node 10.11 Upgrade Opens New Era

On November 1, the Cardano-led member organization Intersect MBO launched the Node 10.11 update. It was the first mainnet update for the platform to support the Chang #2 hard fork. This update offered several major technical and democratic innovations, and will hopefully mark a new era in Cardano’s maturity as an on-chain governance model.

“Following a successful Chang #2 hard fork, decisions on the Cardano blockchain will be shaped and voted on via fully decentralized governance, as detailed in CIP-1694,” Intersect stated.

However, although the community was excited about these decentralization upgrades, it has also taken an increasingly polarized view of Cardano founder Charles Hoskinson. Hoskinson posted a poll via social media, asking, “Is Charles Hoskinson a Cancer for Cardano?” The results were almost a perfect tie, highlighting the community’s mixed views of him.

Grayscale Offers XRP Trust, 21Shares’ ETF Application

Grayscale, a major ETF issuer, launched trading on a new XRP-based trust fund. This aligns with Grayscale’s previous history of ETFs; namely, its Bitcoin ETF was converted from a similar trust fund. These trusts are legal to sell before official ETF approval, but their market value often suffers when approval takes place. This XRP Trust actually declined when sales went live.

21Shares, a competing ETF issuer, also applied for an official XRP ETF this week. The SEC has yet to officially confirm or reject it, but the race is officially on for a new crypto product. BitWise, too, filed for an XRP ETF, and Ripple CEO Brad Garlinghouse considers an eventual SEC approval “inevitable.”

Bitcoin Hits $77,000 All-Time High After Trump Win

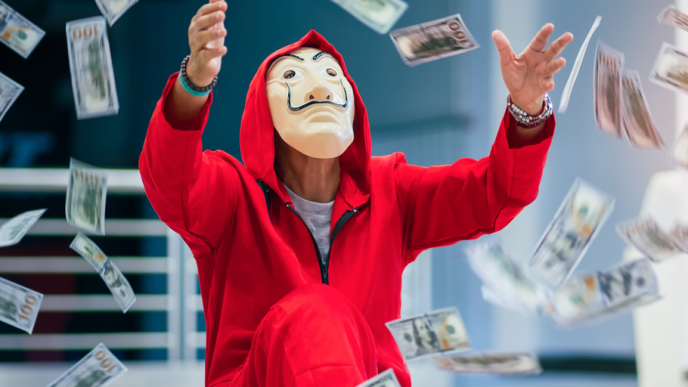

After Donald Trump won the recent Presidential election, Bitcoin reached a new all-time high. Its value jumped to over $75,000 in the immediate aftermath of his victory, and has continued rising to shift around $77,000 Friday. New investor interest in Bitcoin purchases has seen a massive demand on crypto exchanges.

A series of positive factors related to political developments are increasing the bullish case for Bitcoin. Trump’s election also brought heightened gains for risk-on ETF assets, and cryptoassets qualify as risk-on assets. BlackRock’s IBIT has already benefitted from this trend. Additionally, the Federal Reserve cut interest rates by 25 bps, another bullish signal.

Ripple Transactions Boosted By Institutional Demand

Ripple also reported strong growth in Q3 2024, claiming that institutional interest spurred the majority of this action. Major financial institutions like the Chicago Mercantile Exchange began offering XRP offerings, highlighting this acceptance. This trend took place despite regulatory challenges from the SEC, instilling confidence in CEO Brad Garlinghouse.

“The message from the market is clear — institutional interest in XRP products is stronger than ever…The SEC’s war on crypto has lost battle after battle — their continued disregard for the court’s authority will further erode the SEC’s credibility and reputation,” Garlinghouse said.

XRP as a whole enjoyed elevated trade volumes during this period. Average daily volumes on several exchanges consistently remained between $600 and $700 million, with a few outliers going much higher. XRP transaction volumes also nearly doubled, but a large proportion of these were microtransactions. These tiny moves left a reduced impact on total on-chain volume.

Justin Sun Offers Job to Gary Gensler if Trump Fires Him

Tron founder Justin Sun also offered a job to SEC Chairman Gary Gensler, in the event that Trump fires him upon taking office. At the Bitcoin Conference in Nashville, Trump publicly vowed to fire Gensler if elected, drawing an outsized reaction from the crowd. Trump made several promises to halt a “crypto crackdown” from regulators and legislators, and that includes Gensler.

“As an industry, we should have an inclusive heart, no matter who it is. I’m open to hiring Gensler if he can genuinely treat the crypto industry with sincerity. After all, this person also has a family to support,” Sun claimed.

It is unclear if Sun made this as a genuine offer, or mockery. Gensler’s hostile activities towards the crypto industry have earned him many enemies in the space, but he is intimately familiar with it. Sun also congratulated Trump on his electoral success, hoping he can “promote industry growth” through pro-crypto regulations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/week-in-crypto-trump-win-boosts-bitcoin/

2024-11-09 16:00:00