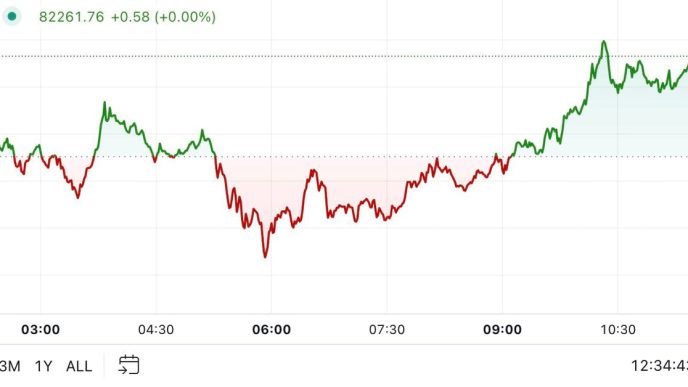

After the US election, digital asset investment products attracted $1.98 billion in inflows, marking the fifth consecutive week of positive inflows. This resulted in year-to-date total inflows to hit a new record of $31.3 billion.

Global assets under management also hit an all-time high of $116 billion following recent price increases. Trading volumes surged by $20 billion, the highest since April, though not a new record.

Market Bullishness Puts Pressure on Short-Bitcoin Products

According to the latest edition of CoinShares’ Digital Asset Fund Flows Weekly Report, Bitcoin saw $1.8 billion in inflows, bringing the total to $9 billion since the US Federal Reserve’s first interest rate cut of the cycle in September.

The supportive macro environment, alongside major shifts in the US political system, is believed to have contributed to the strong investor sentiment, as per the asset manager.

Ethereum also saw inflows of $157 million last week after a period of underperformance. In fact, this was the biggest inflow since the July spot Ether ETF launches, indicating a significant improvement in market sentiment toward the cryptocurrency. Next up was multi-asset products, with inflows of $23.4 million over the past week.

Several other altcoins experienced inflows, led by Solana with $3.9 million and Uniswap with $1 million. XRP and Tron each saw inflows of $0.5 million, while Litecoin and Cardano had smaller inflows of $0.2 million and $0.1 million, respectively. Blockchain equities also saw inflows totaling $61 million.

During the same period, short-Bitcoin products experienced outflows of $2.7 million, marking the only cohort of digital asset investment products to see negative movement. While the broader market saw strong inflows, the outflows from short-Bitcoin products suggest that investors were positioning themselves more cautiously or betting on further price appreciation.

US Leads Regional Inflows

The US led regionally with inflows of $1.95 billion, followed by Europe, where Switzerland and Germany saw inflows of $23 million and $20 million, respectively. Sweden, however, saw outflows of $25.7 million.

Zooming out, Australia and Brazil attracted $6 million and $3.7 million in inflows over the past week. On the other hand, Canada and Hong Kong experienced modest outflows of $1.7 million and $0.8 million, respectively.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Chayanika Deka

https://cryptopotato.com/post-election-market-boost-crypto-inflows-near-2-billion/

2024-11-11 13:01:11