FET, the native token of the Artificial Superintelligence Alliance, is one of the top losers in the market today due to an 18% price decrease in the last 24 hours. This decline drove the FET crypto price from a peak of $1.62 yesterday to $1.28 at the time of writing.

Following the development, it appears that the altcoin might continue to see lower lows. Here is why.

Artificial Superintelligence Alliance Drags Holders Back

One key indicator suggesting that FET’s price could decline further is the Coin Holding Time. The Coin Holding Time is the period in which holders hold a cryptocurrency without selling or transacting.

When it increases, it means that holders are not selling, indicating conviction in a token’s bullish potential. However, a decrease, on the other hand, signifies selling pressure, suggesting that holders do not believe in the token’s short-term potential.

At press time, FET’s Coins Holding Time has decreased by 83% within the last seven days. Based on the conditions mentioned above, this decline is bearish for the altcoin. As such, the price might likely drop below $1.30.

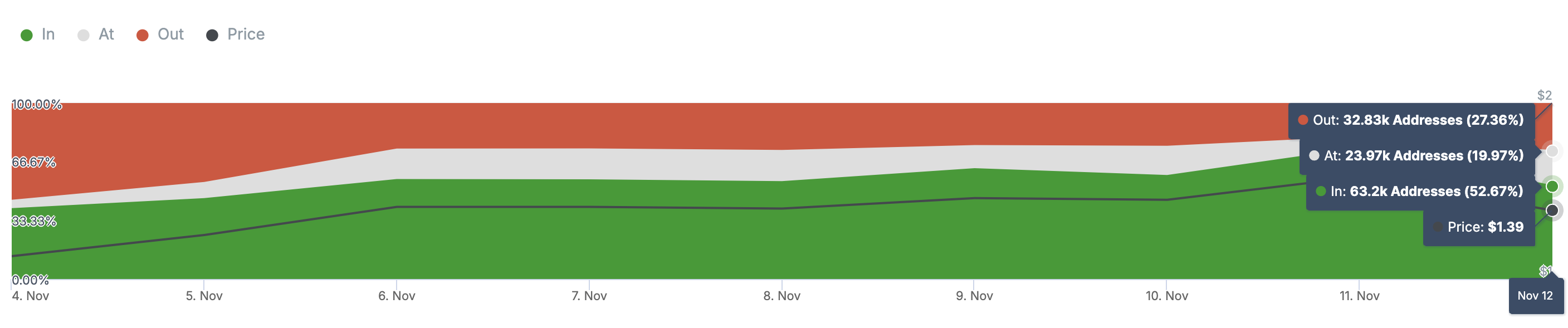

Due to this position, the Historical In/Out of Money (HIOM) shows a decrease in the FET holders with unrealized profits.

The HIOM) metric is useful for comparing the percentage of addresses in profit at two different times when prices are in a similar range. The change in the percentage of profitable addresses helps indicate whether the momentum favors buyers or sellers.

On November 11, the HIOM showed that about 74% of FET holders were in the money. But as of this writing, that figure has decreased to approximately 53%. This decline suggests that market participants may not be encouraged to buy the altcoin; as such, the price could struggle to rise.

FET Price Prediction: Selling Pressure Rises

A look at the daily chart shows that the decrease in the FET crypto price ensured that it dropped below the key Exponential Moving Averages (EMAs). As seen below, both the 20 EMA (blue) and 50 EMA (yellow) are around the same region.

The EMA can indicate areas of support and resistance. A rising EMA often supports the price uptrend, while a falling EMA tends to act as resistance. Since the indicators dropped, and FET’s price is below them, there is no solid support for the cryptocurrency.

If this remains the case, FET’s price could drop to $1.24. If selling pressure intensifies, it could drop as low as $1.13. However, if bulls begin to accumulate the token in large volumes, things might change, and the altcoin could rise to $1.74.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/fet-crypto-price-decline-among-top-losers/

2024-11-13 10:30:00