XRP has been experiencing a significant increase in on-chain activity, which has resulted in a recent surge in its popularity.

Analysts and investors have expressed interest in the XRP Ledger, Ripple’s digital payment platform, due to its increased transaction throughput.

Related Reading

CryptoQuant recently noted an increase in the NVT (Network Value to Transactions) Ratio of XRP in a post on X (formerly Twitter), which implies that on-chain activity has been increasing. This increasing NVT Ratio may indicate that the XRP network is more active than its current market valuation.

Market observers are keeping an eye on the altcoin’s value and activity, which of late are exhibiting a variety of signals. Despite the network usage’s surge, XRP price continues to encounter obstacles, with critical resistance levels imminent.

XRPL: Spike in NVT Ratio

“Given that the NVT Ratio is a calculation between Market Capitalization (which is stable around $51.1B) and On-chain Transaction Volume, this spike reflects higher transaction volume.” – By @JA_Maartun

Read more 👇https://t.co/11LKvfGjDQ pic.twitter.com/1tK1M95cKv

— CryptoQuant.com (@cryptoquant_com) November 13, 2024

What’s The Reason For The Increase In NVT Ratio?

A measure of the “value” of network activity is the NVT Ratio, which is calculated by dividing market capitalization by the volume of on-chain transactions. On November 2, XRP’s NVT Ratio saw a sharp rise, hitting 1,162 in a comparatively short amount of time.

This increase is primarily attributable to a surge in on-chain activity, which resulted in the network processing $44 million in daily transaction traffic, CryptoQuant data shows.

So, what does this imply? A high NVT Ratio usually suggests that the market capitalization hasn’t kept pace with the increased activity in the network, even though the network is in use. With respect to XRP, it implies that the number of transactions is higher, possibly for remittance or other purposes.

This increase in activity, however, has not yet translated into an increase in the price of the token. In fact, despite the rise in activity, the market capitalization of XRP has remained relatively constant, close to $51 billion.

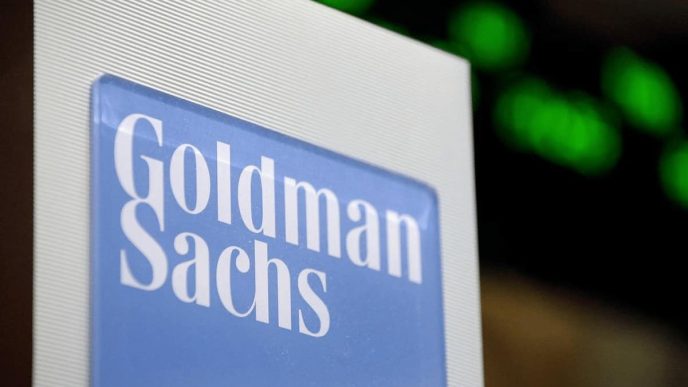

XRP: $0.75 Resistance In Focus

While this is going on, XRP market experts are looking at how the price of the coin changes. For almost a year now, $0.75 has been a strong resistance. A well-known crypto expert, Egrag Crypto, also saw this level as a major obstacle for the token.

#XRP at 0.75c – The Key Level!

by now you are fed up from me talking about $0.75c is crucial! Let’s take a look at the bigger picture 📊:

On the monthly chart, three wicks have formed, showing big selling pressure. Here’s when we saw it:

A) November 2023

B) March 2024

C)… pic.twitter.com/7X0p3Msu9E— EGRAG CRYPTO (@egragcrypto) November 13, 2024

Related Reading

Egrag suggests that if XRP is able to surpass $0.75, it may pursue subsequent targets at $0.85 and even $1.12, potentially triggering a rally. However, it has not been a simple feat—XRP’s most recent endeavors to surpass this threshold in November 2023, March 2024, and this month were all met with substantial selling pressure.

Nevertheless, traders remain optimistic that the heightened network activity and support levels could provide XRP with the necessary boost, despite these setbacks.

December Rally

December 2024 has the potential to be a transformative month for XRP. Many analysts believe that if XRP closes above $0.60 on a weekly basis, it could establish a “wake-up line,” which could result in increased price gains through the end of the year.

Featured image from Yahoo Finance, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/xrp-ledger-booms-44-million-in-transactions-as-activity-soars/

2024-11-15 14:00:01