Despite a recent price decline, Ethereum (ETH) bulls appear to be setting their sight on a renewed rally, according to data obtained by BeInCrypto on-chain. Today, ETH’s price is $3,130 — down from its recent peak of $3,434 on November 12.

Investors, however, remain resolute that the cryptocurrency pullback is temporary. Here is a breakdown of what could happen amid the current sentiment.

Ethereum Investors Decide Not to Sell

According to Glassnode, the total Ethereum exchange inflow is 249,245 as of this writing. Exchange inflow is the number of coins sent to exchanges within a given timeframe. When this metric increases, it means that more holders are willing to sell, which could be bearish for the cryptocurrency.

On the other hand, a decrease in the exchange inflow indicates that investors are removing their holdings from exchanges. For ETH, the current figure, valued at approximately $780 million, is a decrease from the value on Friday, November 15.

Therefore, this suggests that most ETH holders are refraining from selling. If this continues, the cryptocurrency might not experience a decline below $3,000 in the short term.

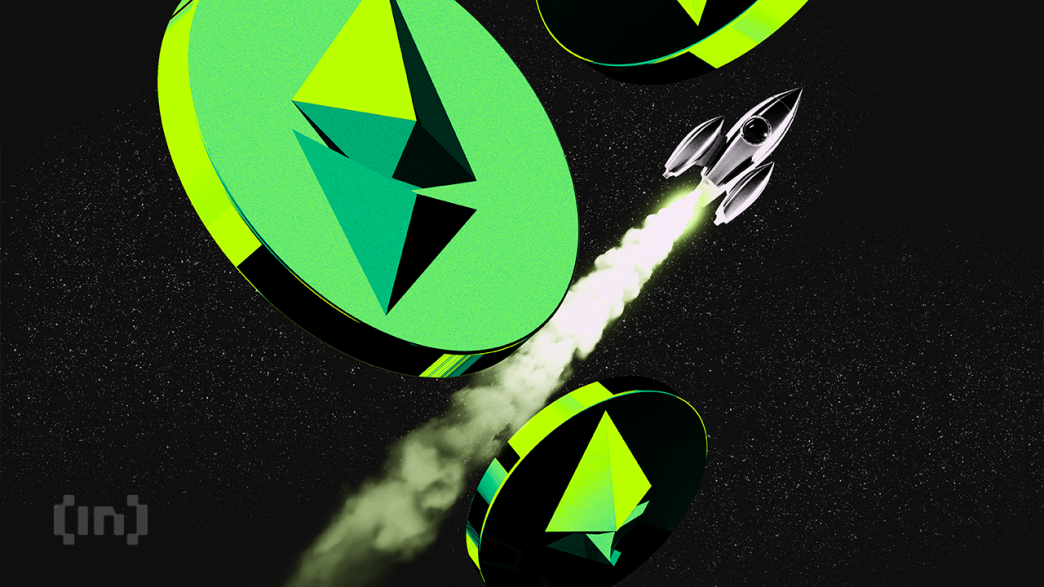

Data from IntoTheBlock reveals that ETH bulls are actively working to sustain the price. This is evident from the Bulls and Bears indicator, which tracks whether addresses trading at least 1% of a cryptocurrency’s volume are predominantly buying or selling.

When the indicator shows more bulls, it signals that participants are primarily buying. Conversely, a higher number of bears indicates increased selling activity.

Over the past 24 hours, Ethereum bulls have outnumbered bears, suggesting ETH’s price could surpass $3,130 in the short term.

ETH Price Prediction: More Support for the Upside

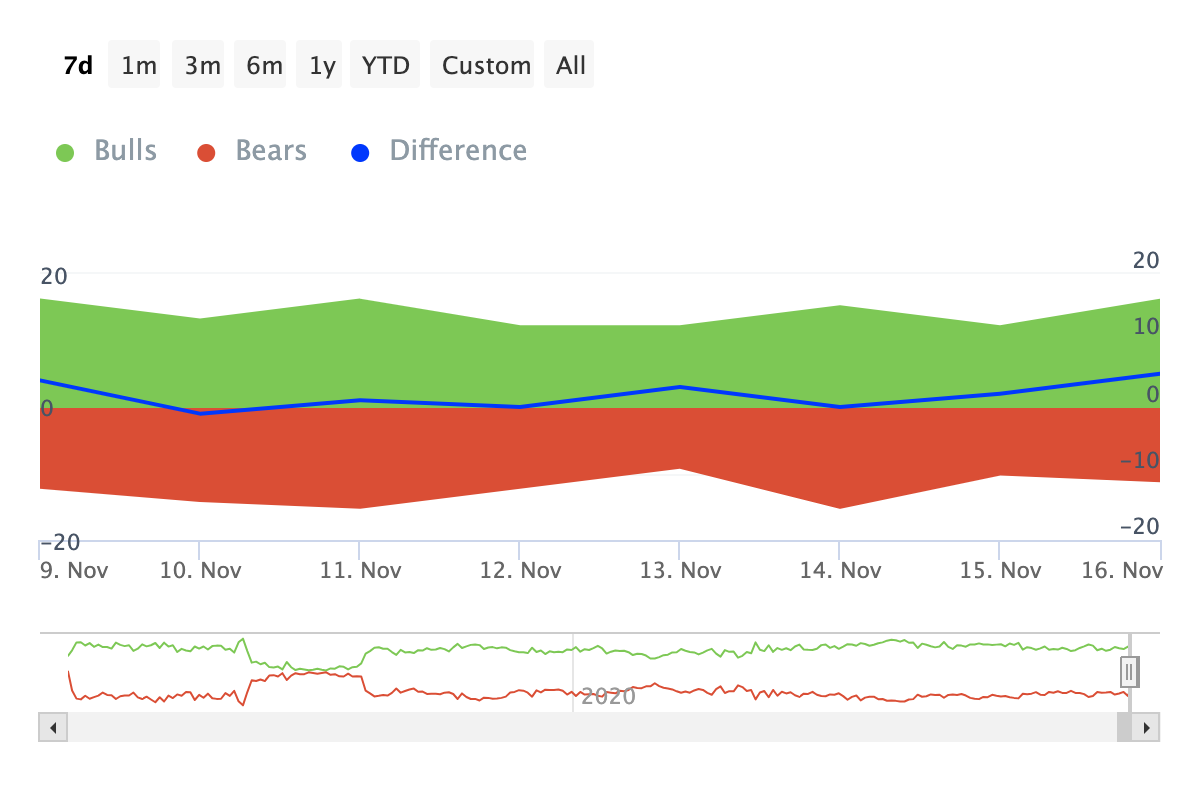

From an on-chain perspective, the In/Out of Money Around Price (IOMAP) supports the bias that ETH’s price could trade higher. The IOMAP indicator helps traders identify key price levels where significant buying or selling activity is likely based on user positions and profitability.

It also highlights areas of support and resistance, depending on the volume at a price range. Typically, the larger the cluster of volume, the stronger the support or resistance.

In the image below, approximately 3 million addresses accumulated Ethereum at the $3,075 price level, collectively holding 3.56 million ETH. These addresses are “in the money,” indicating they are currently profitable based on the prevailing market price.

This cluster suggests strong support at $3,075, as holders at this level may resist selling at almost every other level between $3,251 and $3,591. Considering this position, Ethereum’s price is likely to rally toward $3,600.

However, if selling pressure increases, this might not happen. In that scenario, ETH’s value could decrease below $3,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ethereum-bulls-pull-coins-off-exchanges/

2024-11-17 08:53:15