Cardano (ADA) has seen steady gains over the past two weeks, reaching a two-year high of $0.81 on November 16 before experiencing a slight pullback. It currently trades at $0.75, marking a 5% decline since its peak.

An analysis of its on-chain and technical indicators suggests that this downturn could continue, potentially hindering its ability to reclaim the $1 level — a milestone last reached in 2022.

Cardano Holders Sell For Gains

BeInCrypto’s assessment of Cardano’s exchange netflow has shown a spike in inflows over the past 24 hours, indicating profit-taking activity. As of 9:16 UTC on Monday, data from Coinglass shows that the altcoin has recorded net inflows totaling $7.21 million.

Higher exchange inflows suggest that coin holders are transferring their assets to exchanges to sell, leading to increased selling pressure and downward price movement.

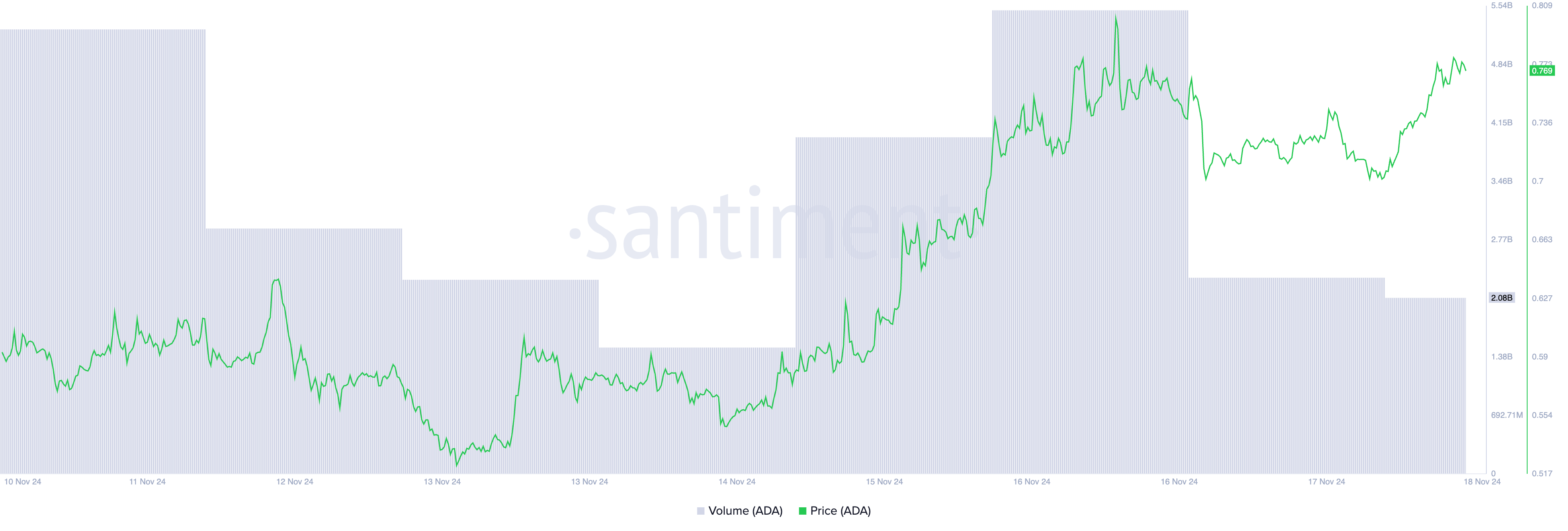

Moreover, the decline in ADA’s trading volume over the past 24 hours confirms this bearish outlook. While the Cardano coin price surged by 7%, its trading volume dropped by 57% during that period.

When an asset’s price climbs while the trading volume decreases, it suggests that fewer buyers are participating in the market, and the upward momentum may not be as strong as it appears. This indicates market participants’ loss of interest or a lack of conviction, as many prefer to sell for profit.

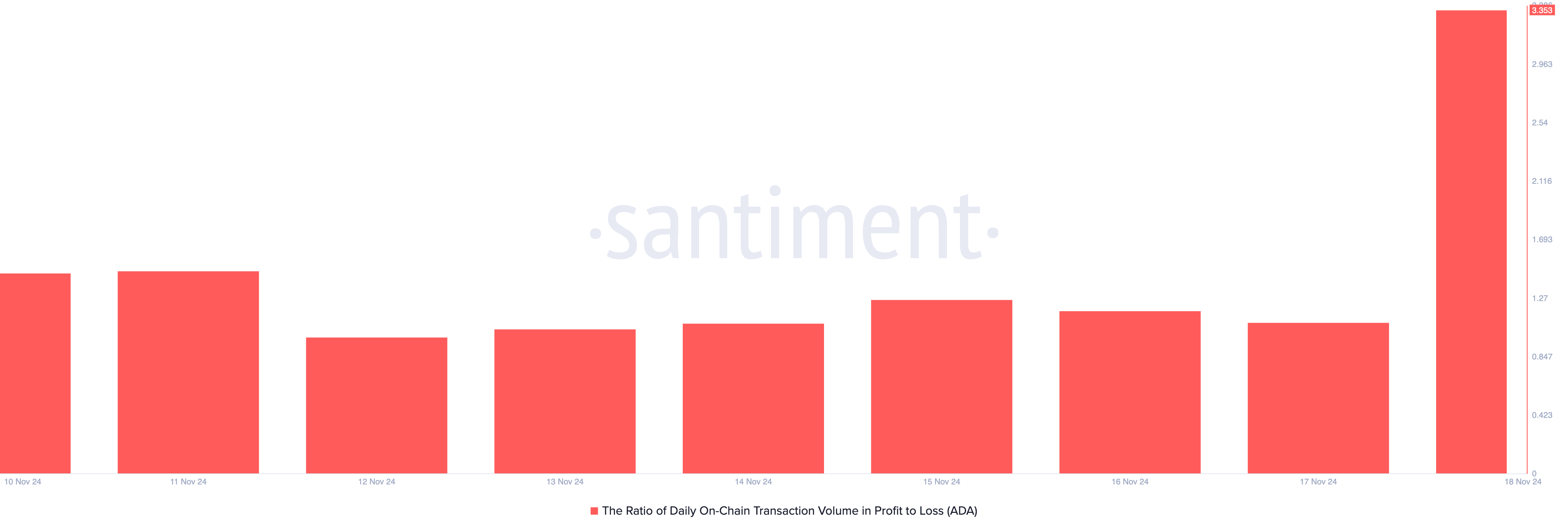

Notably, on Monday, transactions involving ADA have been significantly profitable. Per Santiment’s data, the ratio of daily on-chain transaction volume in profit to loss currently sits at 3.35, its single-day highest value since June 2020.

This means that for every ADA transaction ending in a loss, 3.35 transactions have yielded a profit. This high profit-to-loss ratio signals a potential sell opportunity for Cardano traders aiming to realize gains. It potentially increases the downward pressure on the coin’s price.

ADA Price Prediction: Further Decline on the Horizon

At press time, Cardano is trading at $0.75, shy of its two-year peak of $0.81. If buying pressure continues to wane, the coin’s price could retreat further, seeking support at $0.69. A failure by the bulls to defend this level might push the Cardano coin price even lower, potentially to $0.61.

Conversely, a shift in market sentiment and renewed demand for ADA could see its price reclaim the $0.81 high and rally beyond it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-price-pullback/

2024-11-18 11:00:00