Bitcoin (BTC) has declined from its $93,495 peak, now trading at $92,428 as profit-taking accelerates.

Market sentiment, marked by “extreme greed,” signals a possible price reversal as traders increasingly lock in gains.

Bitcoin’s Rally Prompts Its Long-Term Holders To Sell

BeInCrypto’s assessment of BTC’s on-chain performance has shown a spike in coin distribution by its long-term holders (LTHs). These are investors who have held their coins for an extended period, typically defined as more than 155 days.

Per Glassnode’s data, the coin’s Hodler Net Position Change dropped to a five-month low on Tuesday. This metric reflects the overall buying and selling activity of long-term Bitcoin holders. This decline indicates that the group sold over $3 billion worth of BTC on that day — their highest single-day sell-off since June 26.

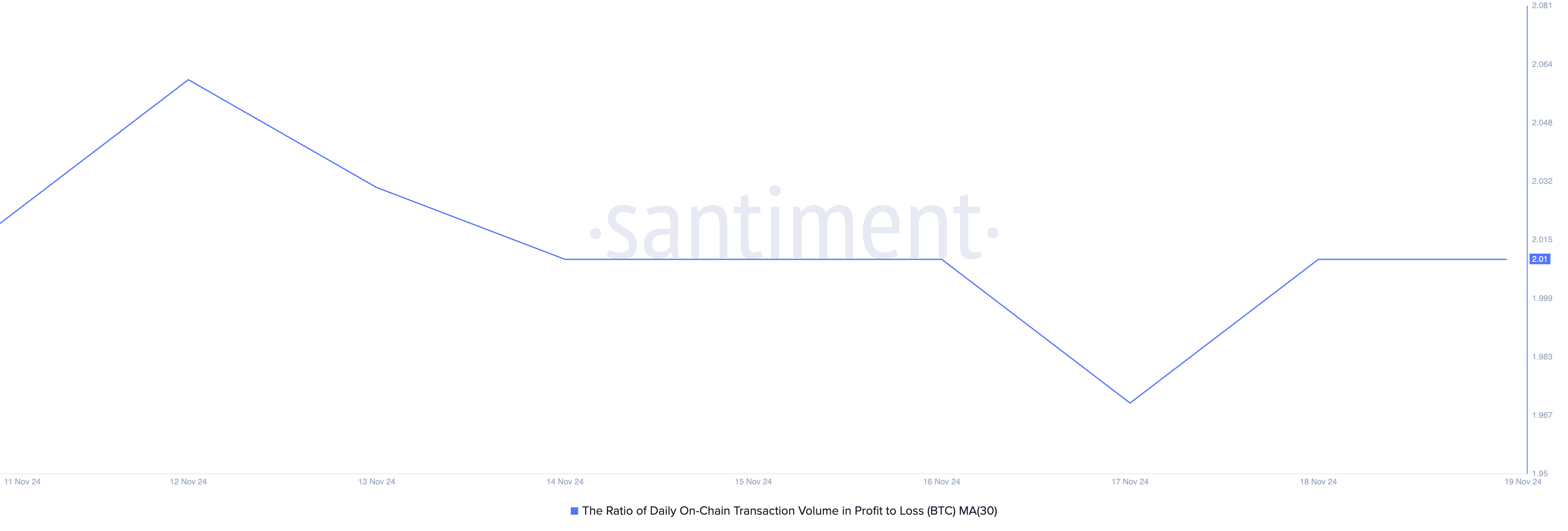

Notably, BTC transactions have been significantly profitable over the past few weeks. As of this writing, the ratio of the coin’s daily transaction volume in profit to loss (assessed using a 30-day moving average) is 2.01. This suggests that for every BTC transaction that has ended in a loss, 2.01 transactions have returned a profit.

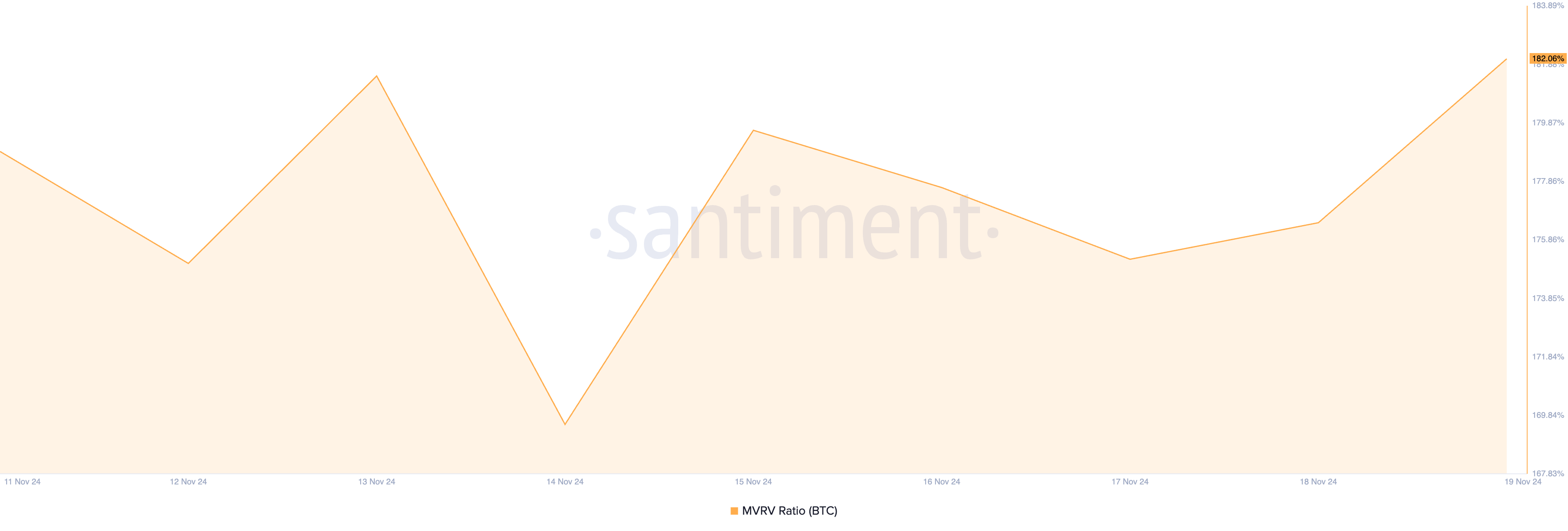

Moreover, BTC’s market value to realized value (MVRV) ratio suggests that the coin may be overvalued, prompting more holders to sell. According to Santiment’s data, BTC’s current MVRV ratio is 182.06%.

At 182.06%, BTC’S MVRV ratio suggests that its current market value is significantly higher than its realized value. Therefore, if all coin holders were to sell, they would, on average, realize 182.06% profit.

BTC Price Prediction: All Lies With the Coin’s Long-Term Holders

At press time, BTC trades at $92,428, slightly below its cycle peak of $93,495. If LTHs persist in their profit-taking activity, BTC’s price will fall further from this high, toward support below $90,000. According to readings from the coin’s Fibonacci Retracement tool, the next major support is formed at $83,983.

However, if selling activity stalls and the coin sees a spike in new demand, its price will reclaim the $93,495 all-time high and attempt to rally past it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/btc-long-term-holders-cash-out/

2024-11-19 23:00:00