POPCAT has been experiencing sideways momentum in recent weeks, raising concerns among investors. While the meme coin has attempted to regain its footing, its struggle to maintain upward momentum could lead to extended losses.

Currently, the cryptocurrency is edging closer to critical support levels, signaling potential corrections ahead.

POPCAT Needs Support

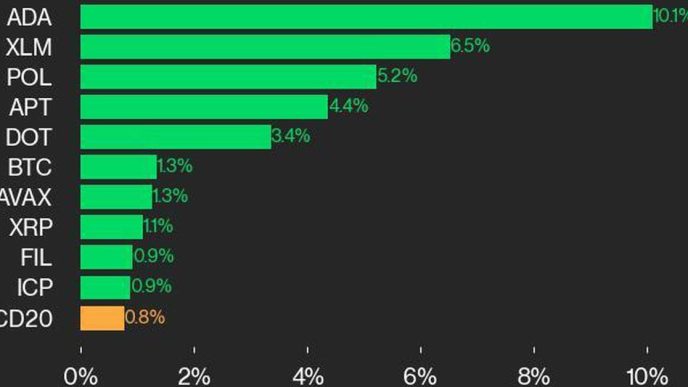

POPCAT’s network growth, a critical metric that tracks the rate of new addresses joining the network, is at a two-month low. This decline suggests that the asset is losing traction among new investors as fewer participants are entering the ecosystem. The lack of fresh interest highlights diminishing incentives for adoption, weakening its market appeal.

This stagnation in network activity is a red flag for long-term growth. A thriving network typically relies on steady user engagement, and POPCAT’s dwindling momentum could deter further investment. Without renewed interest, the meme coin may find it challenging to recover and sustain its market position.

Despite the Relative Strength Index (RSI) remaining in the bullish zone, POPCAT’s macro momentum hints at bearish undertones. The RSI is trending downward, signaling weakening buying pressure that could exacerbate corrections. While the indicator suggests that bullish sentiment exists, the broader market forces seem to be turning against the meme coin.

Such a macro bearish trend typically indicates upcoming struggles in price action. If these signals persist, they may push POPCAT further into a downtrend, limiting any short-term recovery potential. Investors should remain cautious of these indicators, as they could foreshadow extended volatility.

POPCAT Price Prediction: Correction Ahead?

POPCAT’s price has dropped significantly from its all-time high (ATH) of $2.10, currently trading at $1.65. This decline saw the meme coin fall below the critical support level of $1.74, a key marker for maintaining upward momentum.

If bearish pressures continue, POPCAT could fall to $1.49, which serves as its next critical support. A breach of this level may lead to a further decline toward $1.21, erasing more of its recent gains and pushing the meme coin away from a new ATH.

However, should POPCAT reclaim the $1.74 support level, it could signal a bullish reversal. Such a recovery may propel the price back toward its all-time high of $2.10, potentially invalidating the bearish outlook and sparking a renewed rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/popcat-price-new-ath-unlikely/

2024-11-20 14:00:00