SUI price has been on a remarkable run, recently reaching a new all-time high and climbing nearly 74% in the past month. This surge reflects growing momentum for the asset, fueled by increasing adoption and market activity.

Alongside price performance, SUI’s Total Value Locked (TVL) has also been breaking records, hitting $1.65 billion before slightly retracing.

SUI TVL Is Breaking Records

SUI Total Value Locked (TVL) has been making new highs, hitting an impressive $1.65 billion on November 15. However, it has slightly declined since then, stabilizing around $1.62 billion over the past few days.

This shift shows a cooling period after the strong growth trajectory observed earlier in the month.

Tracking SUI’s TVL is critical as it reflects the platform’s ability to attract capital and maintain user trust. Since surpassing $900 million on October 28, SUI has consistently demonstrated its capacity to lock significant value, marking its first milestone of $1 billion in TVL on September 30.

However, the recent dip in growth momentum may suggest a pause in this uptrend.

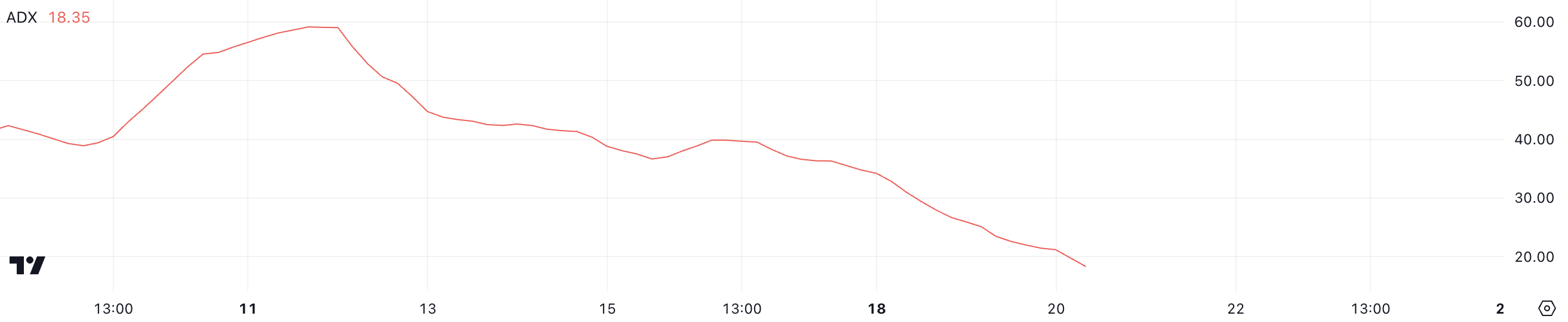

SUI Current Uptrend Isn’t That Strong Anymore

SUI’s Average Directional Index (ADX) has dropped significantly, currently sitting at 18, compared to over 30 just two days ago. This decline indicates that while SUI remains in an uptrend, the strength of this trend is weakening.

A falling ADX often signals reduced momentum, suggesting that SUI’s recent price movements might lack the vigor seen earlier in the current rally.

The ADX measures the strength of a trend, regardless of its direction, with key thresholds indicating different levels of momentum. Values below 20 suggest a weak or non-existent trend, while readings above 25 indicate a strong trend gaining traction.

SUI ADX slipping below this threshold suggests the uptrend may be losing steam. If this weakening trend persists, SUI price could face consolidation or even pullbacks in the coming days.

SUI Price Prediction: Can It Break Above $4 Soon?

If SUI current uptrend regains strength, it is likely to test the resistance at $3.94, which marks its previous all-time high. Breaking this level could pave the way for further gains, with the next key threshold at $4.

This scenario would signal renewed bullish momentum, potentially attracting more interest from traders seeking to capitalize on the rally.

On the other hand, a reversal into a downtrend could see SUI price testing its nearest support at $3.1. Should this level fail to hold, the price could decline further, reaching as low as $2.2.

This represents a potential 39% correction, showing the risk of significant downside if market sentiment turns bearish.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/sui-weakening-trend-delays-breakout/

2024-11-20 16:00:00