Solana (SOL) price has surged 16.96% in the last seven days and is now very close to reaching a new all-time high. The recent rally has positioned SOL just under 3% from its previous ATH, signaling strong bullish sentiment in the market.

However, indicators like BBTrend and ADX suggest that the current uptrend is losing some momentum, raising caution for potential consolidation or a pullback.

SOL BBTrend Is Still Positive

Solana currently has a BBTrend of 9.56, marking a sustained positive trend since November 18. While it remains in bullish territory, the value is down from its monthly high of 18.64 on November 10, indicating a decline in trend strength.

This suggests that while SOL is still in an uptrend, the momentum behind its recent price movements may be weakening.

BBTrend measures the strength and direction of price trends using Bollinger Bands, with positive values signaling an uptrend and negative values indicating a downtrend.

At 9.56, SOL’s BBTrend reflects a moderate bullish sentiment, though it is far weaker compared to earlier in the month. This could mean the current uptrend is stabilizing, leaving SOL vulnerable to consolidation or a potential reversal if buying pressure diminishes further.

Solana Current Uptrend Isn’t as Strong as It Was

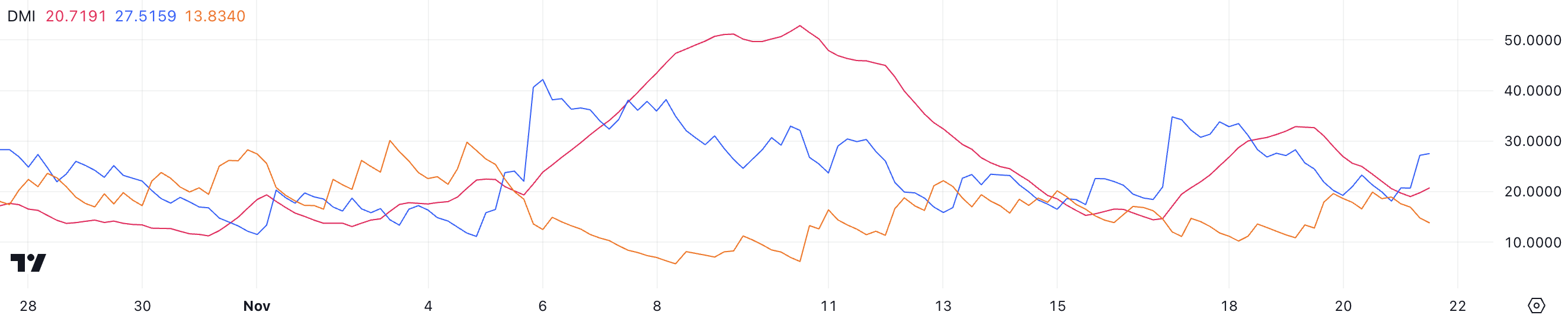

Solana (SOL)’s DMI chart shows its ADX at 20.71, indicating a weaker trend than earlier in the month when it was above 50.

The ADX measures the strength of a trend, regardless of its direction, with values above 25 indicating a strong trend and below 20 indicating a weak or nonexistent trend. The current value suggests that SOL’s trend has significantly weakened, reflecting reduced momentum after its earlier surge.

With the positive directional index (D+) at 27.5 and the negative directional index (D-) at 13.8, bullish pressure continues to outweigh bearish activity.

However, the weak ADX indicates that this bullish momentum lacks the strength to sustain significant upward movement. For SOL price to regain a strong uptrend, the ADX would need to rise above 25.

SOL Price Prediction: A New All-Time High Soon?

SOL price is currently less than 3% from its previous all-time high (ATH). If Solana maintains its current uptrend, it is positioned to rise and potentially reach a new ATH at $260.

Breaking through this level could pave the way for further gains, with the price possibly targeting $265 or even $270.

However, as indicated by BBTrend and ADX, the trend’s strength appears to be weakening, leaving room for a potential reversal. If a downtrend emerges, SOL price could test its support levels at $204 and $194.

Should these supports fail to hold, the price could drop further to $154, marking a significant correction from its current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/solana-nears-all-time-high/

2024-11-21 18:23:15