For some investors, Cardano’s recent dip below $1 might seem catastrophic. However, ADA bulls appear unfazed by the slight decline, as on-chain data suggests they may be gearing up for another sustained uptrend.

Here is an in-depth analysis explaining how things could unfold for the altcoin.

Cardano Investors Stick to Their Bullish Conviction

As of this writing, Cardano’s price is $0.98 after initially rising to $1.15 recently. This slight decrease could be linked to the broader market fall yesterday, which saw Bitcoin (BTC) drop below $95,000.

However, data from Coinglass reveals that the ADA Spot Inflow/Outflow stands at -$40 million as of this writing, down from -$63 million on Monday, November 25. This indicates that Cardano bulls have withdrawn about $100 million from exchanges in just two days

Typically, when holders pull tokens from exchanges, it suggests they’re not planning to sell, which can create upward price pressure. Conversely, an increase in inflows would indicate that holders are willing to sell, potentially leading to a price decline.

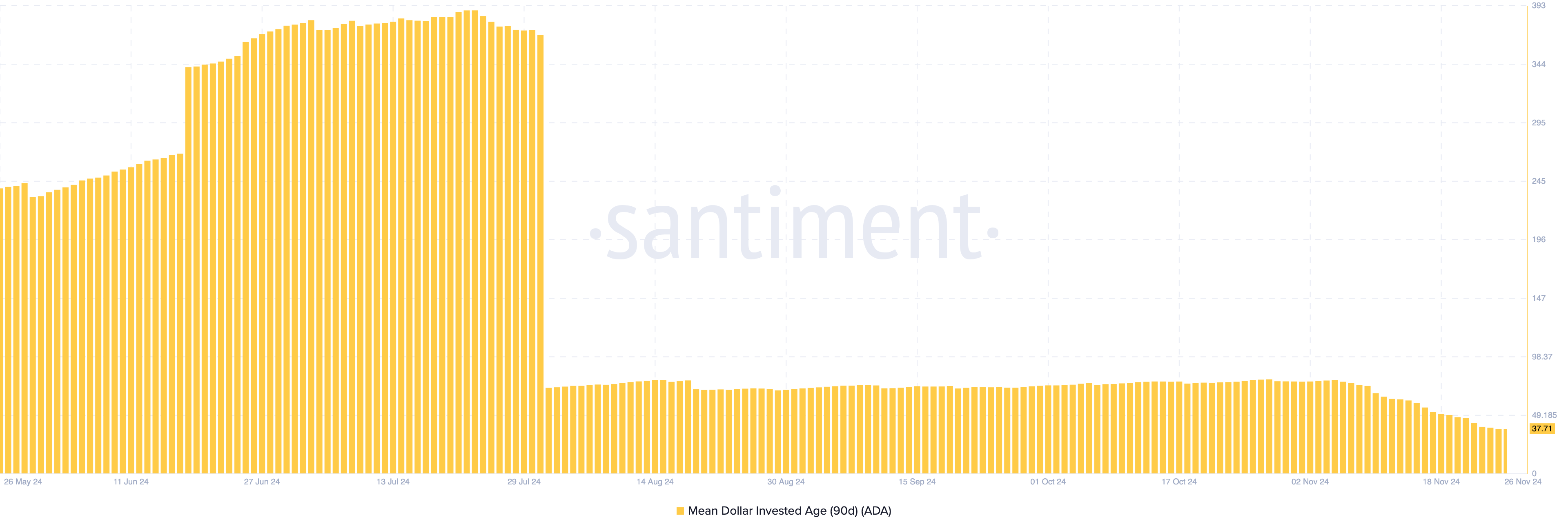

Therefore, if the exchange outflow continues to rise, then Cardano’s price could rebound in the short term. Another indicator predicting such a move is the Mean Dollar Invested Age (MDIA).

The MDIA is the average age of all tokens on a blockchain weighted by the average purchase price. When it increases, it means that most tokens have stayed stagnant. Thus, this makes it challenging for prices to move significantly.

However, for Cardano, the 90-day MDIA has significantly declined, suggesting that trading activity of previously dormant coins has increased. If sustained, ADA might find it relatively easy to trade higher as long as buying pressure increases.

ADA Price Prediction: Uptrend to Continue

The 4-hour ADA chart shows a bull flag forming, a bullish pattern made up of two rallies separated by a short consolidation period.

The pattern begins with a sharp price spike, called the flagpole, driven by strong buying pressure. This is followed by a pullback, creating the flag — a rectangular shape with parallel trendlines. A bull flag typically signals that, after consolidation, the price is likely to resume its upward movement once the pattern breaks out.

Considering the current outlook, Cardano bulls might push the price above $1.15. If that happens, then ADA is likely to rally toward the $2 mark. On the other hand, if selling pressure increases, the price might drop to $0.85.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/cardano-bulls-withdraw-from-exchanges/

2024-11-26 08:30:00