Bitcoin’s price decline over the past few days has led to a notable reduction in trading activity among US-based investors. As of this writing, the leading coin trades at $92,540, having shed 6% of its value in the past four days.

With strong resistance formed at the $99,000 price region, American investors have gradually reduced their coin holdings.

Bitcoin Holders in the US Shy Away

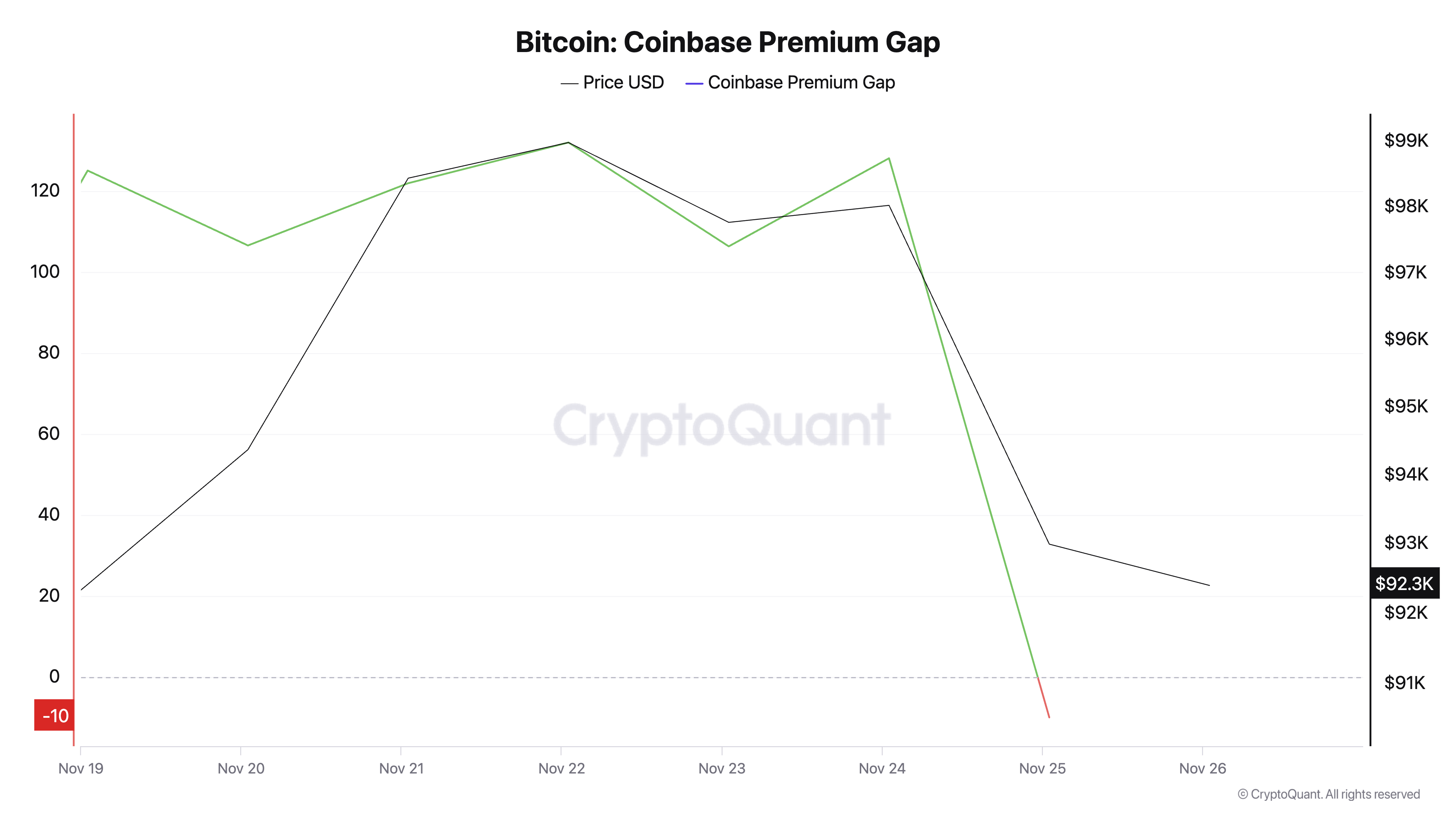

CryptoQuant’s data has shown a decline in BTC’s Coinbase Premium Index over the past seven days. As of this writing, it sits below the zero line and at a seven-day low of -0.01.

This metric measures the price difference of Bitcoin on Coinbase compared to Binance. It tracks the trading activity of institutional and US-based investors, as Coinbase is a preferred platform for these groups. A negative value indicates that the coin’s price on Coinbase is lower than on Binance, suggesting weaker demand or selling pressure from Bitcoin US investors.

Further, this trend of low buying activity among US investors is reflected in Bitcoin’s Coinbase Premium Gap. According to CryptoQuant, this metric has fallen to a seven-day low of -10.

It also measures the price difference between Bitcoin on Coinbase Pro (USD pair) and Binance (USDT pair). A positive gap indicates stronger buying pressure from Bitcoin US investors on Coinbase, suggesting increased demand. Conversely, a negative gap implies weaker demand from US investors.

BTC Price Prediction: Downward Trend May Persist

On BTC’s daily chart, the Parabolic Stop and Reverse (SAR) indicator now shows dots above the price, confirming a downtrend. This is the first time the dots have appeared in this position since November 6.

The SAR indicator tracks an asset’s price trend by plotting dots above or below the price. Dots below the price suggest an uptrend, while dots above the price signal a downtrend.

Bitcoin currently trades at $92,540, which is 4% shy of the support level, formed at $88,630. If the downward trend continues, the coin risks breaking below this support level and falling to $80,159.

However, if market sentiment shifts and buying activity resumes, BTC’s price may reclaim its all-time high of $99,419.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-us-investors-exit/

2024-11-26 14:30:00