The largest holder of the Solana meme coin, Moo Deng (MOODENG), recently added 11 million tokens to its holdings despite a 45% drop in its price.

This move by the top holder has fueled speculation that the cryptocurrency might recover some of its recent losses. But is a rebound on the horizon?

Moo Deng Stake Holder Adds More Tokens, but User Activity Drops

According to data from Arkham Intelligence, the MOODENG largest holder withdrew 11.80 million tokens from the Gate.io exchange. At the time of the transaction, these tokens were valued at $5.37 million.

The crypto intelligence platform further revealed that the holder transferred the entire amount to a non-exchange wallet. Following this move, the wallet now holds 104 million MOODENG, which has a current value of $38.62 million.

Typically, when something like this happens, it means that the market participant does not plan to sell anything soon. However, this does not necessarily imply that the cryptocurrency’s price will increase immediately, especially as MOODENG’s largest holder in the party involved.

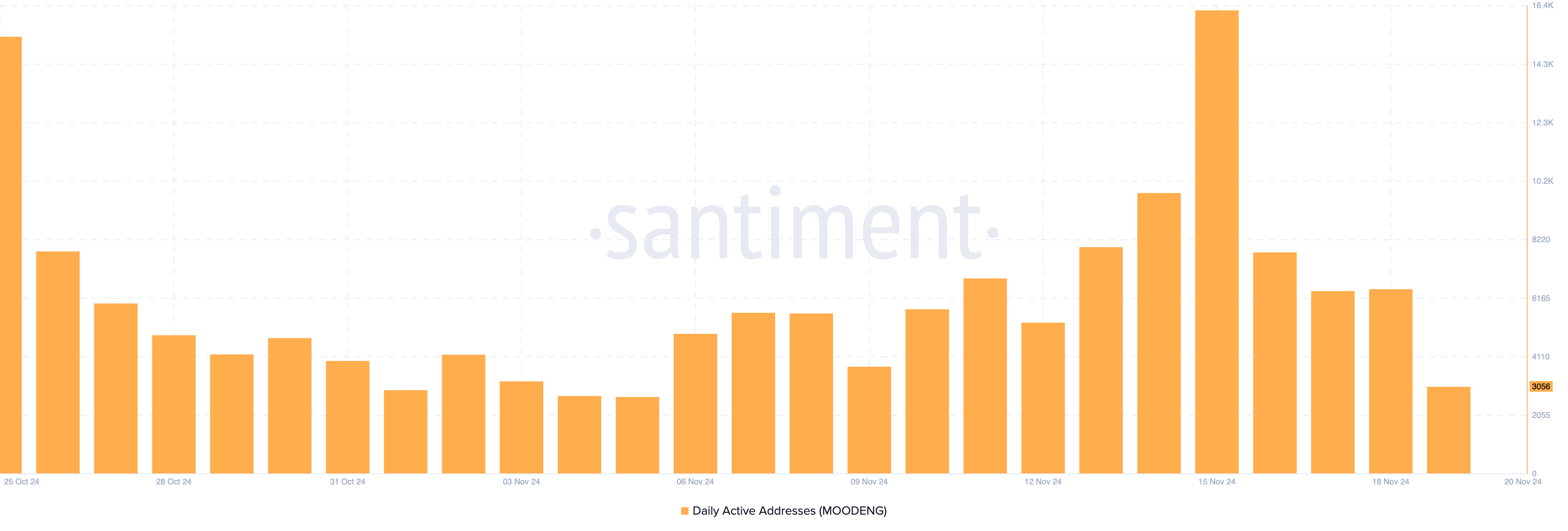

Despite the accumulation, on-chain data from Santiment highlights a significant drop in Moo Deng’s daily active addresses. Active addresses represent participants — either senders or receivers — in successful transactions. Typically, an increase in active addresses signals growing user interaction, which is a bullish indicator.

However, the current decline in MOODENG’s active addresses suggests waning user interest, a bearish sign that could put additional pressure on the meme coin’s price.

MOODENG Price Prediction: Decline Not Over

On the 4-hour chart, MOODENG continues to trade within a descending triangle. A descending triangle is a bearish chart pattern commonly used in technical analysis. It is defined by a downward-sloping upper trendline and a flat, horizontal lower trendline, which serves as a support level.

This pattern indicates increasing selling pressure and often indicates a potential breakdown below the support line. As seen below, the meme coin is on the verge of falling below the $0.34 support.

If validated, then the meme coin’s value could drop as low as $0.34. However, if MOODENG’s largest holder accumulates more volume, this could lead to a rebound toward $0.56.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/moodeng-largest-holder-expands-stash/

2024-11-26 15:30:00