Long-term holders of XRP realized over $1.5 billion in profits last week as the payments-focused cryptocurrency zoomed to a three-year high, data shows, marking the highest profit realization since April 2021.

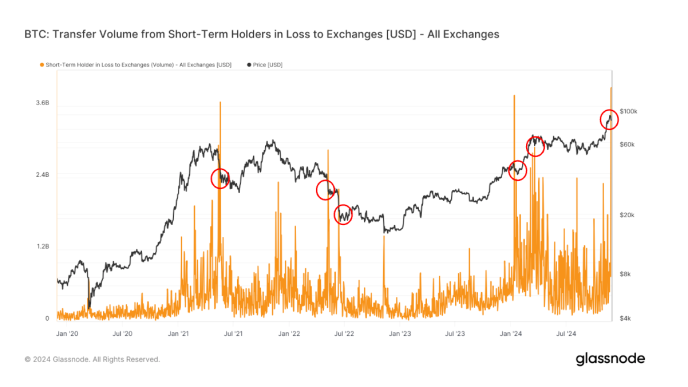

Profit-taking is usual investor behavior after rallies and doesn’t indicate a change in the long-term sentiment for any token.

The Market Value to Realized Value (MVRV) ratio surged to 217% on Tuesday, according to an FXStreet report citing Santiment data, suggesting that the current market valuation of XRP is significantly higher than its average purchase price — indicative of potential overvaluation in the short term in a move that may dampen a swift rally higher.

MVRV is a ratio of the total value of all the coins in circulation by the total value of all coins based on the price at which they were last moved on the blockchain. It can be thought of as the aggregate cost basis of all coins currently in circulation.

High profit-taking combined with the overvaluation signaled by the MVRV could lead to a market correction.

Several factors have helped catapult XRP prices recently, surging to a local high of $1.60 last week before paring gains to as low as $1.30. The token is still up 31% over the past week.

It has more than doubled in two weeks on several positive catalysts, such as the clearing of regulatory headwinds for closely related Ripple Labs, the launch of money market funds on XRP Ledger, and a technical bullish price analysis.

Meanwhile, Ripple plans to invest an unspecified amount in the newly rebranded Bitwise Physical XRP ETP (earlier called the ETC Group Physical XRP), per a Wednesday release. The announcement sent XRP higher by 10%.

The European XRP ETP will now trade under the GXRP ticker on Germany’s Deutsche Börse XETRA, the release said.

“Global demand for exposure to the crypto asset class has exploded in 2024, fueled by a growing interest in crypto-backed investment offerings,” Brad Garlinghouse, CEO at Ripple Labs, said in the release. “With the U.S. regulatory environment for crypto finally becoming more clear, this trend is poised to accelerate, further driving demand for crypto ETPs, such as the Bitwise Physical XRP ETP.”

The 100% physically backed ETP launched by Bitwise in 2022 allows European investors to gain exposure to XRP.

Source link

Shaurya Malwa

https://www.coindesk.com/markets/2024/11/27/xrp-rally-sees-record-profit-taking-as-ripple-labs-plans-to-invest-in-bitwise-xrp-etf

2024-11-27 11:40:32