Cardano (ADA) price has surged 195.11% in the last 30 days, reflecting significant bullish momentum. However, key indicators like ADX and EMA lines suggest the current uptrend may be losing strength.

ADA could still push toward resistance at $1.15 and potentially $1.20 if the uptrend regains momentum. Conversely, a trend reversal could lead to a sharp correction, with prices potentially dropping to $0.51.

Cardano Current Uptrend Isn’t That Strong Anymore

Cardano DMI chart shows its ADX at 24, a notable drop from 60 just days ago. The ADX, or Average Directional Index, measures the strength of a trend, regardless of direction, with values above 25 indicating a strong trend and values below 20 suggesting weak momentum.

The decline in ADX signals that ADA uptrend is losing strength and may enter a consolidation phase unless bullish momentum increases.

With D+ at 22.5 and D- at 19, the positive directional indicator (D+) still outweighs the negative one (D-), suggesting the uptrend is intact but weakening. The narrow gap between D+ and D- reflects reduced bullish dominance, indicating that the market could shift toward neutrality or even a downtrend if selling pressure grows.

For ADA to maintain its uptrend, D+ would need to strengthen, pushing the ADX back above 25 to confirm renewed momentum.

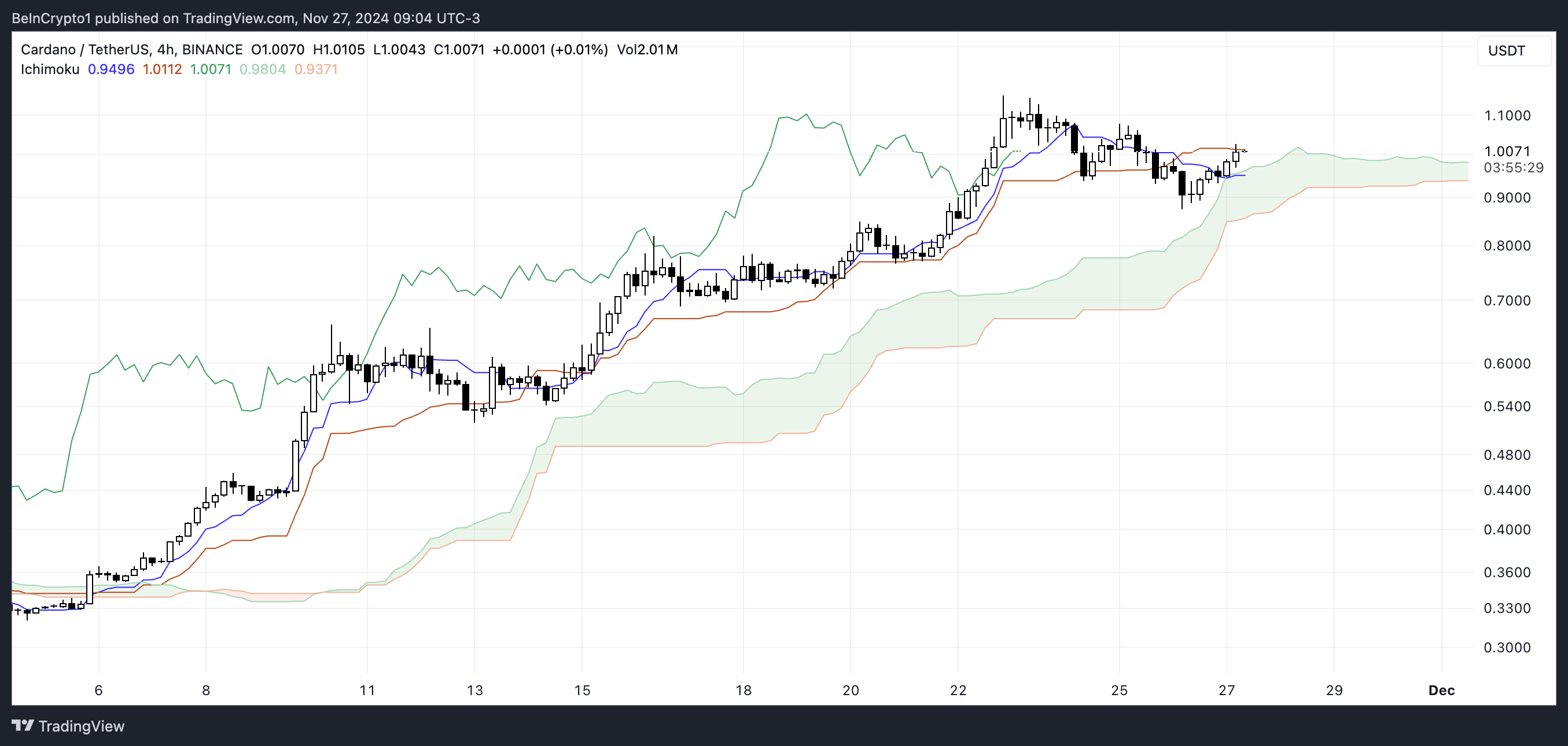

Ichimoku Cloud Shows The Trend Could Change Soon

The Ichimoku Cloud chart for ADA shows a relatively stable uptrend, with the price trading above the cloud (Senkou Span A and B), indicating bullish momentum.

The Tenkan-Sen (blue line) and Kijun-Sen (orange line) remain close, reflecting consolidation after recent gains. The cloud itself provides strong support, as its rising structure reinforces the bullish sentiment.

However, the narrowing gap between the Tenkan-Sen and Kijun-Sen suggests weakening momentum, potentially leading to a short-term pullback.

If ADA fails to maintain its position above the Kijun-Sen, it could test the upper boundary of the cloud as support. On the other hand, a sustained move above current levels would confirm the continuation of the uptrend, with room for further growth.

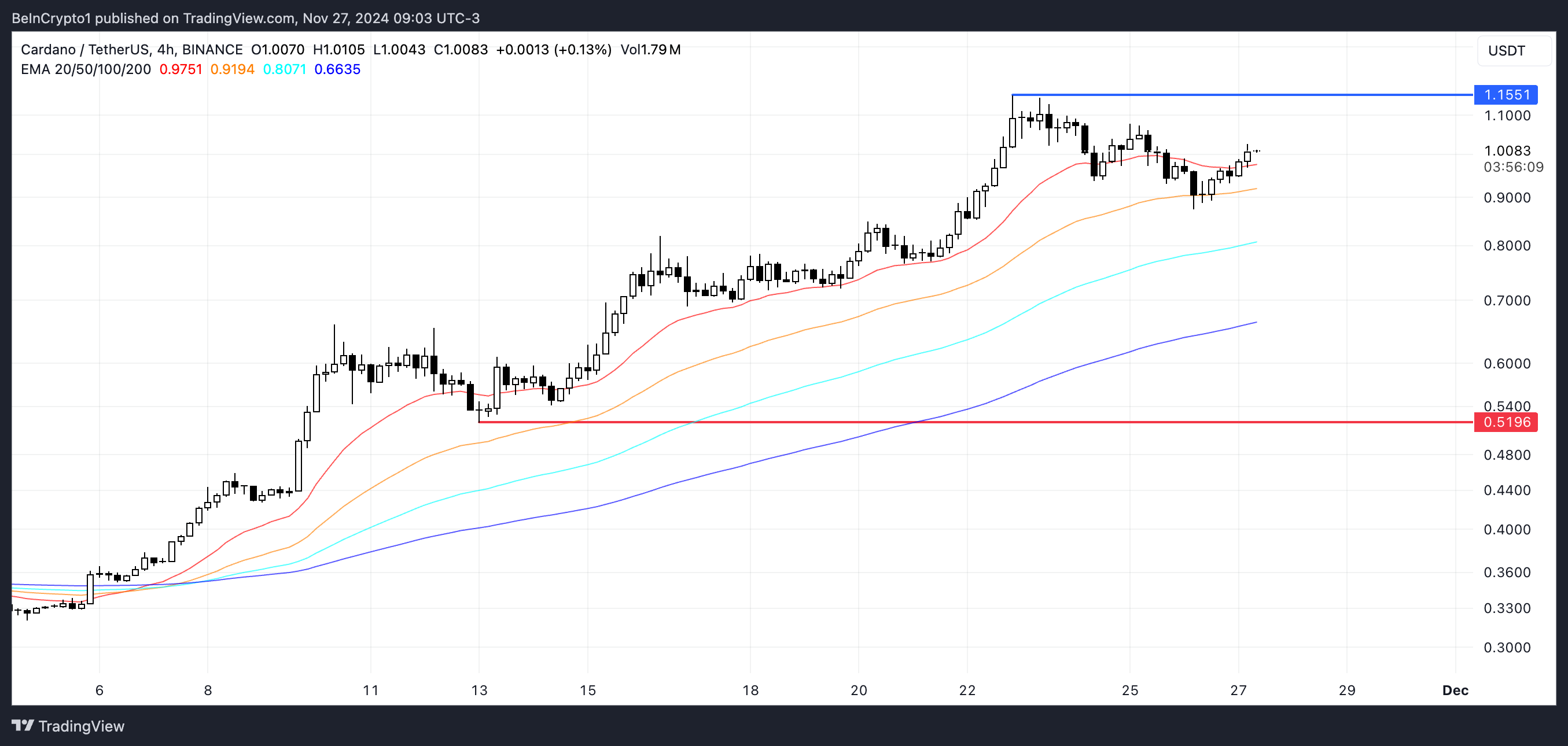

ADA Price Prediction: A Potential 49% Correction

Cardano EMA lines remain bullish, with short-term lines positioned above long-term ones, indicating an ongoing uptrend.

However, the narrowing gap between these lines suggests weakening bullish momentum, signaling that the trend may soon lose strength unless buyers step in.

If Cardano price regains the strength of its uptrend, it could test resistance at $1.15, with the potential to rise to $1.20, marking its highest price since March 2022.

However, indicators like the Ichimoku Cloud and ADX hint at a possible trend reversal. If the uptrend breaks down, ADA price could face a sharp correction, potentially falling to $0.51, representing a 49% decline from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/cardano-bulls-and-bears-collide/

2024-11-27 15:30:00