Bitcoin (BTC) is approaching a $2 trillion market cap, currently at $1.89 trillion, after rising 38% in the past month and breaking new all-time highs in November. Expectations remain high as BTC price nears the $100,000 milestone, a level it is less than 5% away from reaching.

While the ADX suggests the trend is weakening, the NUPL indicates that BTC is far from the “Euphoria” zone, reducing the likelihood of strong corrections.

BTC’s Trend Is Losing Steam

Bitcoin ADX, currently at 17.4, reflects a weakening trend compared to its value of 26 just two days ago. The ADX, or Average Directional Index, measures the strength of a trend on a scale of 0 to 100, without indicating its direction. Values above 25 signify a strong trend, while values below 20 indicate weak or no trend.

BTC current ADX suggests that although it is still in an uptrend, the momentum driving it has significantly weakened, signaling potential consolidation or a slowdown in the bullish movement.

Bitcoin NUPL Is Still Far From Euphoria

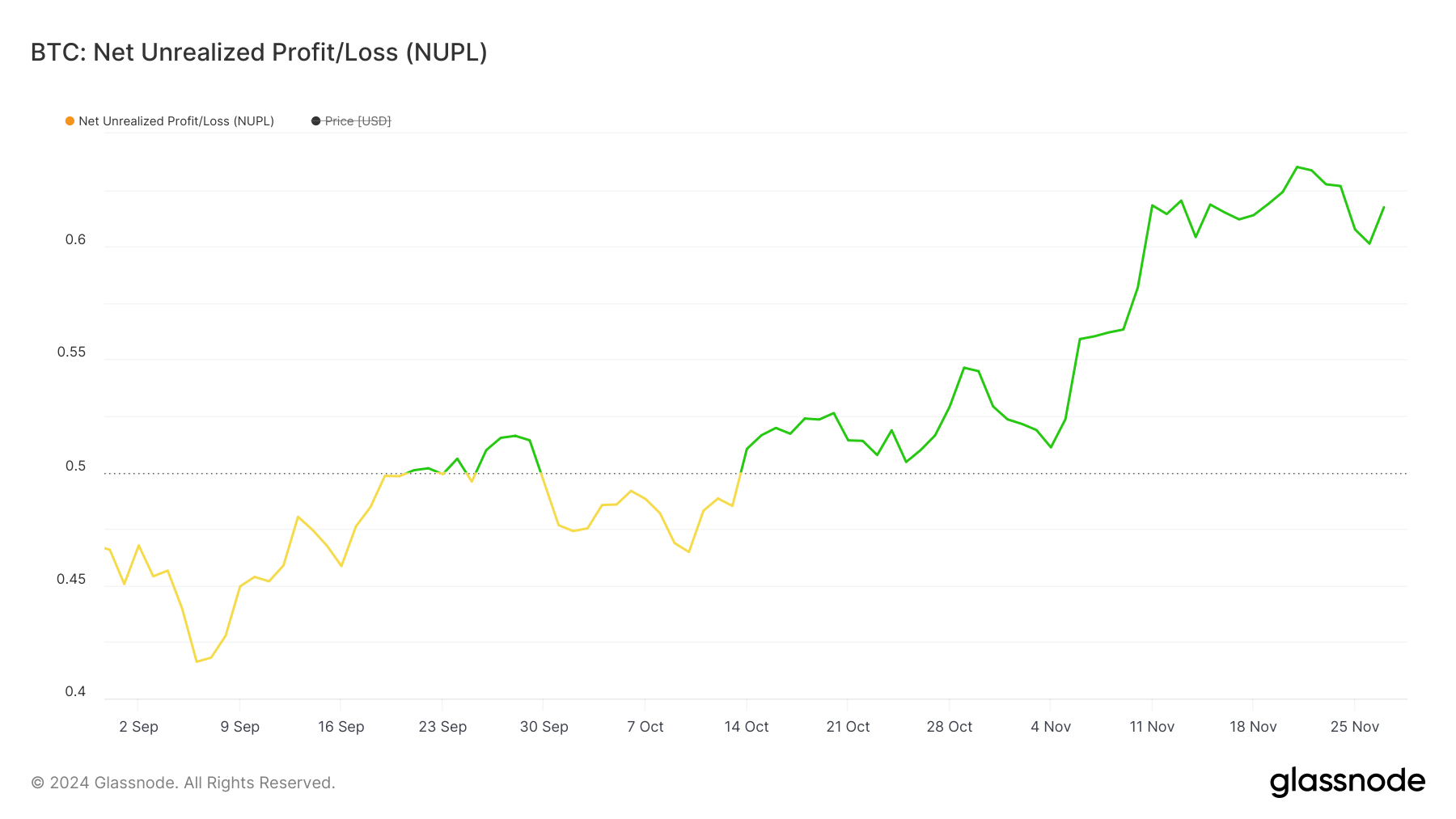

BTC NUPL, or Net Unrealized Profit/Loss, currently stands at 0.61, placing it in the “Belief — Denial” zone since October 14. NUPL evaluates the ratio of unrealized profits to losses, providing insight into market sentiment.

This level indicates growing bullish confidence as holders remain in profit, reflecting optimism about further price increases.

While at 0.61, BTC’s NUPL is still below the 0.7 threshold, which signals entry into the “Euphoria” zone. Historically, crossing into “Euphoria” often leads to strong corrections as profit-taking accelerates.

This current position allows room for BTC price growth before reaching risky levels, suggesting that the uptrend may continue without immediate overextension.

BTC Price Prediction: Is $100,000 Possible In November?

Following a slight correction in recent days, Bitcoin price is now less than 5% away from reaching the historic milestone of $100,000. The ADX suggests that the current trend is losing strength, which could delay BTC’s approach to this key level.

However, the NUPL indicates that the market is still far from the “Euphoria” zone, suggesting that strong corrections are unlikely at this stage.

If the uptrend regains momentum, BTC price could breach $100,000 and potentially test $105,000 in the near term. Conversely, if a downtrend emerges, the price may fall to $88,000 before making another attempt to push higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/bitcoin-price-needs-to-reach-100000/

2024-11-28 20:30:00