Solana (SOL) has experienced notable price fluctuations recently, reaching an all-time high (ATH) of $264 before undergoing a significant decline. This pullback raised concerns about potential corrections.

However, SOL holders remain optimistic about the cryptocurrency’s growth prospects, supported by consistent network activity and bullish market sentiment.

Solana Investors Are Active

Despite the recent drawdown, Solana’s active addresses have not seen a major decline. High participation levels suggest ongoing demand and optimism among investors, reinforcing the idea that cryptocurrency still holds strong market interest. This sustained engagement is a positive indicator of Solana’s future price movement.

Investor activity on the Solana network highlights the resilience of its user base. Continued network participation has helped maintain price momentum, even in the face of bearish market conditions. This consistent activity suggests that SOL’s recent price fluctuations have not deterred investors, keeping the altcoin’s upward trajectory intact.

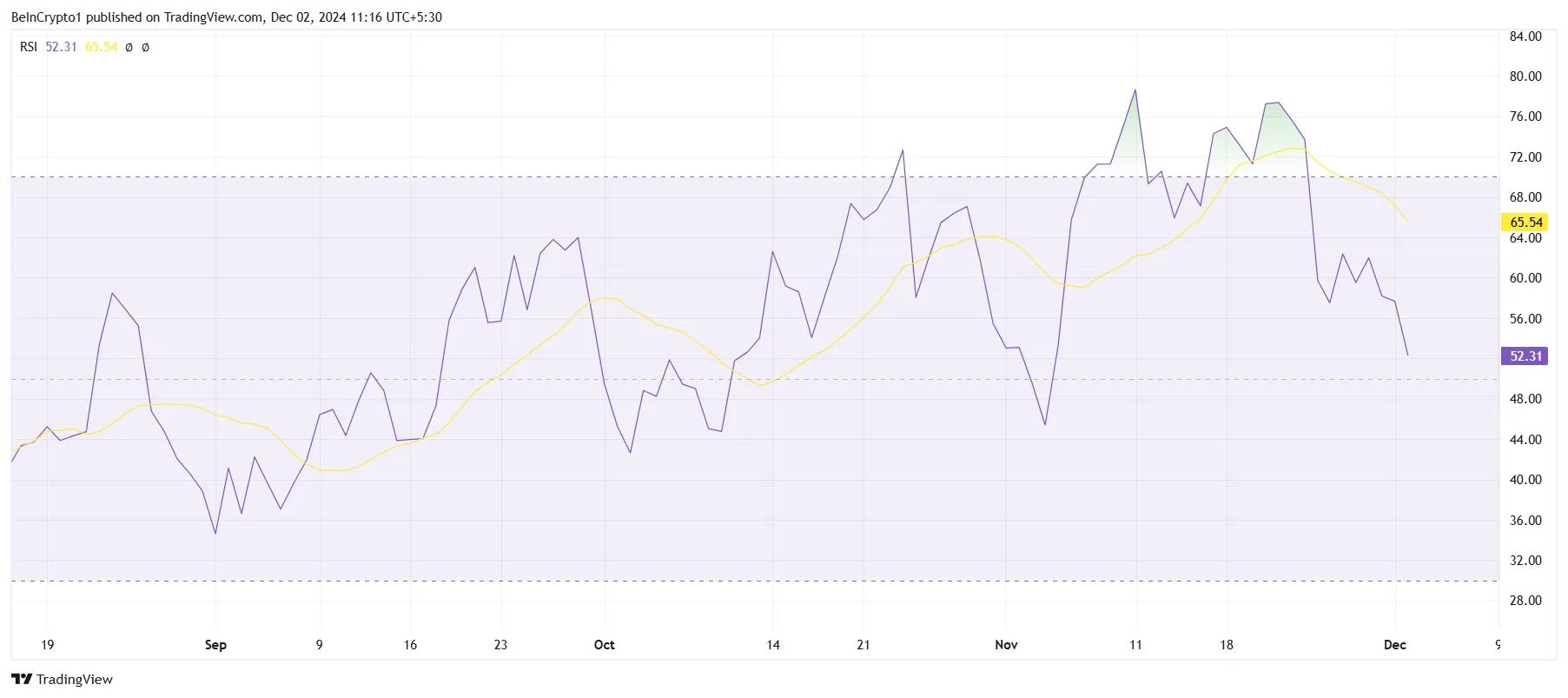

From a technical perspective, Solana’s Relative Strength Index (RSI) is holding above the neutral line at 50.0, signaling resilience despite recent bearish trends. Staying above this level indicates that bullish momentum still has strength. As long as the RSI remains above neutral, the possibility of a sustained rally is viable.

However, if the RSI dips below 50.0, bearish momentum could intensify, leading to a potential decline in Solana’s price. This threshold serves as a key indicator for traders monitoring SOL’s macro momentum. Maintaining this balance will be crucial for Solana to continue its upward movement in the near term.

SOL Price Prediction: Preventing Corrections

Solana is currently trading at $228 after noting a drop recently, which was due to the altcoin losing its spot as the fourth biggest crypto as XRP surpassed it. However, it is holding above the crucial support level of $221.

This price level has historically acted as significant support and resistance, highlighting its importance. As long as SOL holds above this threshold, the bullish outlook for the cryptocurrency remains intact.

A drop below the $221 support is considered unlikely, but if it happens, it could push SOL toward $201. A breach of this level might signal deeper losses, challenge investor confidence, and trigger broader market corrections for the altcoin.

If Solana successfully bounces off the $221 support, it could target the resistance at $245. Breaking through this resistance would invalidate the bearish outlook, potentially pushing the altcoin back toward its ATH of $264. Such a move would reaffirm Solana’s strength as one of the leading cryptocurrencies in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-price-drop-is-likely/

2024-12-02 06:49:26