Cardano (ADA) has been experiencing a remarkable rally, with its price surging by 300% over the past five weeks. The altcoin recently crossed the $1 mark, reaching a near two-year high.

While this upward momentum has sparked optimism among investors, it has also led to profit-taking, with many viewing the current levels as an opportunity to sell.

Cardano Investors Focus on Profits

Smaller holders of ADA have been actively selling in recent weeks. Data indicates that wallets holding between 100 and 10,000 ADA have offloaded more than 72 million ADA worth over $92 million. This selling trend has persisted for over a month, highlighting ongoing profit-taking among retail investors.

Although the volume of sales by smaller holders is significant, it is not as impactful as the larger transactions made by whales.

Despite the large volume of ADA being sold by these smaller holders, the market has not seen a drastic price drop. However, this selling activity could signal caution among investors, with some choosing to lock in gains rather than risk holding onto the altcoin through potential market volatility. This trend of Cardano investors’ profit-taking, while not enough to trigger a major sell-off, may add downward pressure if it continues.

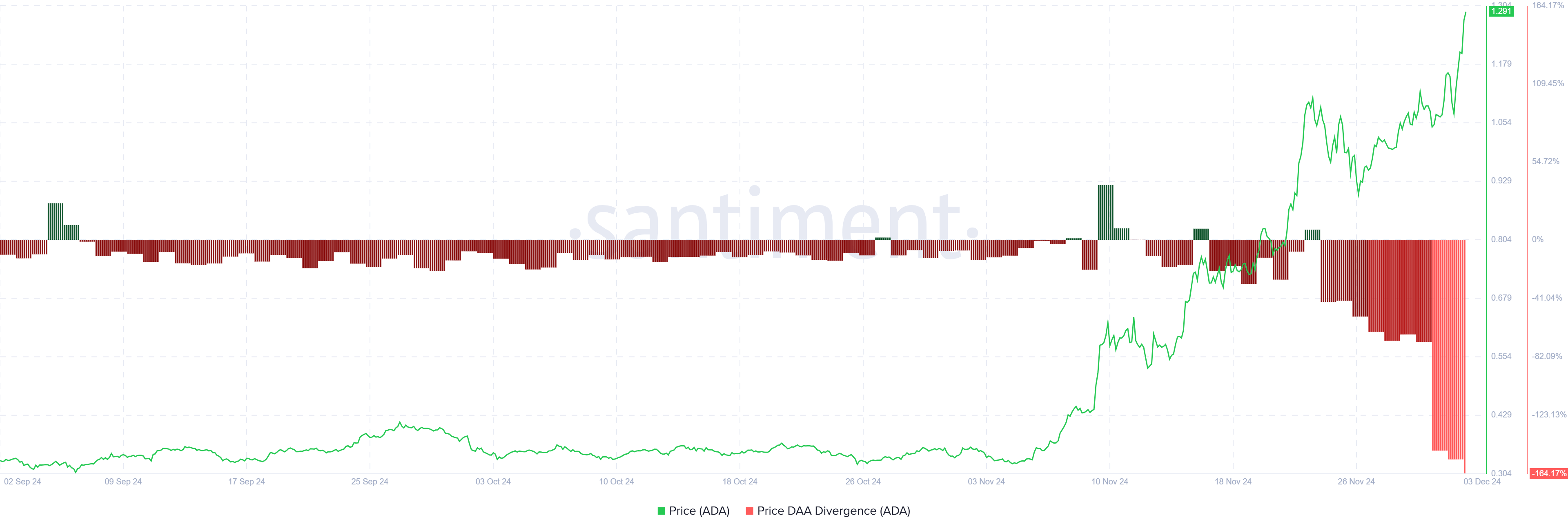

The overall macro momentum of Cardano is a bit more complex. The Price DAA Divergence indicator shows that while ADA’s price is rising, participation in the market is not increasing at the same rate. This divergence is often seen as a bearish signal, as it suggests that the rally may be driven more by speculative buying rather than organic interest and sustained inflows.

The lack of increased participation, especially from larger investors, raises concerns about the sustainability of the current price levels. If the divergence continues, it could induce a correction in the price, as larger investors may be less inclined to continue buying into the rally. This stagnation in market participation could lead to a reduction in price momentum in the coming weeks.

ADA Price Prediction: Sustaining The Gains

Cardano’s price surged by 25% this week, reaching $1.29, bringing the altcoin to its highest level in nearly two years. This uptick reflects growing optimism among investors and traders.

The current momentum is significant as ADA approaches crucial resistance levels. Many are watching whether this rally can be sustained, especially with the psychological $1.30 threshold in play.

For Cardano to maintain its upward trajectory, it needs to flip the $1.30 resistance into support. If it can successfully hold above this level, the rally may continue. However, a failure to do so could lead to a pullback to the $1.01 support, erasing recent gains and potentially signaling the end of the bullish momentum.

If Cardano manages to hold $1.30 as support, the next target could be $1.50. A move above this level would further strengthen the bullish outlook, confirming that the current rally has legs. Such a scenario would invalidate the bearish thesis and signal continued growth, making $1.50 the next major resistance level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-profit-taking-signal-strengthens/

2024-12-03 09:00:00