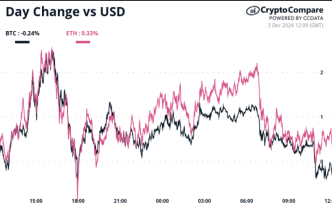

With December historically a volatile and choppy month for bitcoin (BTC), analysts at the crypto exchange Bitfinex believe the digital asset could experience a short-term pullback; however, a shift in network dynamics could push it above $100,000.

According to a weekly report, BTC could maintain upward momentum this month and rally past $100,000 if short-term holder (STH) demand can meet long-term holder (LTH) supply. At the time of writing, BTC was changing hands at $94,800, following a week of consolidation between $90,000 and $98,000.

Can STH Demand Meet LTH Supply?

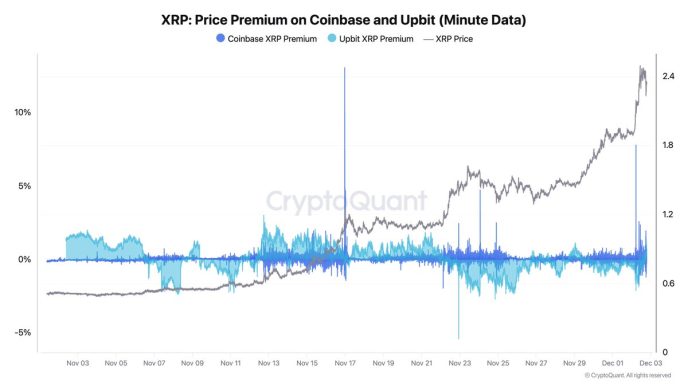

Bitcoin long-term holders have begun to capitalize on increased BTC demand in the market to distribute their held supply on a large scale. Heightened BTC demand from institutional investors and the spot Bitcoin exchange-traded fund (ETF) market drove the latest rally.

The LTH supply recorded a peak in September, and since then, this cohort of market participants has distributed roughly 508,990 BTC. While this figure represents a significant volume, Bitfinex revealed that it is smaller than the 934,000 BTC LTHs spent during the March rally, which led to bitcoin’s high of $73,666.

The last eight months saw LTHs re-accumulate after distributing their bitcoins before the halving. However, with the resumption of a redistribution phase among this cohort of investors, STHs have been buying and accumulating rapidly. Per Bitfinex’s analysis, a reduction in the LTH-held supply is expected at this stage of the bull cycle.

BTC Needs ETF Inflows And Strong Demand

As LTHs continue to take profits, BTC needs positive ETF flows and strong demand from marginal buyers in the short term to maintain upward momentum. This is because the supply entering the Bitcoin market from LTHs has been sustained for the past two weeks, and a weak spot demand would fail to absorb the supply, resulting in a significant price correction.

It is worth mentioning that the LTH Spent Output Profit Ratio (SOPR), which measures the profit margin at which this investor cohort is selling their BTC, signals the market is not near the top. In past cycles, this metric has shown LTHs selling at an average profit of 3.5x at market tops; however, at the time of writing, the SOPR average hovered around 2.6x.

Also, the final leg of the bull market starts when the STH supply crosses the pre-halving cycle high of 3,282,000 BTC; this figure is currently at 3,252,000 BTC.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Mandy Williams

https://cryptopotato.com/bitcoin-to-maintain-upward-momentum-and-break-through-100k-if-this-happens-bitfinex/

2024-12-03 11:51:50